PepsiCo (NasdaqGS:PEP) Launches Exclusive Samii Ryan Fashion Collaboration for Summer 2025

PepsiCo (NasdaqGS:PEP) recently launched an exclusive capsule collection in partnership with streetwear brand Samii Ryan. Over the past month, PepsiCo’s share price rose by 4%, aligning with the generally positive market trend while slightly outperforming the flat movement observed recently. The alliance with Samii Ryan may have provided additional excitement around the company’s brand image. The launch of Thirst Guards, a unique beverage delivery initiative, may also have contributed positively. Meanwhile, the appointment of a new CEO for the Australia and New Zealand Foods division is expected to help focus on growth in the region.

PepsiCo has 2 weaknesses we think you should know about.

Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

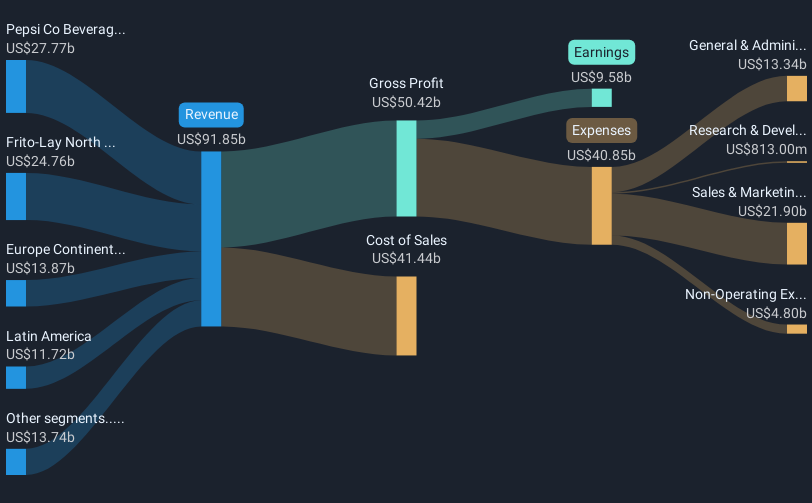

The recent partnership between PepsiCo and streetwear brand Samii Ryan, along with innovative initiatives like the Thirst Guards, has contributed positively to PepsiCo's brand image and may stimulate consumer engagement. These developments, combined with the new leadership in the Australia and New Zealand Foods division, could enhance focus in the region and contribute to long-term revenue and earnings growth. Analysts forecast a revenue of $99.5 billion and earnings of $12.2 billion by 2028, reflecting a growth trajectory boosted by strategic initiatives such as the Frito Redesign and SAP rollout.

Over the last five years, PepsiCo's total return, comprising share price appreciation and dividends, was 16.58%. This is indicative of its steady performance, although it underperformed both the US Market, which returned 13%, and the US Beverage industry, which saw a decline of 3.5%, over the past year. Presently, PepsiCo's shares, trading at US$130.74, suggest a 13.7% upside opportunity compared to the analyst consensus target of US$151.55. This indicates room for appreciation if the forecasted improvements in revenue and margins materialize as expected, positioning PepsiCo close to its fair valuation amidst current market conditions.

Upon reviewing our latest valuation report, PepsiCo's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10