What Telix Pharmaceuticals (ASX:TLX)'s Gozellix HCPCS Code Approval Means For Shareholders

- Telix Pharmaceuticals announced that its next-generation PSMA PET imaging agent, Gozellix, has been granted a permanent Healthcare Common Procedure Coding System (HCPCS) code by the U.S. Centers for Medicare & Medicaid Services, effective from October 1, 2025.

- This approval marks a pivotal development that could streamline provider reimbursement and potentially increase accessibility to advanced prostate cancer imaging.

- We'll explore how expanded reimbursement options could impact Telix Pharmaceuticals' investment narrative and long-term market positioning for Gozellix.

These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Telix Pharmaceuticals' Investment Narrative?

The essence of Telix Pharmaceuticals’ investment story centers on its rapid transformation into a leader in precision oncology, anchored by high-profile regulatory wins and commercial expansion in prostate cancer imaging. The newly granted permanent HCPCS code for Gozellix has the potential to accelerate reimbursement and unlock wider clinical adoption in the US, which could, in turn, become an important catalyst for near-term growth. This event may lessen the immediate execution and reimbursement risks associated with its launch, shifting attention instead to market competition and the sustainability of strong earnings momentum. Prior to this update, investor focus was primarily on the pace of commercial ramp-up and regulatory milestones, now, streamlined reimbursement might provide an edge versus peers, though the long-term success will also depend on execution and clinical adoption rates. Recent share price gains reflect optimism, but near-term volatility could still stem from evolving competitive and regulatory dynamics. However, changing dynamics in prostate cancer imaging mean market competition remains a key risk to watch.

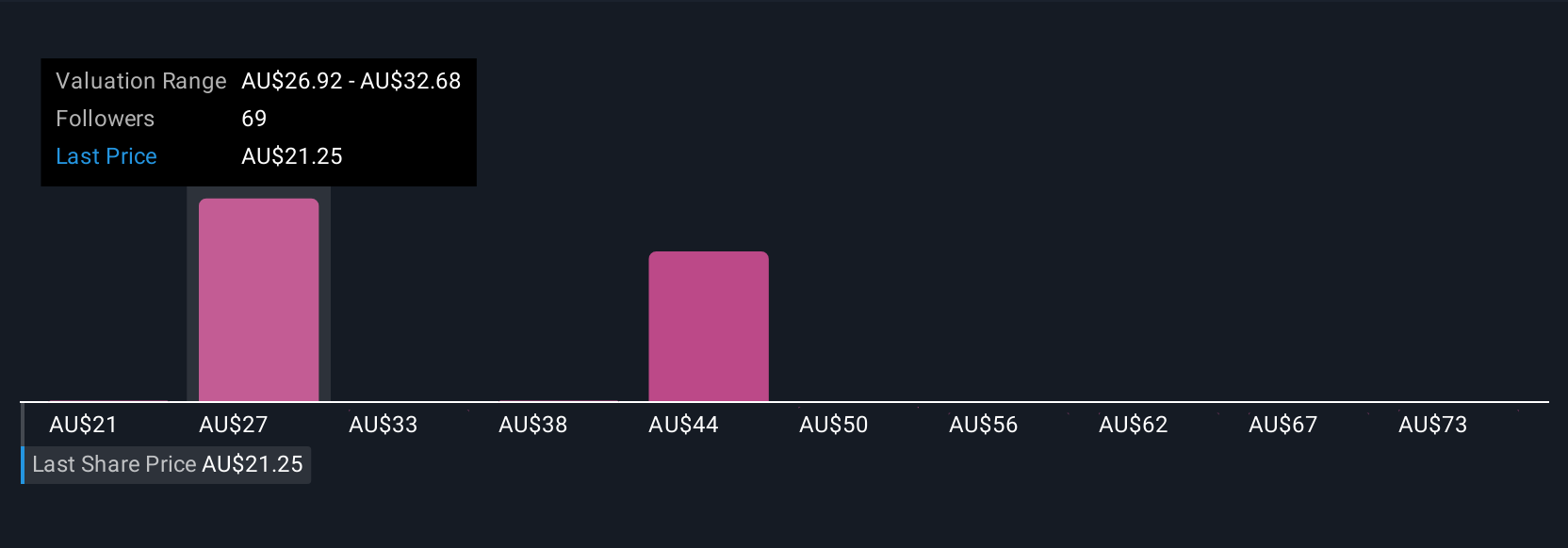

Telix Pharmaceuticals' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 24 other fair value estimates on Telix Pharmaceuticals - why the stock might be worth over 3x more than the current price!

Build Your Own Telix Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telix Pharmaceuticals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Telix Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telix Pharmaceuticals' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10