Why Investors Shouldn't Be Surprised By Damai Entertainment Holdings Limited's (HKG:1060) 32% Share Price Surge

Despite an already strong run, Damai Entertainment Holdings Limited (HKG:1060) shares have been powering on, with a gain of 32% in the last thirty days. The last month tops off a massive increase of 210% in the last year.

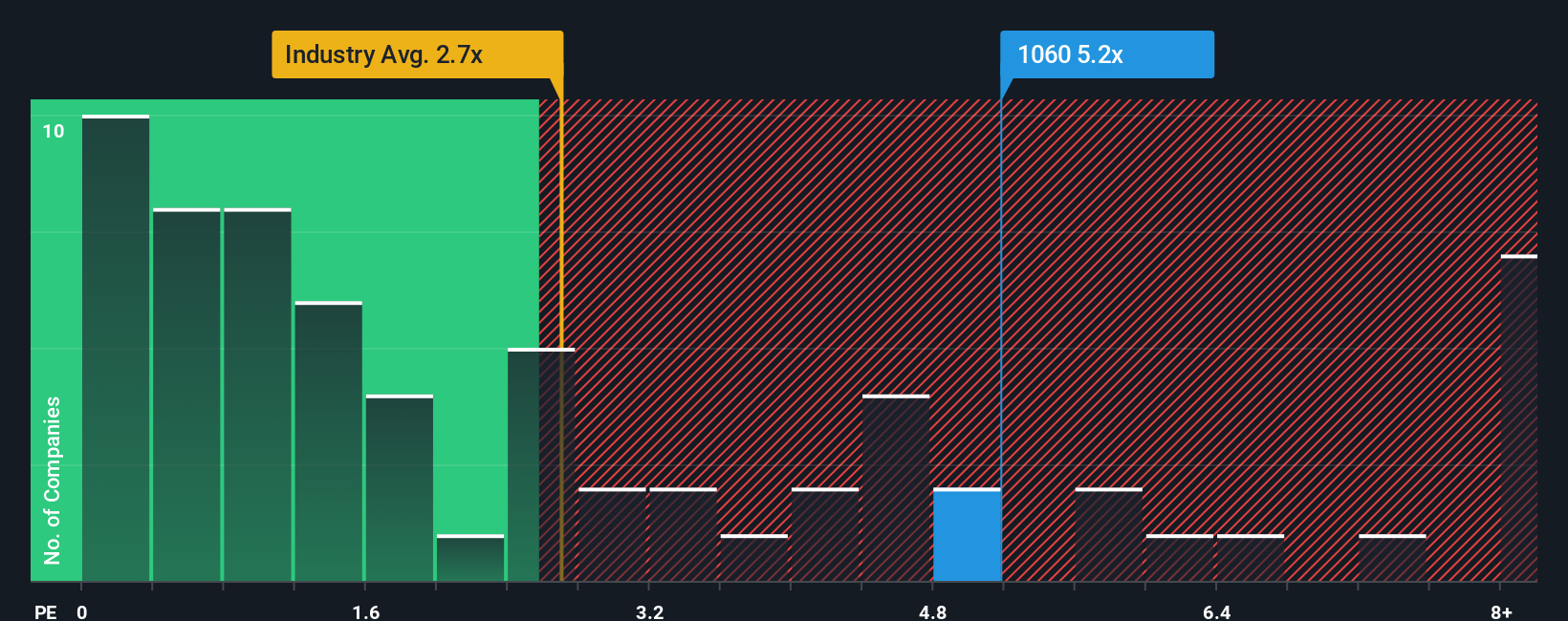

Since its price has surged higher, you could be forgiven for thinking Damai Entertainment Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.2x, considering almost half the companies in Hong Kong's Entertainment industry have P/S ratios below 2.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

See our latest analysis for Damai Entertainment Holdings

How Has Damai Entertainment Holdings Performed Recently?

Recent times have been advantageous for Damai Entertainment Holdings as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Damai Entertainment Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Damai Entertainment Holdings?

In order to justify its P/S ratio, Damai Entertainment Holdings would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. Pleasingly, revenue has also lifted 84% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 14% each year as estimated by the eight analysts watching the company. With the industry only predicted to deliver 10% per annum, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Damai Entertainment Holdings' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Damai Entertainment Holdings' P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Damai Entertainment Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Damai Entertainment Holdings is showing 3 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10