NuScale Power (SMR) Sees 174% Price Surge Last Quarter Amid New Chief Legal Officer Appointment

NuScale Power (SMR) has seen a significant price increase of 174% over the last quarter, amid key developments in its technology and strategic partnerships. The hydrogen simulation model developed by GSE Solutions and the agreement with Paragon Energy Solutions reflect NuScale's commitment to enhancing its SMR technology and optimizing hydrogen production, which could bolster investor confidence. Additionally, the appointment of Shahram Ghasemian as Chief Legal Officer may strengthen the company's corporate governance. While the market remains flat, these initiatives likely added weight to NuScale's distinct price movement against broader market trends.

We've spotted 4 weaknesses for NuScale Power you should be aware of.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

The recent developments surrounding NuScale Power, including technological advancements and new strategic partnerships, could significantly accelerate the company's commercialization efforts. By enhancing its small modular reactor technology and optimizing hydrogen production, NuScale may see increased revenue and an improved profit outlook. The company is actively working on efficiency improvements and cost reductions, aiming to strengthen its margins over time. However, challenges related to long-term agreements and supply chain management persist, potentially affecting financial stability.

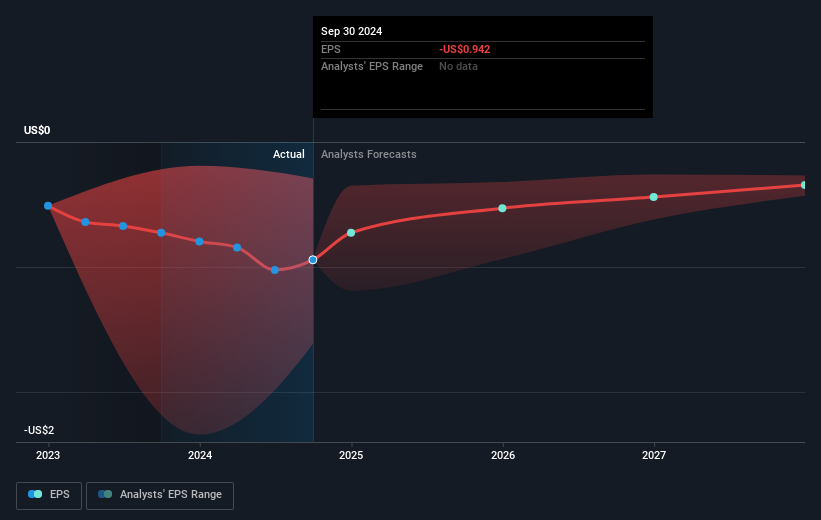

Over the past three years, NuScale Power's total shareholder return, including share price increases and any dividends, has been impressive at 309.73%. When focusing on yearly performance, NuScale has managed to surpass the US Electrical industry's 31.6% return, demonstrating resilience in a competitive sector landscape. Despite its considerable recent gains, the current share price of US$42.12 trades above the consensus analyst price target of US$37.59, suggesting limited upside according to analysts' expectations. Analysts project strong revenue growth for NuScale, but the path to profitability remains uncertain in the next few years as the firm continues to invest in and refine its technology.

Assess NuScale Power's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10