US High Growth Tech Stocks Leading The Market

The United States market remained flat over the last week, but it has risen 13% over the past 12 months with earnings forecasted to grow by 15% annually. In this context, identifying high growth tech stocks that align with these positive earnings projections can be key to capitalizing on potential future opportunities in the sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.71% | 39.09% | ★★★★★★ |

| Circle Internet Group | 30.78% | 60.64% | ★★★★★★ |

| Ardelyx | 21.16% | 61.58% | ★★★★★★ |

| Mereo BioPharma Group | 50.84% | 58.22% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.86% | 59.49% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.83% | ★★★★★★ |

| Lumentum Holdings | 23.14% | 103.97% | ★★★★★★ |

Click here to see the full list of 228 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

KalVista Pharmaceuticals (KALV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: KalVista Pharmaceuticals, Inc. is a clinical stage pharmaceutical company focused on the discovery, development, and commercialization of drug therapies for diseases with unmet needs, with a market cap of $748.72 million.

Operations: KalVista Pharmaceuticals specializes in developing drug therapies, particularly inhibitors, targeting diseases with unmet needs. The company operates as a clinical stage entity without reported revenue segments, focusing on advancing its pipeline through discovery and development phases.

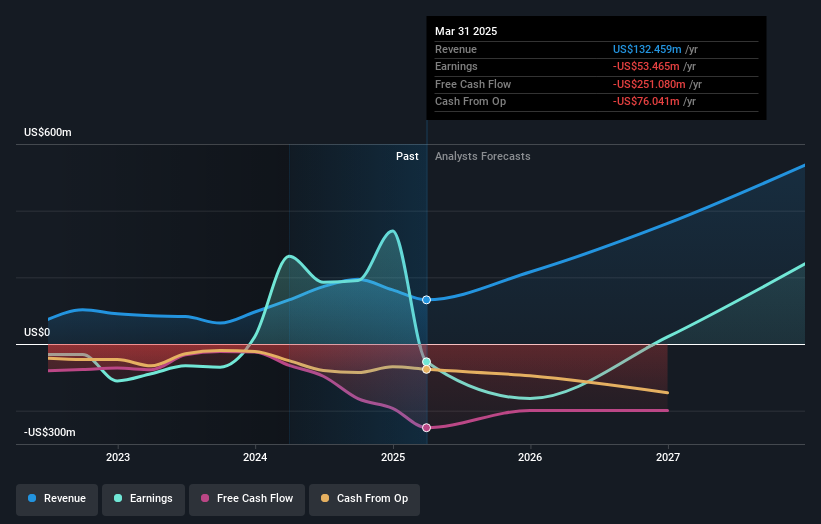

KalVista Pharmaceuticals, recently approved by the FDA for its novel treatment EKTERLY®, is poised to revolutionize care for hereditary angioedema (HAE) with the first oral on-demand option. This approval follows a robust KONFIDENT trial, which demonstrated EKTERLY®'s efficacy in significantly reducing symptom severity and attack resolution times compared to placebo. With an annual revenue growth forecast at 49.7% and earnings expected to surge by 54.67%, KalVista's strategic focus on R&D has positioned it well within the high-growth biotech sector, despite current unprofitability. The company's recent distribution agreement with Pendopharm® marks a significant step towards expanding its market reach in Canada, enhancing its growth trajectory amidst a competitive landscape.

- Delve into the full analysis health report here for a deeper understanding of KalVista Pharmaceuticals.

Gain insights into KalVista Pharmaceuticals' past trends and performance with our Past report.

Hut 8 (HUT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hut 8 Corp. is a vertically integrated operator of energy infrastructure and Bitcoin mining in North America with a market capitalization of $2.44 billion.

Operations: Hut 8 Corp. generates revenue through its power segment, contributing $51.04 million, and digital infrastructure, adding $20.99 million. The company is involved in energy infrastructure and Bitcoin mining operations across North America.

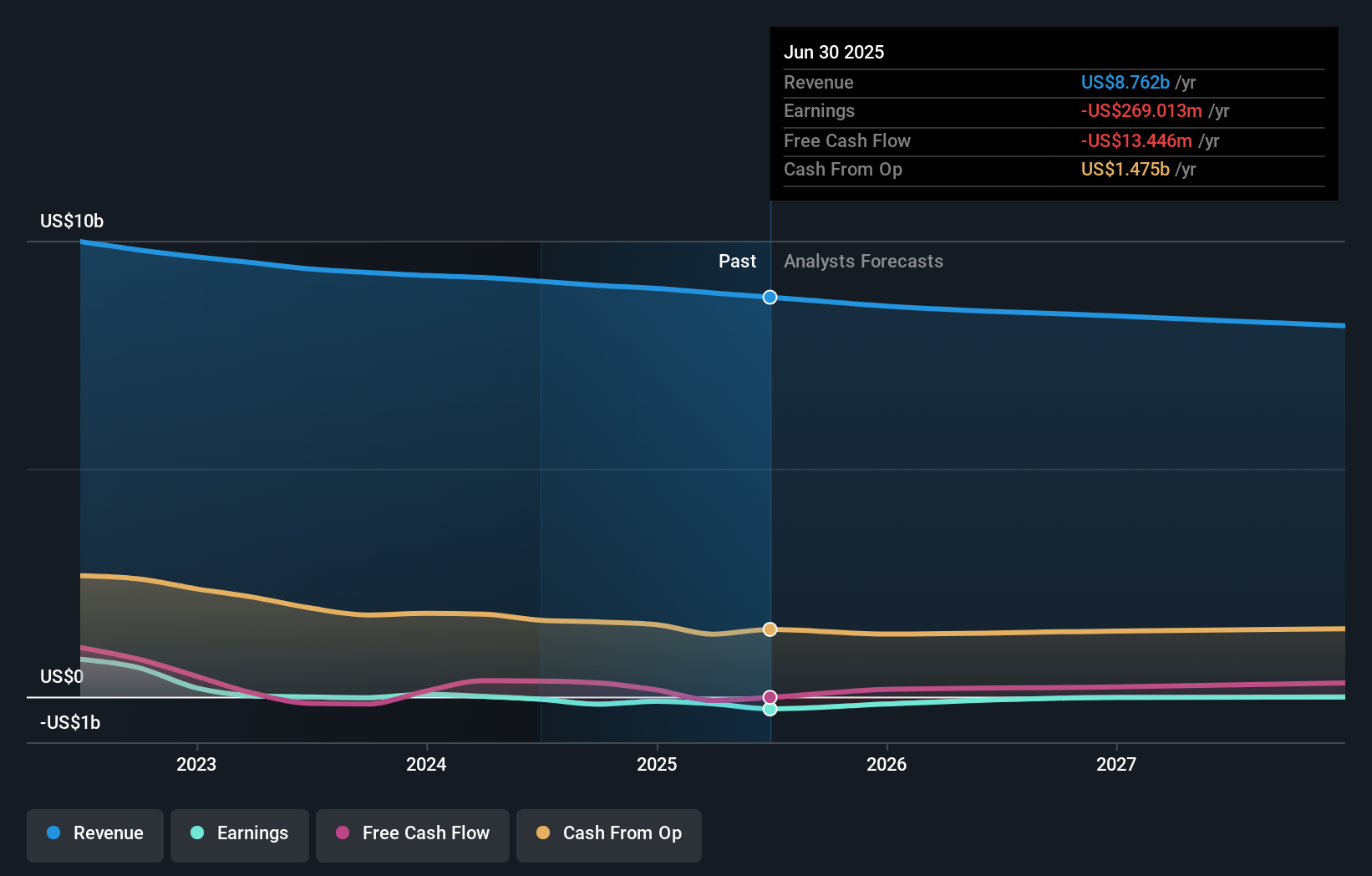

Amidst a challenging landscape, Hut 8's Vega facility marks a significant stride in Bitcoin mining technology. With an innovative liquid cooling system, the facility optimizes thermal efficiency and operational reliability, supporting compute densities up to 180 kilowatts per rack—a notable advancement over traditional air-cooled systems. Despite recent drops from various Russell indexes and a substantial net loss reported in Q1 2025, Hut 8's amended credit agreement with Coinbase suggests strategic financial maneuvering to bolster its growth trajectory. This move could potentially stabilize the company amidst volatile market conditions and pave the way for leveraging emerging high-performance computing workloads.

- Take a closer look at Hut 8's potential here in our health report.

Gain insights into Hut 8's historical performance by reviewing our past performance report.

Altice USA (ATUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Altice USA, Inc. operates as a provider of broadband communications and video services under the Optimum brand across the United States, Canada, Puerto Rico, and the Virgin Islands with a market cap of approximately $1.04 billion.

Operations: Altice USA, operating under the Optimum brand, generates revenue primarily from its cable segment, which amounts to approximately $8.86 billion. The company focuses on delivering broadband communications and video services across multiple regions.

Altice USA's recent inclusion in multiple Russell indexes underscores its potential in the tech sector, despite a forecasted annual revenue decline of 2%. This juxtaposition highlights the company's strategic positioning and investor interest. With earnings expected to grow by 66.76% annually, Altice is navigating its financial challenges, evidenced by a significant net loss of $75.68 million in Q1 2025. These developments suggest a complex but possibly rewarding future as it aims for profitability amidst operational adjustments and market recognition.

- Click here and access our complete health analysis report to understand the dynamics of Altice USA.

Evaluate Altice USA's historical performance by accessing our past performance report.

Make It Happen

- Discover the full array of 228 US High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10