How the Vodafone Joint Venture and $100M Financing at AST SpaceMobile (ASTS) Changed Its Investment Story

- In recent days, AST SpaceMobile announced a new joint venture with Vodafone to launch SatCo, a Luxembourg-based satellite company focused on delivering direct-to-smartphone broadband services across Europe, and closed a US$100 million non-dilutive equipment financing facility led by Trinity Capital to boost manufacturing and network deployment through 2026.

- This collaboration aims to bolster Europe’s digital connectivity by integrating space technology with terrestrial networks and will see SatCo headquartered in Luxembourg, a country recognized for its digital infrastructure and policy leadership.

- We'll explore how the Vodafone partnership expands AST SpaceMobile's European footprint and its implications for the company's investment narrative.

Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

What Is AST SpaceMobile's Investment Narrative?

For anyone considering AST SpaceMobile, the investment story hinges on the belief that space-based cellular networks can successfully extend coverage to unserved areas, unlocking meaningful revenue growth as these networks become commercially viable. The recent joint venture with Vodafone and launch of SatCo in Luxembourg represent a tangible step toward that ambition, positioning AST SpaceMobile at the center of Europe's emerging digital connectivity initiatives. The US$100 million non-dilutive equipment financing, paired with the recent equity raise, shores up liquidity for manufacturing and deployment efforts, directly addressing prior concerns about funding runway and near-term progress. Short-term catalysts now focus more on operational execution, regulatory milestones, and market adoption, especially in the leadup to commercial launch, while execution risk remains high and profitability is still years away. Given the sharp share price gains, risk appetite and patience will be as crucial as ever for current and would-be shareholders. But with untested technology and profitability still on the horizon, ongoing execution risk remains important for investors to track.

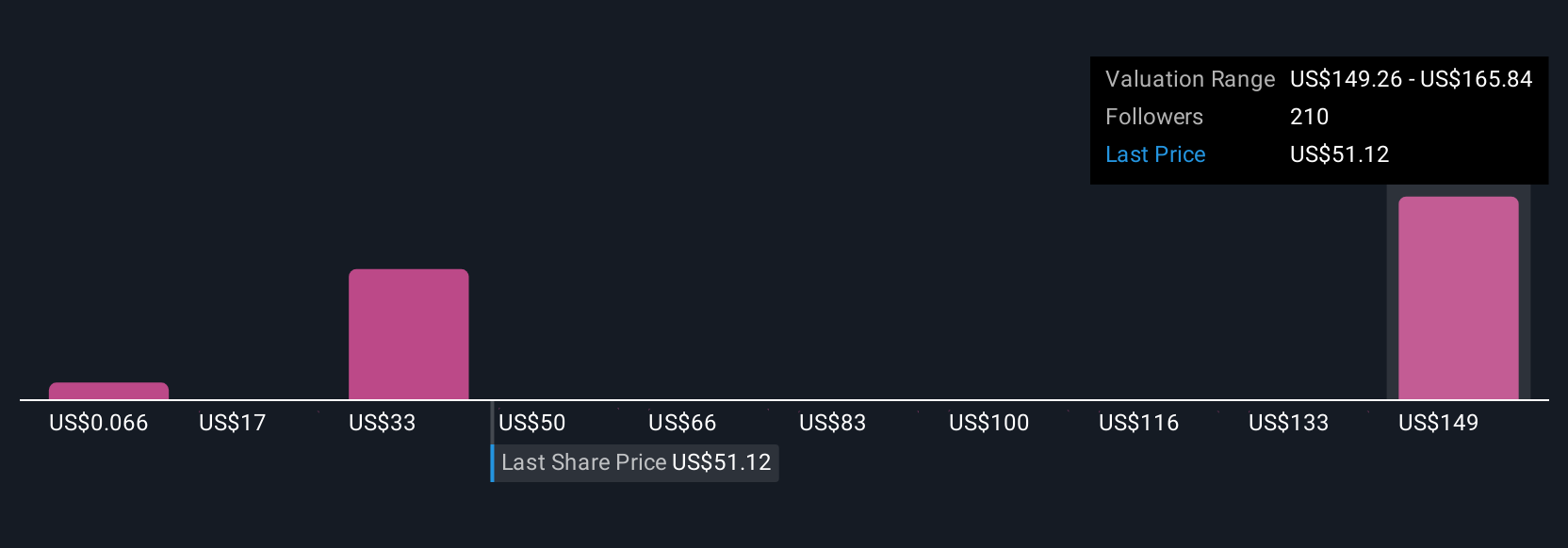

Despite retreating, AST SpaceMobile's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 41 other fair value estimates on AST SpaceMobile - why the stock might be worth less than half the current price!

Build Your Own AST SpaceMobile Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AST SpaceMobile research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free AST SpaceMobile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AST SpaceMobile's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- The end of cancer? These 24 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10