Undervalued Small Caps With Insider Buying In Global Markets July 2025

The United States market has experienced a notable uptick, climbing 1.8% in the last seven days and showing a robust 14% increase over the past year, with earnings projected to grow by 15% annually. In this dynamic environment, identifying small-cap stocks that are perceived as undervalued and exhibit insider buying can be an intriguing strategy for investors seeking opportunities amid these favorable conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | NA | 0.5x | 39.57% | ★★★★★☆ |

| Lindblad Expeditions Holdings | NA | 1.0x | 27.33% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | 49.56% | ★★★★★☆ |

| Citizens & Northern | 11.7x | 2.9x | 44.44% | ★★★★☆☆ |

| Southside Bancshares | 10.7x | 3.7x | 37.96% | ★★★★☆☆ |

| S&T Bancorp | 11.4x | 3.9x | 39.27% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 30.99% | ★★★★☆☆ |

| Montrose Environmental Group | NA | 1.1x | 4.66% | ★★★★☆☆ |

| Standard Motor Products | 12.8x | 0.5x | -2395.66% | ★★★☆☆☆ |

| Farmland Partners | 9.3x | 9.4x | -12.78% | ★★★☆☆☆ |

Click here to see the full list of 75 stocks from our Undervalued US Small Caps With Insider Buying screener.

Here's a peek at a few of the choices from the screener.

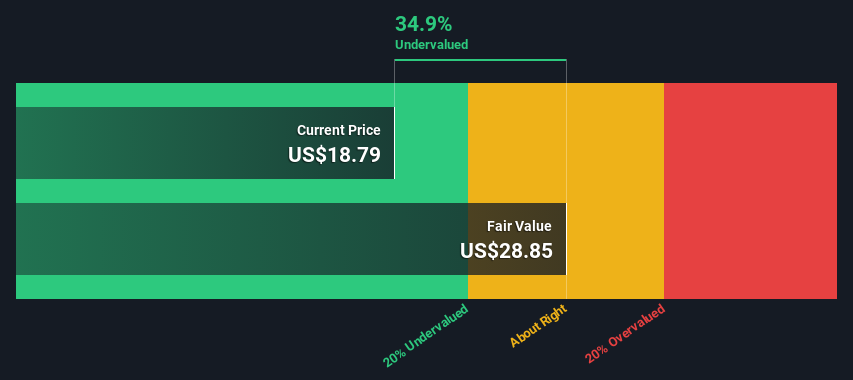

Alerus Financial (ALRS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Alerus Financial is a diversified financial services company offering wealth management, banking including mortgage services, and retirement and benefit solutions with a market cap of approximately $0.52 billion.

Operations: Alerus Financial generates revenue primarily from Banking Including Mortgage services, followed by Retirement and Benefit Services, and Wealth management. The company has consistently reported a gross profit margin of 100%, indicating no cost of goods sold data available. Operating expenses are a significant component, with General & Administrative expenses being the largest portion. Net income margin shows variability over time, peaking at 22.17% in March 2021 and declining to 10.96% by March 2025.

PE: 23.6x

Alerus Financial, a smaller U.S. firm, showcases potential despite recent index exclusions on June 30, 2025. With net interest income rising to US$41.16 million in Q1 2025 from US$22.22 million the previous year and net income doubling to US$13.32 million, Alerus demonstrates financial resilience amidst challenges like higher charge-offs of US$407,000 compared to last year's US$58,000. Insider confidence is evident with share purchases in early 2025, while a dividend increase hints at commitment to shareholder returns.

- Click to explore a detailed breakdown of our findings in Alerus Financial's valuation report.

Gain insights into Alerus Financial's historical performance by reviewing our past performance report.

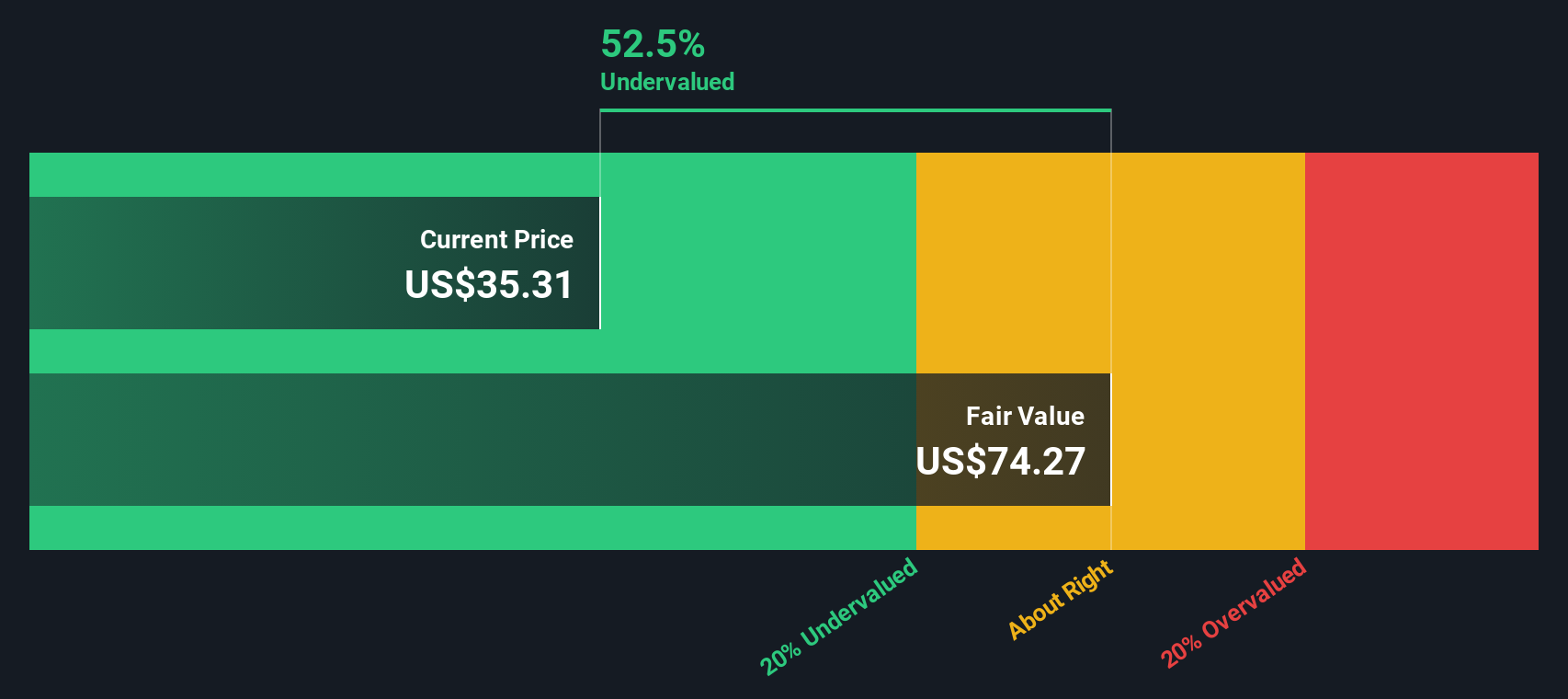

LTC Properties (LTC)

Simply Wall St Value Rating: ★★★★★☆

Overview: LTC Properties is a real estate investment trust focusing on the healthcare sector, with operations primarily in senior housing and skilled nursing facilities, and a market cap of approximately $1.73 billion.

Operations: The company primarily generates revenue from its REIT - Health Care segment, with recent quarterly revenue reaching $202.69 million. Its cost structure includes COGS of $13.65 million and operating expenses of $67.30 million, impacting net income figures significantly. The gross profit margin has shown a trend of being above 90%, indicating efficient management in covering direct costs associated with revenue generation.

PE: 18.7x

LTC Properties, a company in the healthcare real estate sector, shows potential as an undervalued investment. Despite a dip in Q1 2025 revenue to US$49.03 million from US$51.37 million the previous year, insider confidence is evident with recent share purchases over several months. The firm's financial position remains stable with forecasted revenue growth of 14% annually and consistent monthly dividends of US$0.19 per share for Q3 2025, indicating steady income prospects for investors.

- Navigate through the intricacies of LTC Properties with our comprehensive valuation report here.

Understand LTC Properties' track record by examining our Past report.

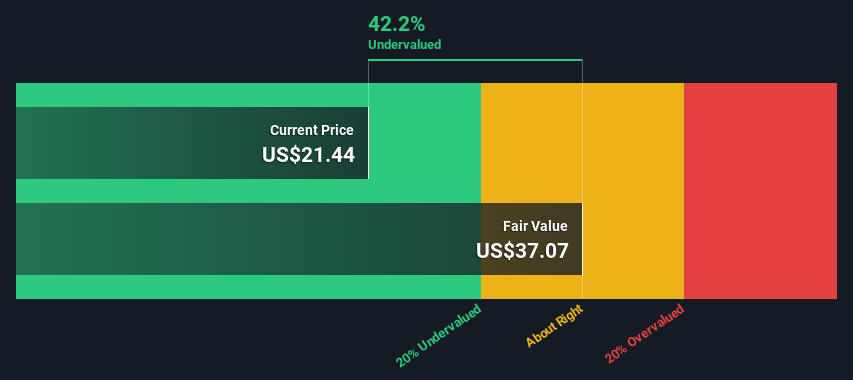

Magnera (MAGN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magnera is a global company that operates primarily in the Americas and other international markets, with a focus on delivering innovative solutions across various sectors, and has a market cap of $2.5 billion.

Operations: Magnera generates revenue primarily from the Americas and Rest of World markets, totaling $2.64 billion. The company's financial performance shows a declining trend in net income margin, which dropped from 10.97% in 2021 to -9.90% by mid-2025, driven by increasing non-operating expenses and consistent cost of goods sold (COGS).

PE: -1.8x

Magnera, a small company in the U.S., has recently shown insider confidence with CEO Curtis Begle purchasing 23,786 shares for US$501,297. Despite a volatile share price over the past three months and reliance on external borrowing, earnings are expected to grow significantly at 109% annually. Recent financials revealed sales of US$824 million in Q2 2025 but also a net loss of US$41 million. Magnera's participation in industry conferences indicates proactive engagement with investors and stakeholders.

- Get an in-depth perspective on Magnera's performance by reading our valuation report here.

Assess Magnera's past performance with our detailed historical performance reports.

Taking Advantage

- Investigate our full lineup of 75 Undervalued US Small Caps With Insider Buying right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10