Should Board’s Support for CEO Amid Scrutiny Require Action From National Australia Bank (ASX:NAB) Investors?

- National Australia Bank's board has recently reaffirmed support for CEO Andrew Irvine after investor concerns were raised about his leadership approach and conduct at client events.

- This explicit board endorsement comes as investors continue to scrutinize the bank's governance and seek reassurance around executive accountability.

- We'll examine how the board's public support for the CEO impacts National Australia Bank's investment narrative amid ongoing investor scrutiny.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is National Australia Bank's Investment Narrative?

To be a National Australia Bank (NAB) shareholder, you need to believe in the bank’s resilience, its ability to steadily generate earnings across economic cycles, and its commitment to shareholder returns through dividends and capital management initiatives like buybacks. The recent board endorsement of CEO Andrew Irvine after concerns about his management style brings NAB’s corporate governance sharply into focus. While this attention comes at a time of leadership change and relatively new directors, NAB’s experienced management and ongoing pursuit of growth through digital initiatives and potential acquisitions, such as the rumored interest in HSBC’s Australian arm, remain important short-term catalysts. So far, financial markets appear to have taken the board’s support in stride, with only modest share price movement, suggesting limited immediate impact. Still, governance scrutiny and potential reputational risks have become more relevant catalysts and risks for shareholders to monitor.

Yet, with governance concerns front and center, reputational risk is now something investors should keep an eye on.

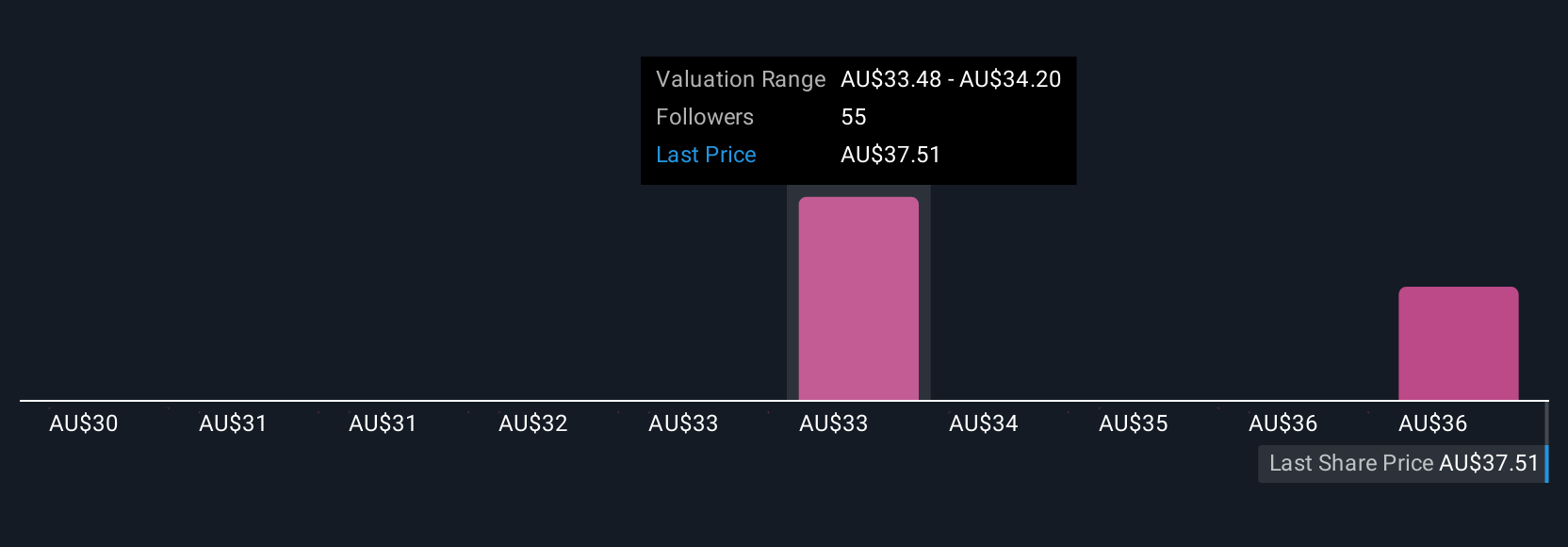

National Australia Bank's share price has been on the slide but might be up to 6% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 5 other fair value estimates on National Australia Bank - why the stock might be worth as much as A$37.12!

Build Your Own National Australia Bank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Australia Bank research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free National Australia Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Australia Bank's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Australia Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10