How Investors May Respond To AST SpaceMobile (ASTS) Europe Satellite Joint Venture Launch With Vodafone

- AST SpaceMobile and Vodafone have established SatCo, a joint venture in Luxembourg, to deliver integrated space-based cellular broadband across Europe using AST SpaceMobile’s satellite technology, with commercial services expected to begin in 2026.

- This venture aims to provide direct-to-smartphone connectivity throughout Europe, offering a single turnkey satellite service for mobile network operators and supporting the EU’s goals for digital sovereignty.

- We’ll explore how the launch of SatCo shapes AST SpaceMobile’s investment narrative amid increased competition and evolving telecom partnerships.

Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

What Is AST SpaceMobile's Investment Narrative?

Being a shareholder in AST SpaceMobile often means banking on the broad adoption of direct-to-device satellite connectivity, especially through advances like the SatCo joint venture with Vodafone. The recent US$100 million non-dilutive debt financing, aimed at scaling manufacturing and network deployment in 2025 and 2026, shores up liquidity and lessens near-term dilution risk, which could be meaningful as investors previously watched cash burn and large losses with concern. However, with shares showing high volatility and trading well below consensus price targets, the catalysts remain focused on meeting commercial launch timelines, executing on major contracts, and delivering on European market ambitions. It’s just as important to keep an eye on rising competition, persistent unprofitability, and macro uncertainty, given the recent price swings and investor “wait-and-see” attitude heading into the next earnings report. Operational and execution risks could quickly move back into focus if milestones slip.

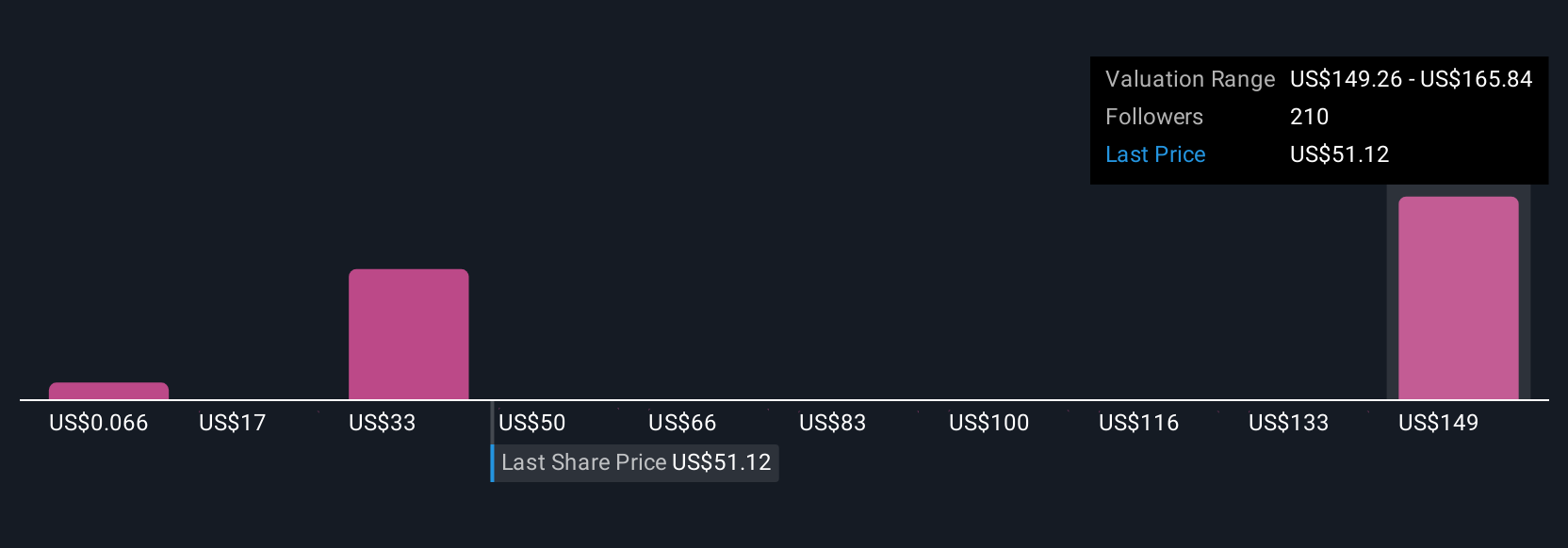

Yet, rapid progress could be checked by big established competitors entering the same market. Despite retreating, AST SpaceMobile's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 41 other fair value estimates on AST SpaceMobile - why the stock might be worth over 3x more than the current price!

Build Your Own AST SpaceMobile Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AST SpaceMobile research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free AST SpaceMobile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AST SpaceMobile's overall financial health at a glance.

No Opportunity In AST SpaceMobile?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 24 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10