Top Growth Companies With Strong Insider Ownership In July 2025

In the last week, the U.S. market has been flat, yet it has shown a robust 13% increase over the past year, with earnings anticipated to grow by 15% annually in the coming years. In this context of steady growth and optimistic forecasts, identifying companies with strong insider ownership can be crucial as it often indicates confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 15.4% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 39.1% |

| Prairie Operating (PROP) | 34.6% | 92.4% |

| McEwen (MUX) | 15.8% | 134.4% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.5% |

| Credo Technology Group Holding (CRDO) | 11.8% | 47% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| Astera Labs (ALAB) | 13.1% | 44.4% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 63.1% |

Click here to see the full list of 195 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Here we highlight a subset of our preferred stocks from the screener.

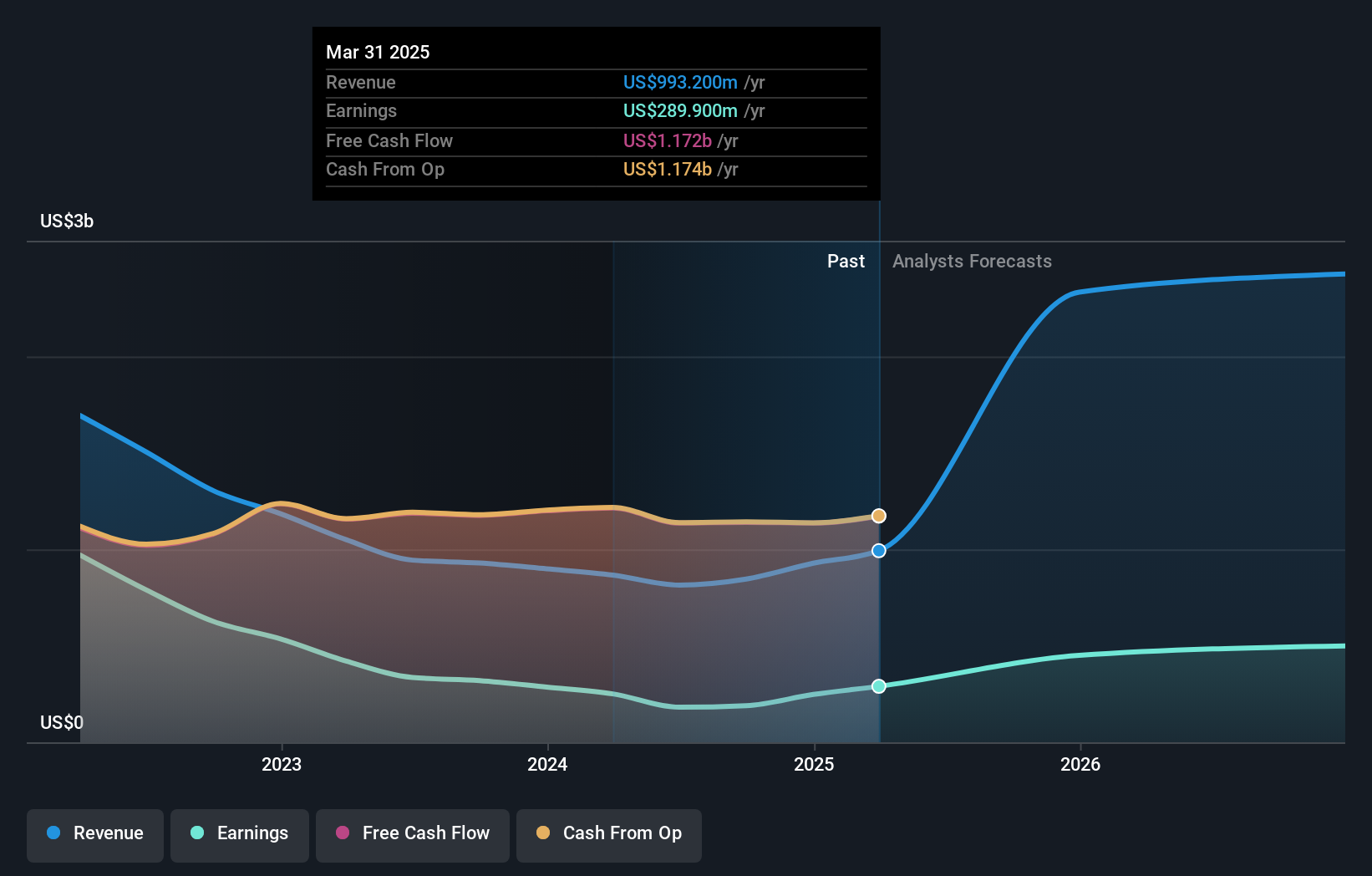

Credit Acceptance (CACC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Credit Acceptance Corporation provides financing programs and related products and services in the United States, with a market cap of $6.16 billion.

Operations: The company's revenue is primarily derived from offering dealers financing programs and related products and services, totaling $993.20 million.

Insider Ownership: 16.1%

Credit Acceptance Corporation demonstrates strong growth potential, with revenue forecasted to grow 40.9% annually, outpacing the US market. Earnings are expected to increase significantly at 28.3% per year. Recent developments include a debt facility extension and a substantial share buyback program, repurchasing shares worth US$555.72 million. Despite facing legal challenges, including a lawsuit partially withdrawn by the CFPB, insider ownership remains high with no significant insider trading activity reported in recent months.

- Take a closer look at Credit Acceptance's potential here in our earnings growth report.

- According our valuation report, there's an indication that Credit Acceptance's share price might be on the expensive side.

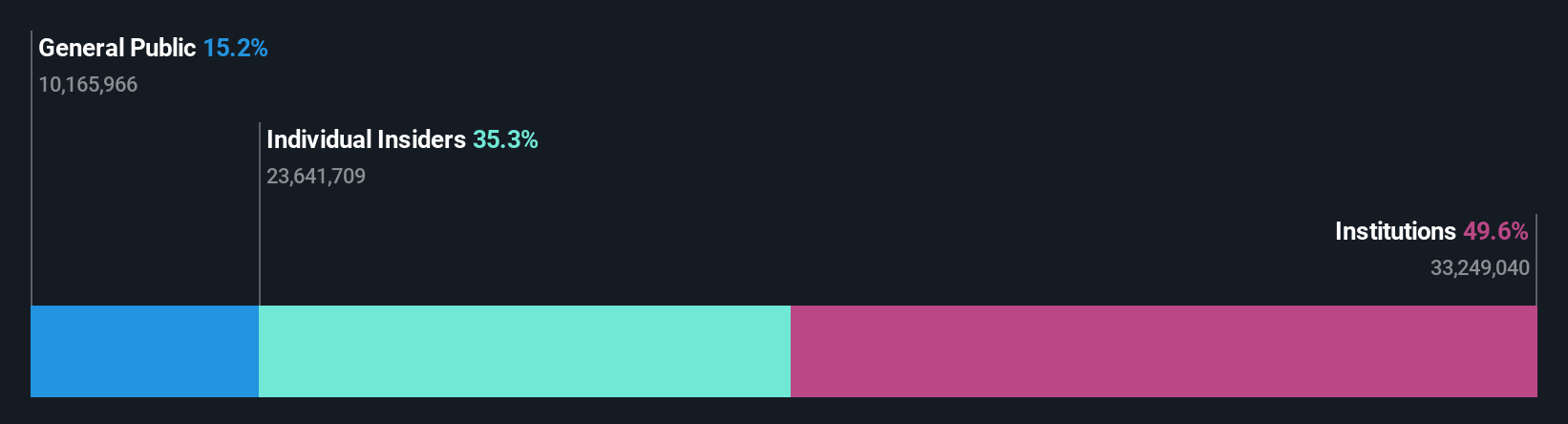

Daqo New Energy (DQ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Daqo New Energy Corp. manufactures and sells polysilicon to photovoltaic product manufacturers in China, with a market cap of approximately $1.27 billion.

Operations: The company generates revenue of $737.68 million from the sale of polysilicon to photovoltaic product manufacturers in China.

Insider Ownership: 35.3%

Daqo New Energy is poised for substantial growth, with revenue expected to increase 28.5% annually, surpassing the US market rate. Although currently unprofitable, earnings are projected to rise significantly over the next three years. Recent production guidance indicates robust polysilicon output targets for 2025 despite a challenging first quarter with a net loss of US$71.84 million and declining sales of US$123.91 million compared to last year’s figures.

- Navigate through the intricacies of Daqo New Energy with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Daqo New Energy's shares may be trading at a discount.

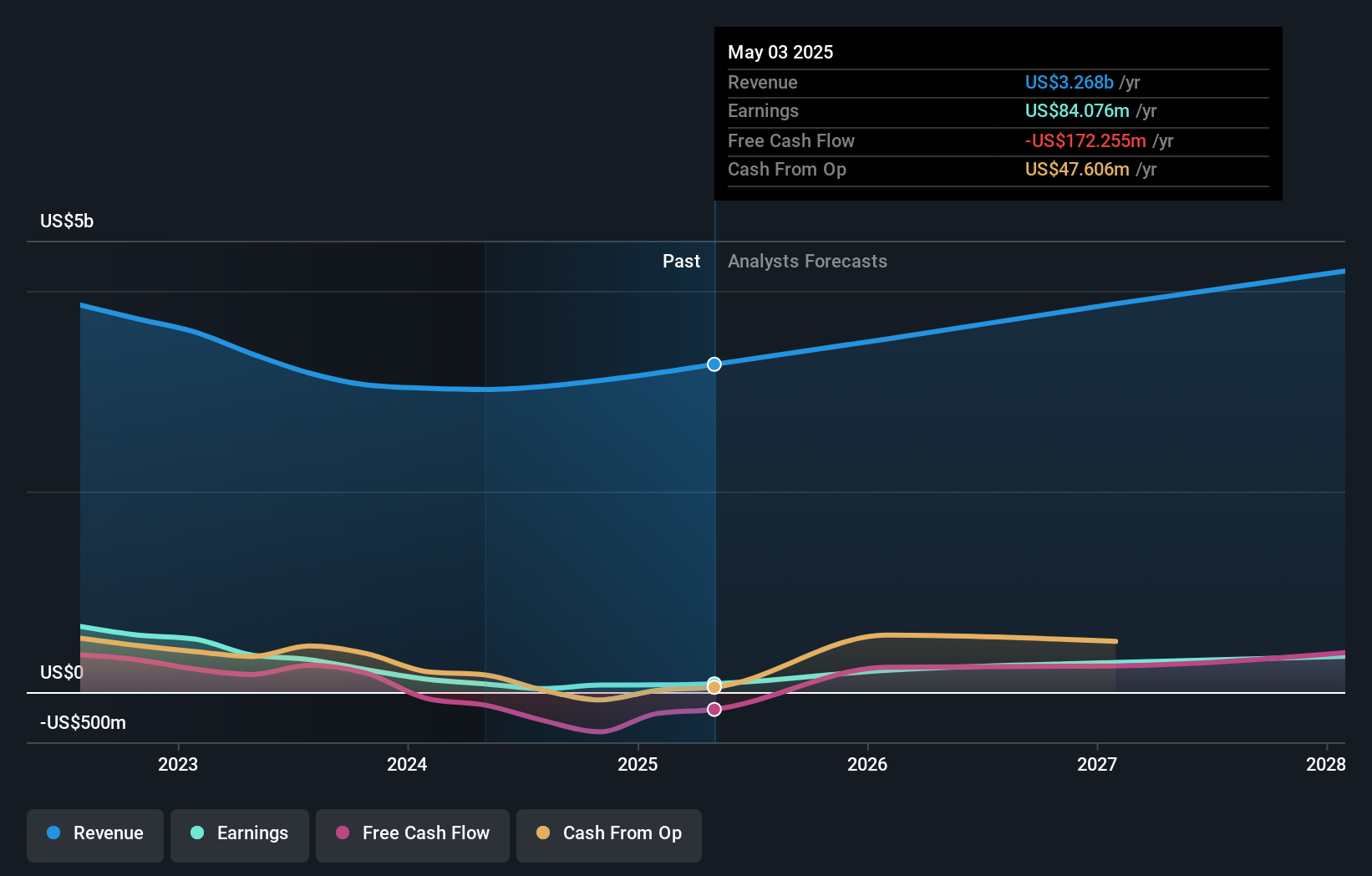

RH (RH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RH operates as a retailer and lifestyle brand in the home furnishings market across the United States, Canada, the United Kingdom, Germany, Belgium, and Spain with a market cap of approximately $3.88 billion.

Operations: The company's revenue is primarily derived from its Restoration Hardware (RH) segment, which accounts for $3.08 billion, and its Waterworks segment, contributing $192 million.

Insider Ownership: 15.9%

RH's expansion strategy, including new gallery openings in Oklahoma City and globally, aligns with its growth trajectory despite revenue forecasts trailing the US market. The company anticipates significant earnings growth of 42.1% annually over the next three years, yet it faces challenges like volatile share prices and negative equity. Recent earnings showed improvement with a net income of US$8.04 million compared to last year's loss, reflecting operational resilience amidst financial hurdles.

- Get an in-depth perspective on RH's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, RH's share price might be too optimistic.

Where To Now?

- Embark on your investment journey to our 195 Fast Growing US Companies With High Insider Ownership selection here.

- Curious About Other Options? Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10