High Growth Tech Stocks In The US To Watch This July 2025

The United States market has experienced a 2.1% increase over the past week and is up 14% over the last year, with earnings projected to grow by 15% annually. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.71% | 39.09% | ★★★★★★ |

| Circle Internet Group | 32.27% | 61.44% | ★★★★★★ |

| Mereo BioPharma Group | 50.84% | 58.22% | ★★★★★★ |

| Ardelyx | 21.02% | 61.29% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.72% | 59.95% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 23.02% | 103.97% | ★★★★★★ |

Click here to see the full list of 217 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Amicus Therapeutics (FOLD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Amicus Therapeutics, Inc. is a biotechnology company dedicated to discovering, developing, and delivering novel medicines for rare diseases globally, with a market capitalization of approximately $1.88 billion.

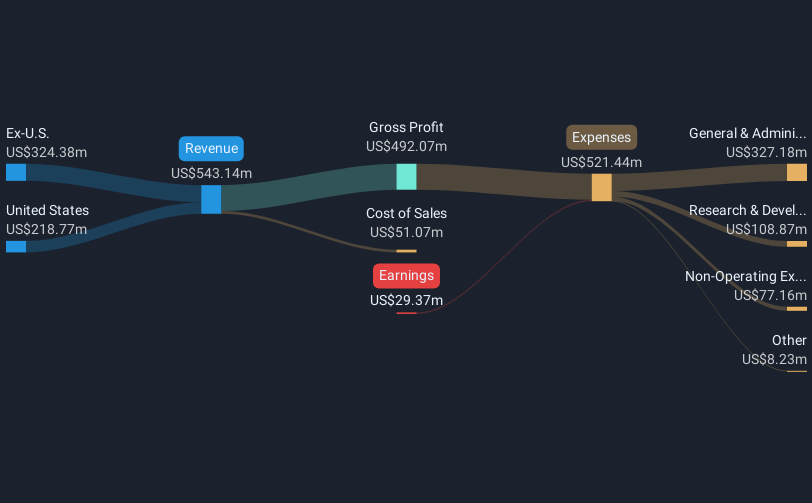

Operations: FOLD focuses on the discovery, development, and commercialization of advanced therapies for rare diseases, generating $543.14 million in revenue.

Amicus Therapeutics, despite being unprofitable, shows promising growth prospects with a revenue increase forecasted at 17.7% annually, outpacing the US market's 8.7%. The company's recent approval in Japan for its innovative two-component therapy for Pompe disease underscores its commitment to expanding global access to treatment. This strategic move, coupled with a significant reduction in net loss from $48.42 million to $21.69 million year-over-year and an anticipated profitability within three years, positions Amicus as a potential key player in biotech innovation and market expansion.

- Click here and access our complete health analysis report to understand the dynamics of Amicus Therapeutics.

Examine Amicus Therapeutics' past performance report to understand how it has performed in the past.

Okta (OKTA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Okta, Inc. operates as an identity partner both in the United States and internationally, with a market cap of $17.35 billion.

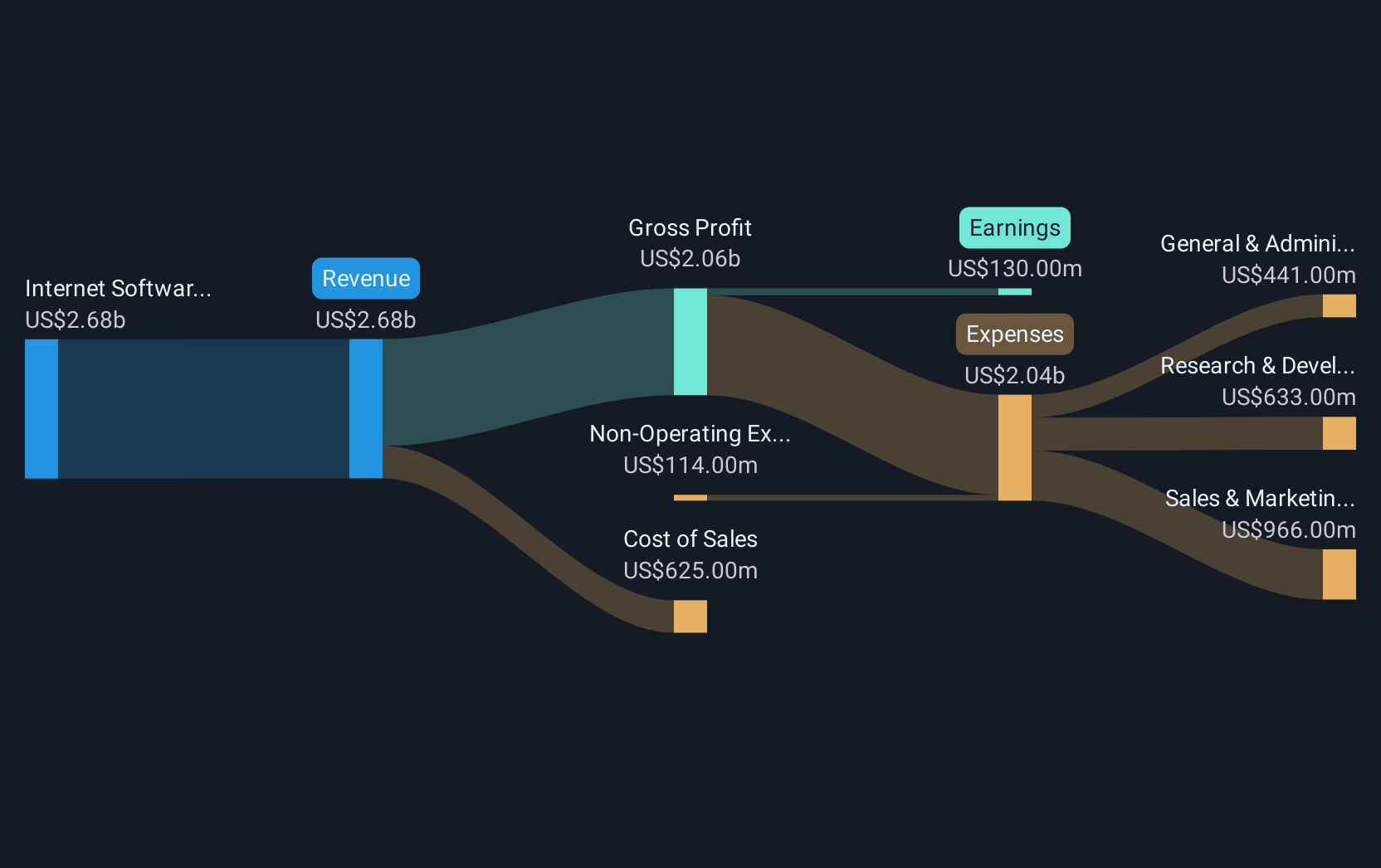

Operations: Okta generates revenue primarily from its Internet Software & Services segment, amounting to $2.68 billion.

Okta, recently profitable, is navigating the high-growth tech landscape with innovations like its Cross App Access protocol, enhancing AI agent security across enterprise applications. This move reflects a strategic pivot to address the complexities of modern cybersecurity, especially as enterprises integrate more autonomous AI tools. With a robust 25% expected annual earnings growth and recent revenue hitting $688 million—a significant leap from last year—the company is poised for continued expansion. These developments come alongside Okta's active participation in major industry conferences, underscoring its commitment to shaping future tech standards and practices.

- Get an in-depth perspective on Okta's performance by reading our health report here.

Learn about Okta's historical performance.

Sarepta Therapeutics (SRPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company specializing in RNA-targeted therapeutics and gene therapies for rare diseases, with a market cap of approximately $1.79 billion.

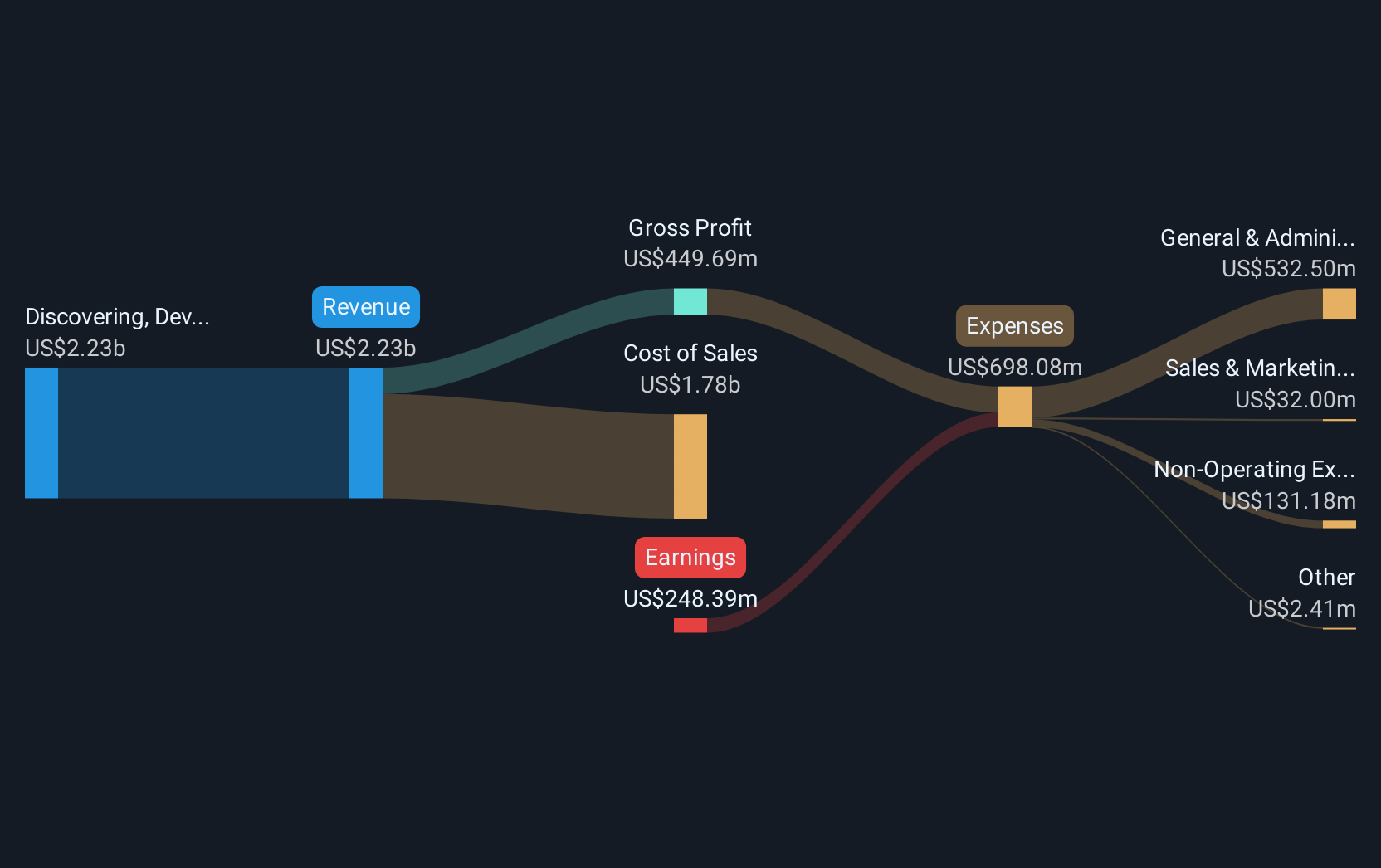

Operations: Sarepta Therapeutics generates revenue primarily from discovering, developing, manufacturing, and delivering therapies for rare diseases, amounting to $2.23 billion. The company's operations focus on RNA-targeted therapeutics and gene therapies.

Sarepta Therapeutics, despite its unprofitable status and a projected revenue decline of 0.6% annually, is navigating the high-growth biotech landscape with significant strategic moves. Recently added to multiple Russell indexes, the company is poised to enhance its market visibility. Sarepta's commitment to innovation is underscored by its recent safety updates and regulatory engagements concerning ELEVIDYS, its gene therapy for Duchenne muscular dystrophy. This focus on advancing gene therapies reflects a broader industry trend towards targeted, personalized medicine—a sector that continues to attract significant investment and research interest.

- Dive into the specifics of Sarepta Therapeutics here with our thorough health report.

Evaluate Sarepta Therapeutics' historical performance by accessing our past performance report.

Key Takeaways

- Click through to start exploring the rest of the 214 US High Growth Tech and AI Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10