Top Dividend Stocks To Consider In July 2025

Over the last 7 days, the United States market has risen 2.1%, contributing to a notable 14% climb over the past year, with earnings expected to grow by 15% annually. In this favorable environment, identifying strong dividend stocks can be an effective strategy for investors seeking reliable income and potential growth in line with these market trends.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.58% | ★★★★★★ |

| Southside Bancshares (SBSI) | 4.62% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.53% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.04% | ★★★★★★ |

| Ennis (EBF) | 5.36% | ★★★★★★ |

| Dillard's (DDS) | 5.70% | ★★★★★★ |

| Credicorp (BAP) | 4.83% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.64% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.57% | ★★★★★☆ |

| Chevron (CVX) | 4.61% | ★★★★★★ |

Click here to see the full list of 133 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

General American Investors Company (GAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: General American Investors Company, Inc. is a publicly owned investment manager with a market cap of approximately $1.33 billion.

Operations: General American Investors Company, Inc. generates revenue primarily through its Financial Services segment, specifically from Closed End Funds, amounting to $28.40 million.

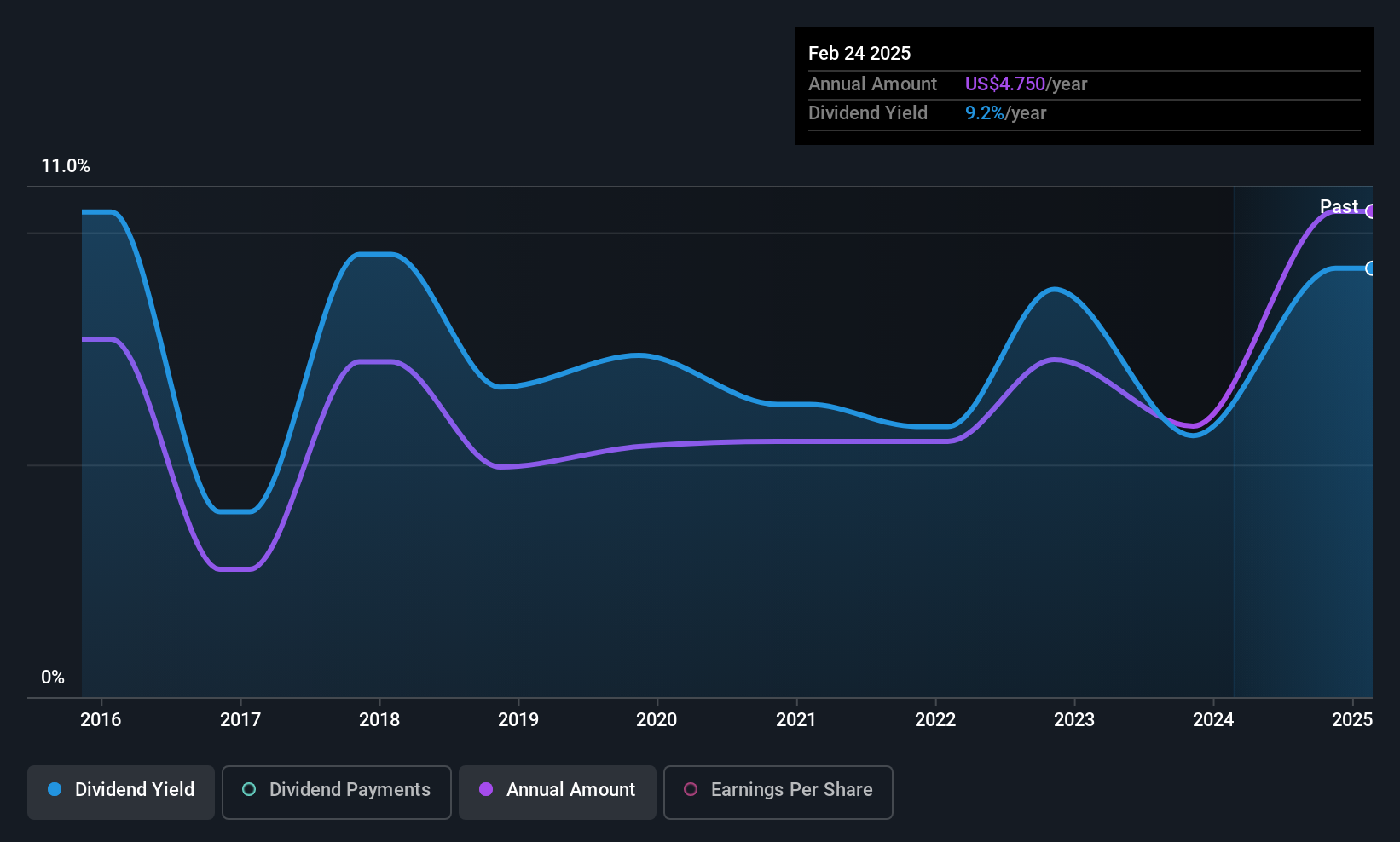

Dividend Yield: 8.4%

General American Investors Company offers a compelling dividend yield of 8.39%, placing it in the top 25% of US dividend payers. Despite a reasonably low payout ratio of 47.6%, its dividends have been volatile and unreliable over the past decade, with large one-off items impacting earnings quality. Recent developments include a declared preferred stock dividend and an expanded equity buyback plan, signaling strategic capital allocation despite insufficient data on cash flow coverage for dividends.

- Delve into the full analysis dividend report here for a deeper understanding of General American Investors Company.

- The valuation report we've compiled suggests that General American Investors Company's current price could be quite moderate.

Merck (MRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Merck & Co., Inc. is a global healthcare company with operations worldwide and a market cap of approximately $203.22 billion.

Operations: Merck & Co., Inc. generates revenue primarily from its Pharmaceutical segment, which accounts for $57.03 billion, and its Animal Health segment, contributing $5.95 billion.

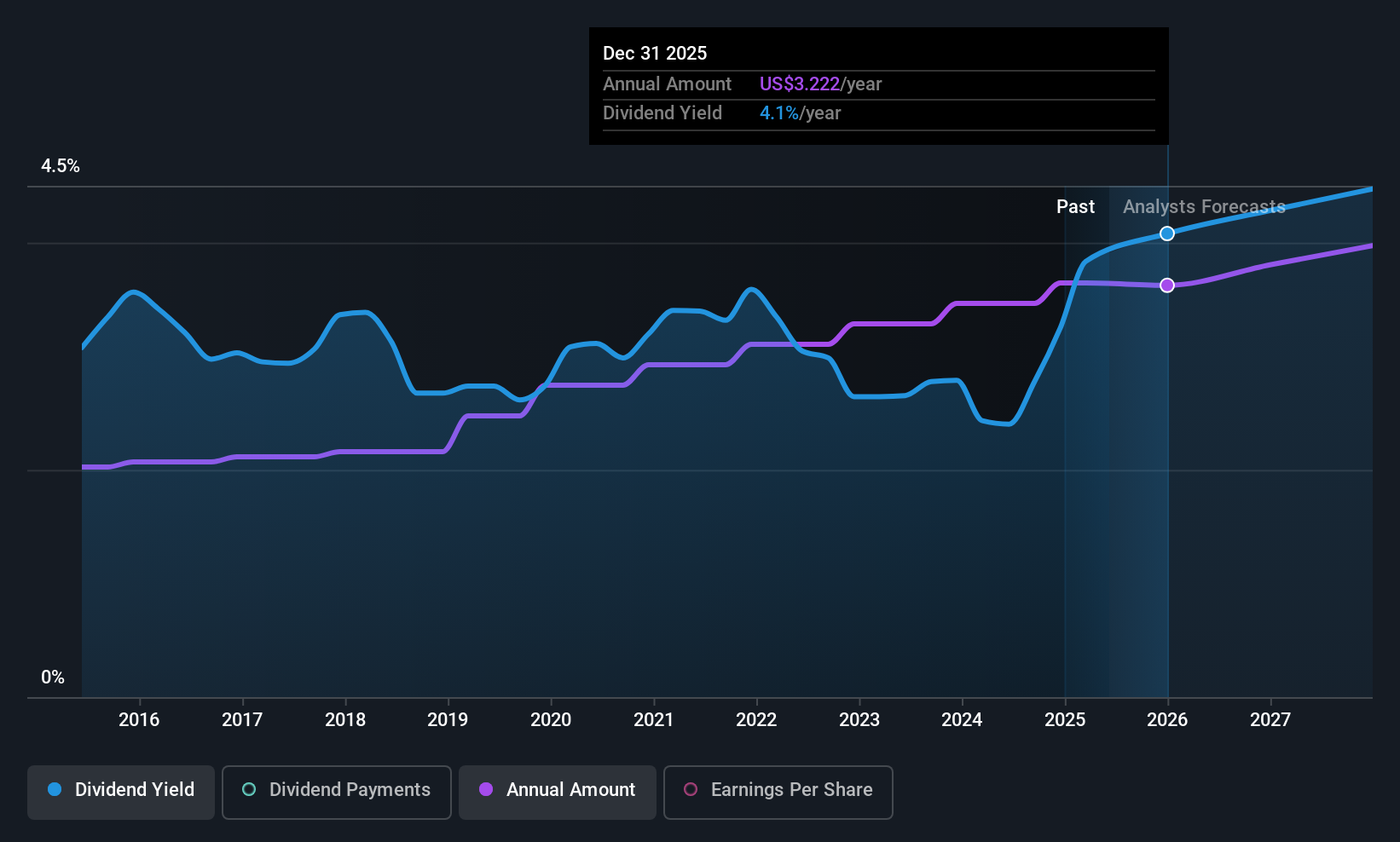

Dividend Yield: 4%

Merck offers a stable dividend yield of 4%, supported by a low payout ratio of 45.3%, ensuring coverage by earnings and cash flows. Despite high debt levels, Merck's dividends have grown consistently over the past decade. Recent index reclassifications shifted Merck from growth to value indices, reflecting its strategic focus on value-driven growth through innovative product developments like WINREVAIR for pulmonary arterial hypertension and ENFLONSIA for RSV prevention in infants.

- Click here to discover the nuances of Merck with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Merck is priced lower than what may be justified by its financials.

Safe Bulkers (SB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Safe Bulkers, Inc., along with its subsidiaries, offers marine drybulk transportation services on an international scale and has a market cap of $386.73 million.

Operations: Safe Bulkers, Inc. generates revenue primarily from its transportation - shipping segment, amounting to $290.31 million.

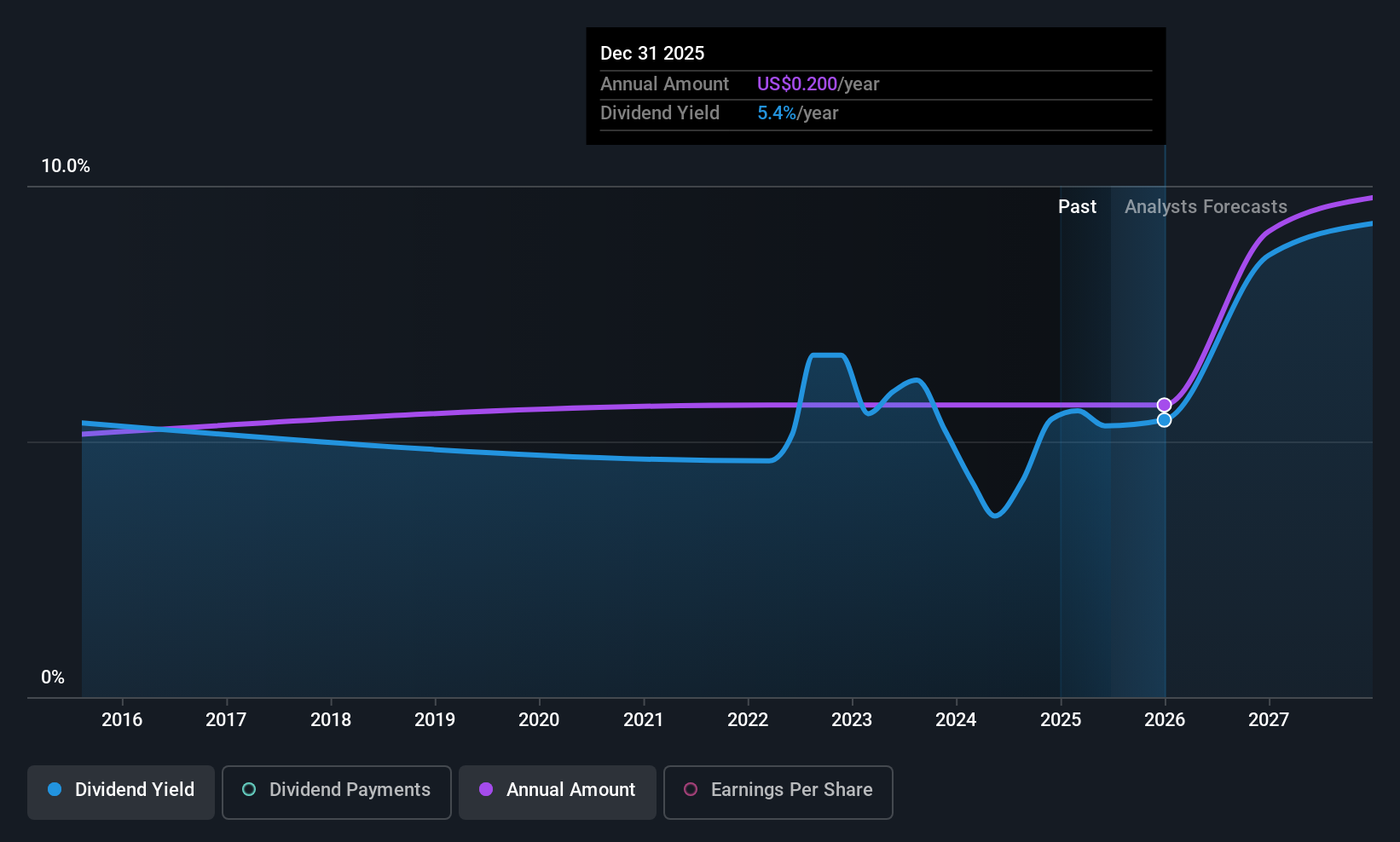

Dividend Yield: 5.3%

Safe Bulkers' dividend yield is among the top 25% in the US, but its payments have been volatile and not reliably covered by free cash flow. Despite a low payout ratio of 29.8%, indicating coverage by earnings, high debt levels and large one-off items affect financial stability. Recent announcements include a common stock dividend of US$0.05 per share and preferred dividends on Series C and D shares, highlighting ongoing shareholder returns amidst fluctuating earnings performance.

- Take a closer look at Safe Bulkers' potential here in our dividend report.

- The analysis detailed in our Safe Bulkers valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Click here to access our complete index of 133 Top US Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10