Joby Aviation (NYSE:JOBY) Achieves Successful Piloted Flights In Dubai

Joby Aviation (NYSE:JOBY) has recently made headlines with significant advancements, including successful piloted flights in Dubai and key partnerships for its air taxi services, signaling its readiness for commercial markets. These milestones likely bolstered investor confidence, driving an impressive 82% price increase over the last quarter. While the broader market experienced modest gains amidst trade policy uncertainties, Joby's achievements in product development and strategic collaborations provided a strong narrative to counter market trends. The company's amendment to incorporate liability limitations also likely contributed positively, positioning it favorably in the aerospace innovation landscape.

We've identified 5 weaknesses for Joby Aviation (1 doesn't sit too well with us) that you should be aware of.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Over the past year, Joby Aviation's shares yielded a total return of 122.90%, a very large jump, which underscores the company's appeal despite reported losses. Compared to the US Airlines industry and the overall market, where Joby surpassed the industry's 30% return and the market's 12.6% return over one year, the company's share performance has been exceptional. This growth highlights investor optimism in Joby's potential, particularly amidst its advancements in the urban air mobility sector.

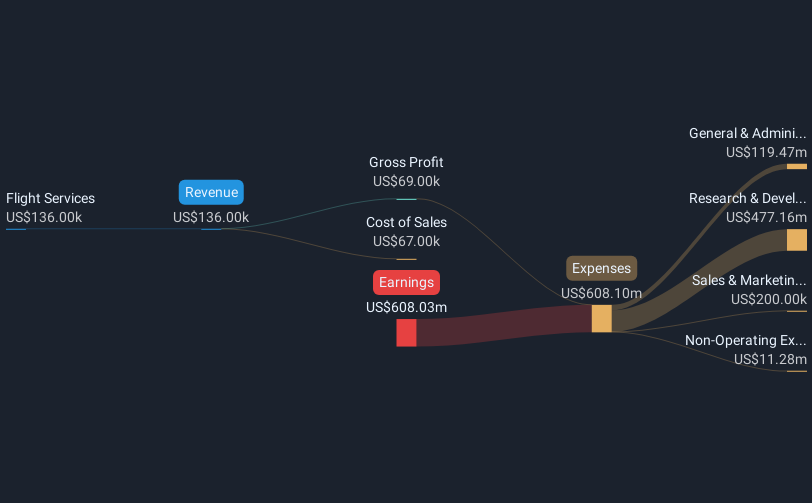

The recent price surge follows the company's notable achievements like successful piloted flights and collaborations, which have likely boosted revenue projections significantly as reflected in the anticipated annual growth rate of 65.6% per year. However, with continuing net losses reported, Joby remains unprofitable and forecasts indicate it is unlikely to become profitable in the near term. Additionally, the current share price eclipses the consensus analyst price target of US$8.25, suggesting that some investors might be pricing in an optimistic future outlook despite the earnings challenges. The combination of robust share price performance and ongoing strategic developments positions Joby as an exciting prospect in its industry, though profitability remains a key focus going forward.

The analysis detailed in our Joby Aviation valuation report hints at an inflated share price compared to its estimated value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10