Bond Offering and AI Launch Could Be a Game Changer for Alibaba (BABA)

- In early July 2025, Alibaba Group Holding completed a HK$12.02 billion zero-coupon bond offering, callable and exchangeable, due in 2032, and reported progress on its extensive share buyback program.

- The company has also advanced its AI ambitions through the launch of the Kimi K2 large language model, positioning itself more prominently amid rapid demand for generative AI and cloud services.

- We'll explore how Alibaba's innovation in artificial intelligence is shaping its current investment story and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Alibaba Group Holding's Investment Narrative?

For anyone considering an investment in Alibaba, the core thesis centers on whether the company’s large-scale buyback activity, ongoing profitability, and significant investments in AI and cloud can outweigh broader macro and regulatory concerns. The completion of the HK$12.02 billion zero-coupon bond offering, alongside acceleration in share repurchases, appears to reinforce management’s confidence in the company’s long-term prospects and capital strength, but the direct, near-term impact on catalysts such as earnings growth and margins looks modest. Alibaba’s recent launch of the Kimi K2 AI model fits its strategy to capture AI demand, though the market’s reaction so far suggests this isn’t yet a needle-mover for the stock. The biggest risks, regulatory headwinds, geopolitical tensions, and a competitive Chinese retail and cloud market, remain unresolved and may continue to have an outsized impact relative to new bond issuances or product launches. On the other hand, the regulatory pressures in China could quickly alter the outlook investors expect.

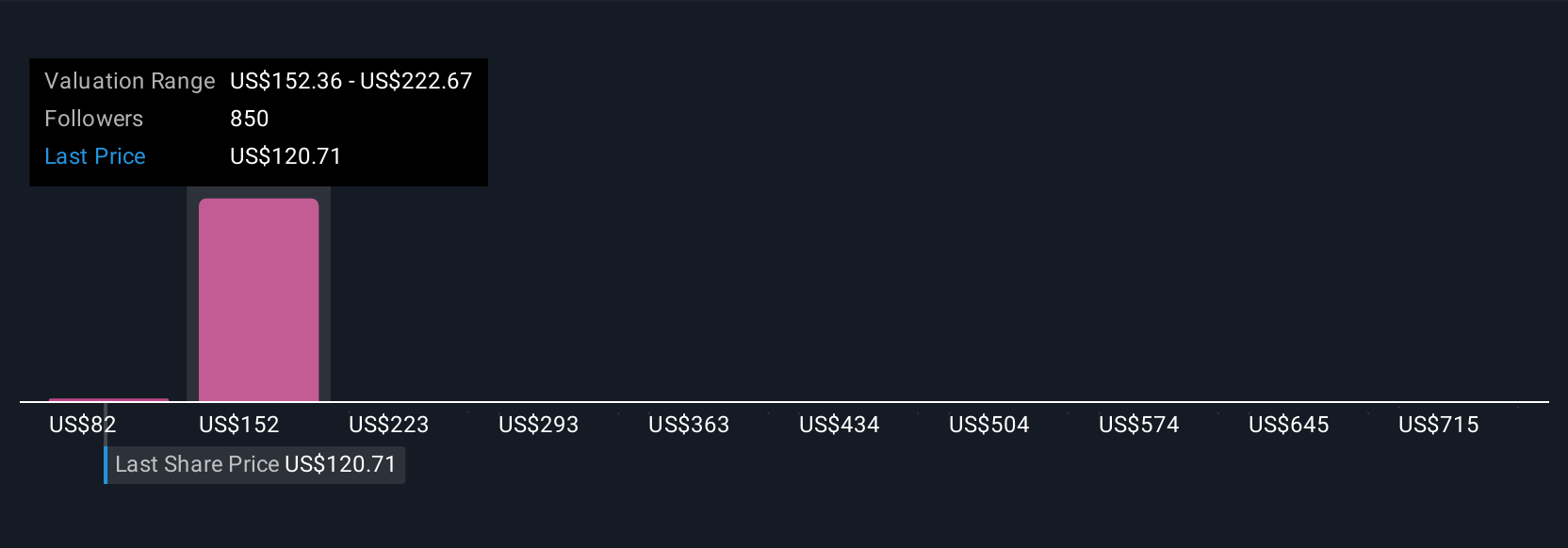

Alibaba Group Holding's shares have been on the rise but are still potentially undervalued by 44%. Find out what it's worth.Exploring Other Perspectives

Explore 78 other fair value estimates on Alibaba Group Holding - why the stock might be worth over 7x more than the current price!

Build Your Own Alibaba Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alibaba Group Holding research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Alibaba Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alibaba Group Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10