Here's Why iFAST (SGX:AIY) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in iFAST (SGX:AIY). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

iFAST's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Impressively, iFAST has grown EPS by 34% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that iFAST's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. The good news is that iFAST is growing revenues, and EBIT margins improved by 9.5 percentage points to 31%, over the last year. Both of which are great metrics to check off for potential growth.

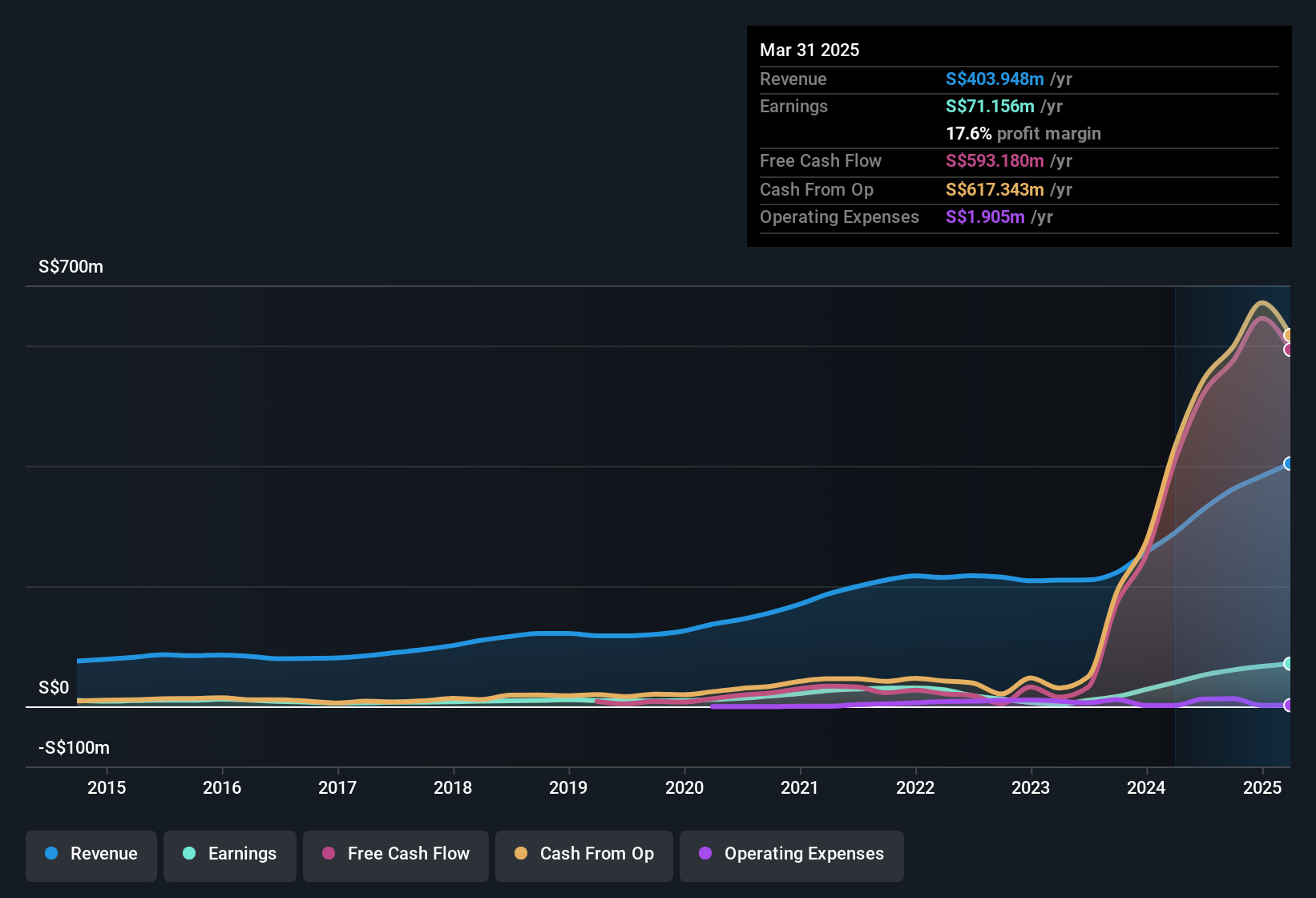

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

See our latest analysis for iFAST

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for iFAST's future profits.

Are iFAST Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Our analysis into iFAST has shown that insiders have sold S$313k worth of shares over the last 12 months. But this is outweighed by the trades from Non-Independent Non-Executive Director Wee Kian Lim who spent S$520k buying shares, at an average price of around S$6.51. So, on balance, that's positive.

The good news, alongside the insider buying, for iFAST bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth S$582m. This totals to 28% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Should You Add iFAST To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into iFAST's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. If you think iFAST might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

The good news is that iFAST is not the only stock with insider buying. Here's a list of small cap, undervalued companies in SG with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if iFAST might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10