ASX Growth Companies With Strong Insider Backing July 2025

As the Australian market continues to navigate a flat trading environment, with sectors like materials providing stability amid fluctuating export data from China and upcoming US CPI announcements, investors are keenly observing growth companies with strong insider ownership. In such conditions, stocks that combine robust internal backing with growth potential can be particularly appealing, as they may offer resilience and strategic alignment in an uncertain economic landscape.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Image Resources (ASX:IMA) | 22.3% | 79.9% |

| Findi (ASX:FND) | 33.8% | 91.2% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.4% |

| Echo IQ (ASX:EIQ) | 18% | 51.4% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Brightstar Resources (ASX:BTR) | 11.6% | 115.1% |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Adveritas (ASX:AV1) | 18.1% | 88.8% |

| Acrux (ASX:ACR) | 15.5% | 106.9% |

Click here to see the full list of 95 stocks from our Fast Growing ASX Companies With High Insider Ownership screener.

Let's take a closer look at a couple of our picks from the screened companies.

Duratec (ASX:DUR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Duratec Limited, listed on the ASX under the ticker DUR, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure in Australia with a market cap of A$393.73 million.

Operations: Duratec's revenue is derived from several key segments, including Energy (A$62.54 million), Defence (A$193.48 million), Buildings & Facades (A$113.64 million), and Mining & Industrial (A$144.05 million).

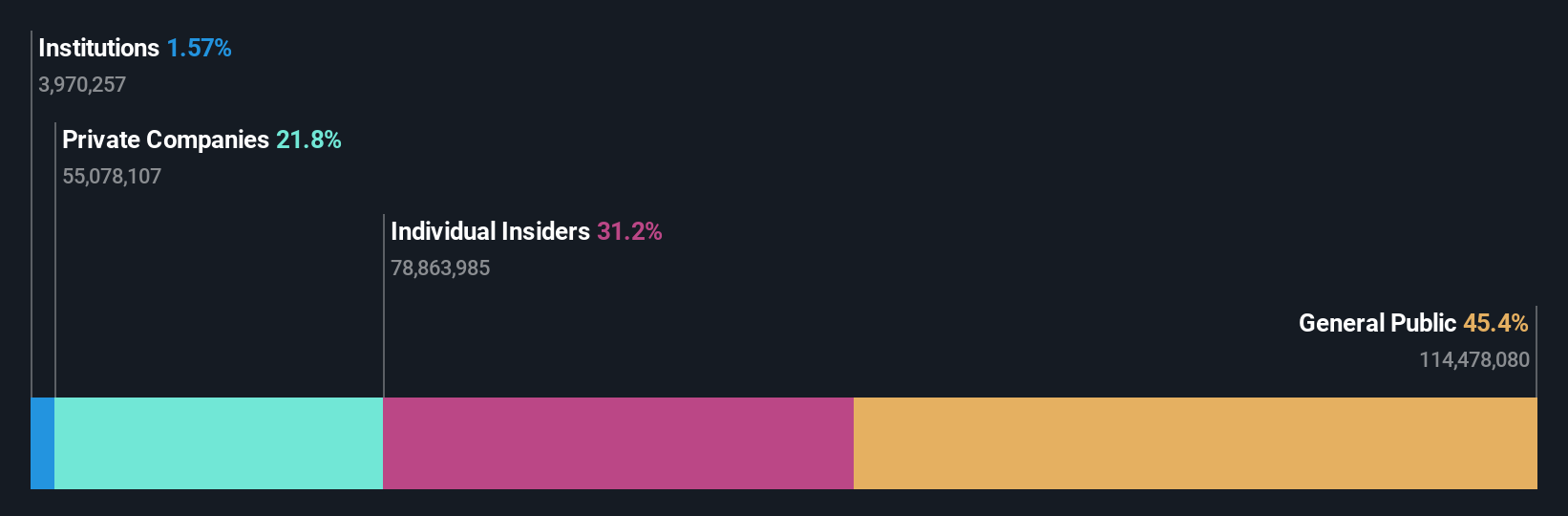

Insider Ownership: 31.2%

Earnings Growth Forecast: 11.8% p.a.

Duratec's revenue is projected to grow at 7.7% annually, outpacing the Australian market's 5.5%, while earnings are expected to increase by 11.84% per year, exceeding the market average of 10.9%. The company's Return on Equity is anticipated to reach a high of 30.3% in three years, suggesting efficient use of equity capital despite an unstable dividend track record. Currently trading at a discount, Duratec presents potential value for investors seeking growth opportunities with substantial insider ownership influence.

- Unlock comprehensive insights into our analysis of Duratec stock in this growth report.

- The analysis detailed in our Duratec valuation report hints at an deflated share price compared to its estimated value.

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited owns, operates, and franchises quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$2.81 billion.

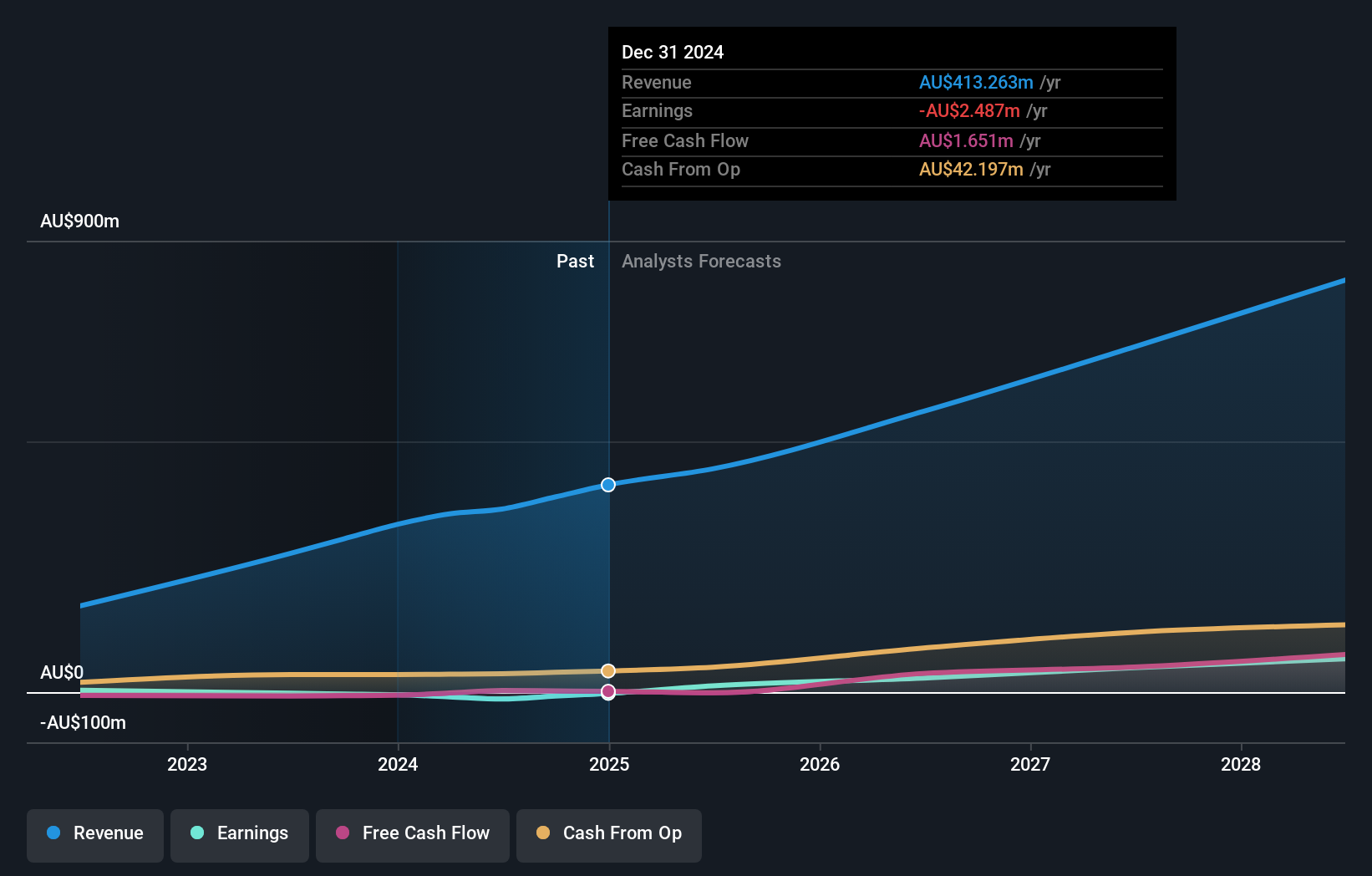

Operations: The company generates revenue primarily through its quick service restaurant operations, amounting to A$413.26 million.

Insider Ownership: 12.8%

Earnings Growth Forecast: 39.2% p.a.

Guzman y Gomez is forecast to experience significant growth, with revenue expected to increase by 16.8% annually, surpassing the Australian market's 5.5%. Earnings are projected to grow at a robust rate of 39.19% per year, positioning the company for profitability within three years. Despite a forecasted Return on Equity of just 14.6%, which is relatively low compared to benchmarks, insider ownership remains influential without recent substantial insider trading activity noted.

- Click here to discover the nuances of Guzman y Gomez with our detailed analytical future growth report.

- Our valuation report unveils the possibility Guzman y Gomez's shares may be trading at a premium.

Nanosonics (ASX:NAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nanosonics Limited is a global infection prevention company with a market cap of A$1.14 billion.

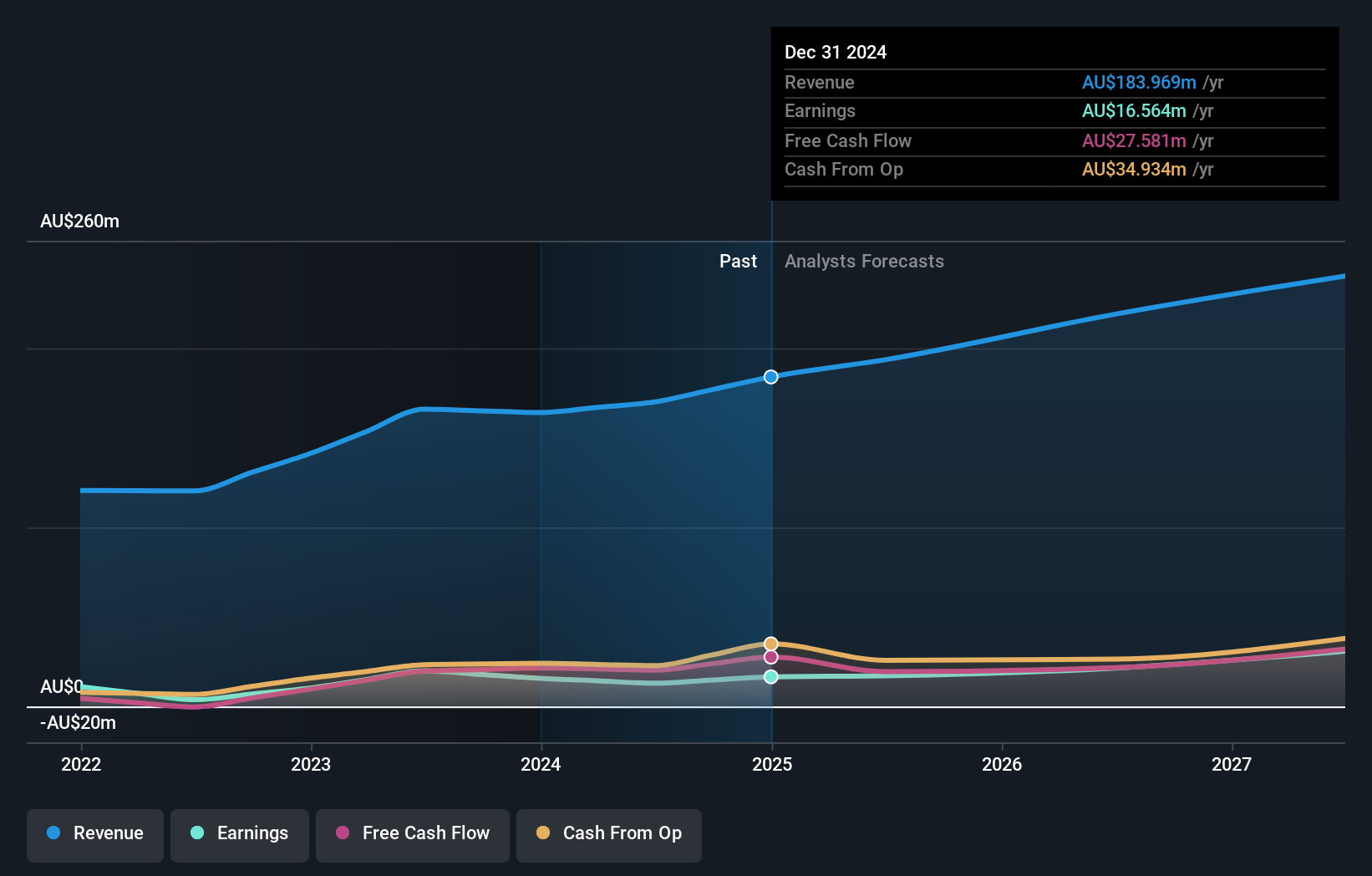

Operations: The company's revenue is primarily derived from its Healthcare Equipment segment, totaling A$183.97 million.

Insider Ownership: 15.4%

Earnings Growth Forecast: 22.9% p.a.

Nanosonics is poised for growth, with earnings projected to expand at 22.9% annually, outpacing the Australian market's 10.9%. Revenue is also set to grow faster than the market at 9.6% per year. The stock trades at a 26% discount to its estimated fair value, and analysts anticipate a price increase of 25.3%. Despite a forecasted Return on Equity of only 13.9%, insider ownership remains significant, with no recent substantial insider trading activity reported.

- Navigate through the intricacies of Nanosonics with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Nanosonics' share price might be too pessimistic.

Where To Now?

- Discover the full array of 95 Fast Growing ASX Companies With High Insider Ownership right here.

- Ready To Venture Into Other Investment Styles? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10