Cencora (COR) Partners With Citius Oncology For Immunotherapy Distribution Expansion

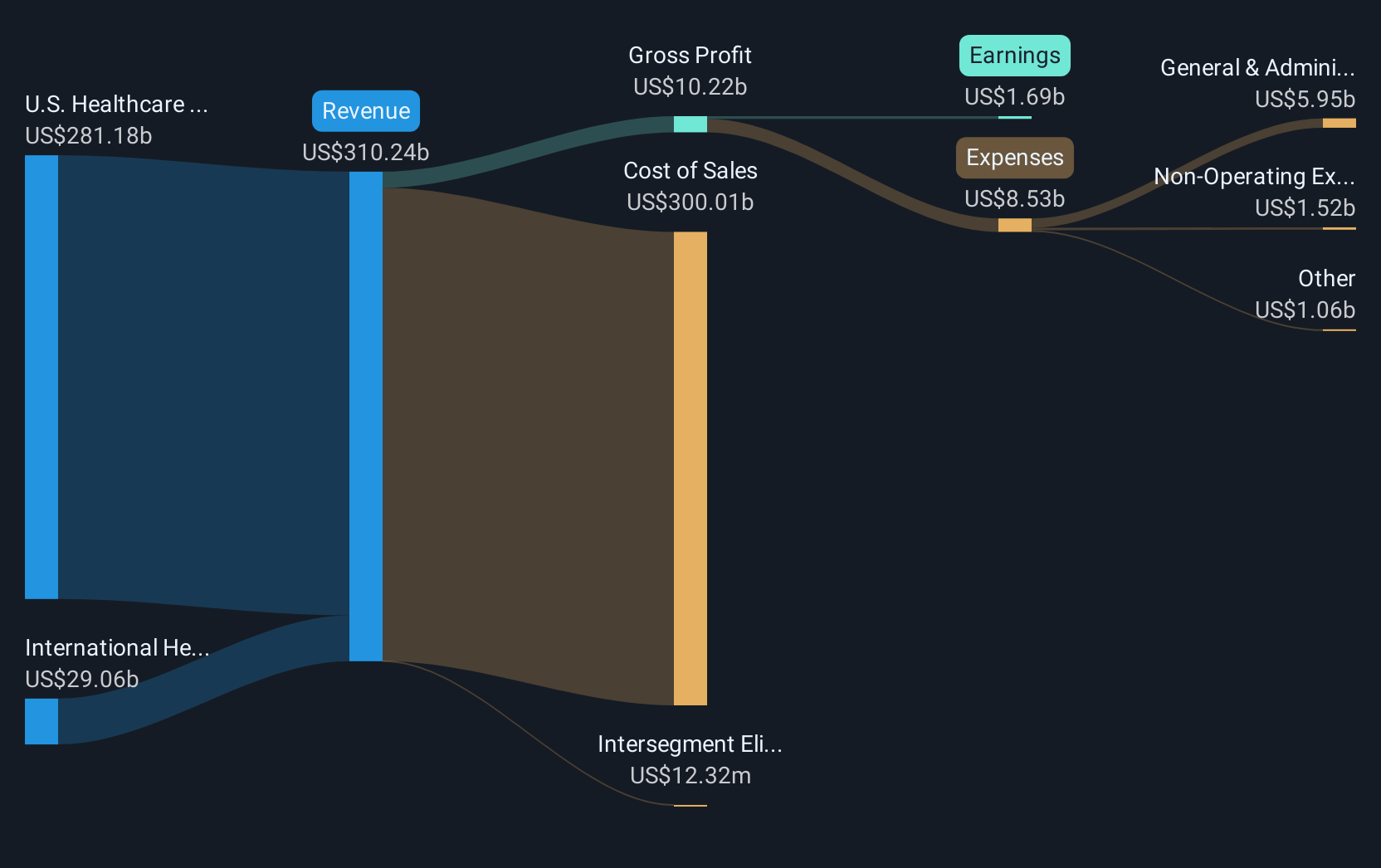

Cencora (COR) recently executed a distribution services agreement with Citius Oncology, signaling an expansion in its pharmaceutical distribution capabilities. Over the past quarter, Cencora’s share price rose by 4.4%, aligning with the market trend of major indexes reaching record highs. This gain is supported by several corporate actions, including strong second-quarter earnings and ongoing share buybacks, which may have bolstered investor confidence. The dividend announcement and completion of significant debt financing likely fortified the company’s financial position, adding weight to its stable performance amidst a mixed broader market influenced by tech sector rallies and inflation data.

We've spotted 3 weaknesses for Cencora you should be aware of.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

The recent distribution services agreement with Citius Oncology aligns with Cencora's aim to enhance its specialty medications and logistics integration, supporting their narrative of boosting global reach and revenue growth. This agreement could positively impact revenue forecasts, as it may strengthen Cencora's position in pharmaceutical distribution, potentially improving margins through optimized services and strategic stakeholder engagement.

Over the past five years, Cencora's total shareholder return, including share price and dividends, was very large at 208.69%. This performance significantly outstrips its recent one-year return, where Cencora outperformed the generally declining US Healthcare industry, which fell by 23.3%. This long-term performance suggests Cencora's growth strategies, like those evident in the recent news, have contributed to its robust market presence.

Although Cencora’s current share price is US$297.06, analyst consensus estimates a slightly higher price target of US$323.16. The 4.4% rise in share price aligns with market trends and reflects investor confidence, bolstered by corporate actions such as share buybacks and dividend announcements. However, the minimal discount to the price target implies that the growth potential may already be largely priced in by the market. This highlights the need for Cencora to sustain revenue and earnings momentum through expansions like the Citius agreement, while addressing risks such as interest expenses and market challenges.

The valuation report we've compiled suggests that Cencora's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10