Snowflake (SNOW) Partners With Bloomreach To Enhance AI-Powered Marketing Solutions

Bloomreach's partnership with Snowflake (SNOW) to enhance data infrastructure highlights the latter's active role in expanding AI-driven solutions. Snowflake's stock price increased by 44% over the last quarter, partly buoyed by various partnerships, such as with MindBridge and Intapp, which underline its expanding client base and capabilities. The company's growth aligns with broader market trends, as the S&P 500 reached a new high on trade deal optimism, indicating overall positive investor sentiment. Announcements like Snowflake's AI advancements and shareholder-approved governance changes possibly reinforced this upward momentum. However, broader market practices would have predominantly influenced the company's shares.

We've identified 2 warning signs for Snowflake that you should be aware of.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Snowflake's recent partnership with Bloomreach to enhance data infrastructure signifies a continued push into AI-driven solutions. This collaboration is poised to support the company's narrative of strengthening product adoption and boosting revenue growth, aligning with its strategic focus on AI advancements. Over the past three years, Snowflake's total shareholder return, including share price and dividends, reached 63.12%, illustrating robust long-term performance. In contrast, over the last year, Snowflake's shares have outperformed the US IT industry, which saw a 29.6% return, reflecting strong relative performance.

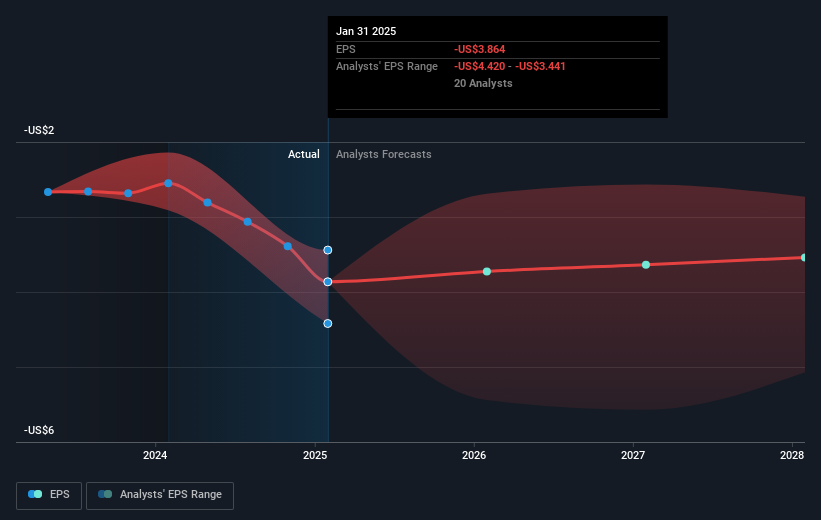

The recent news, combined with partnerships and product enhancements, could positively impact future revenue and earnings forecasts. However, it is essential to consider potential challenges, such as competitive pressures and internal transitions that may affect revenue consistency. Currently trading at $212.25, Snowflake's share price is close to the consensus analyst price target of $231.60, reflecting an 8.72% discount from the target. This suggests optimism among analysts regarding future growth, albeit tempered by the fact that earnings forecasts remain unprofitable in the near term.

Learn about Snowflake's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10