3 Reliable Dividend Stocks Offering Up To 8.3% Yield

As the S&P 500 and Nasdaq Composite reach new all-time highs, buoyed by a robust June jobs report and optimism surrounding trade agreements, investors are increasingly optimistic about the U.S. economy's resilience. In this environment of strong market performance, dividend stocks offering attractive yields can provide a reliable income stream, making them an appealing choice for those seeking stability amidst market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.63% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.56% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.15% | ★★★★★★ |

| Ennis (EBF) | 5.38% | ★★★★★★ |

| Dillard's (DDS) | 5.77% | ★★★★★★ |

| Credicorp (BAP) | 4.86% | ★★★★★☆ |

| CompX International (CIX) | 4.69% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.74% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.67% | ★★★★★☆ |

| Chevron (CVX) | 4.62% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

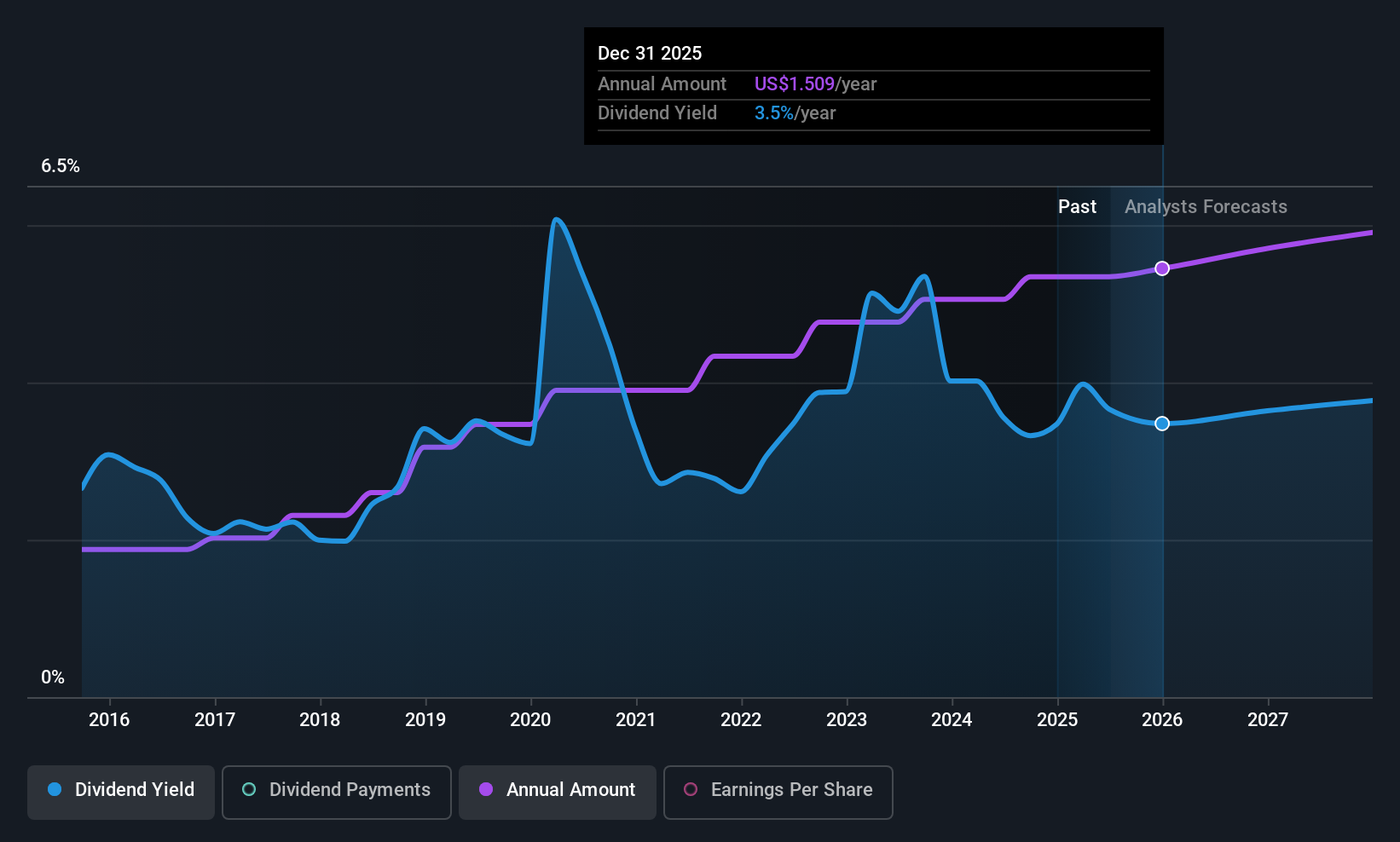

Fifth Third Bancorp (FITB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fifth Third Bancorp is a bank holding company for Fifth Third Bank, National Association, offering a variety of financial products and services in the United States, with a market cap of approximately $28.33 billion.

Operations: Fifth Third Bancorp generates revenue through its Commercial Banking segment ($3.57 billion), Wealth and Asset Management segment ($611 million), and Consumer and Small Business Banking segment ($4.78 billion) in the United States.

Dividend Yield: 3.4%

Fifth Third Bancorp offers a stable and reliable dividend, currently yielding 3.43%, with dividends well-covered by earnings, evidenced by a 46% payout ratio. Recent strategic moves include its addition to the Russell 1000 Value-Defensive Index and executive appointments aimed at growth and talent development. The company declared a cash dividend of $0.37 per share for Q2 2025, payable on July 15, reflecting its commitment to shareholder returns amidst ongoing buyback programs.

- Click here to discover the nuances of Fifth Third Bancorp with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Fifth Third Bancorp is trading behind its estimated value.

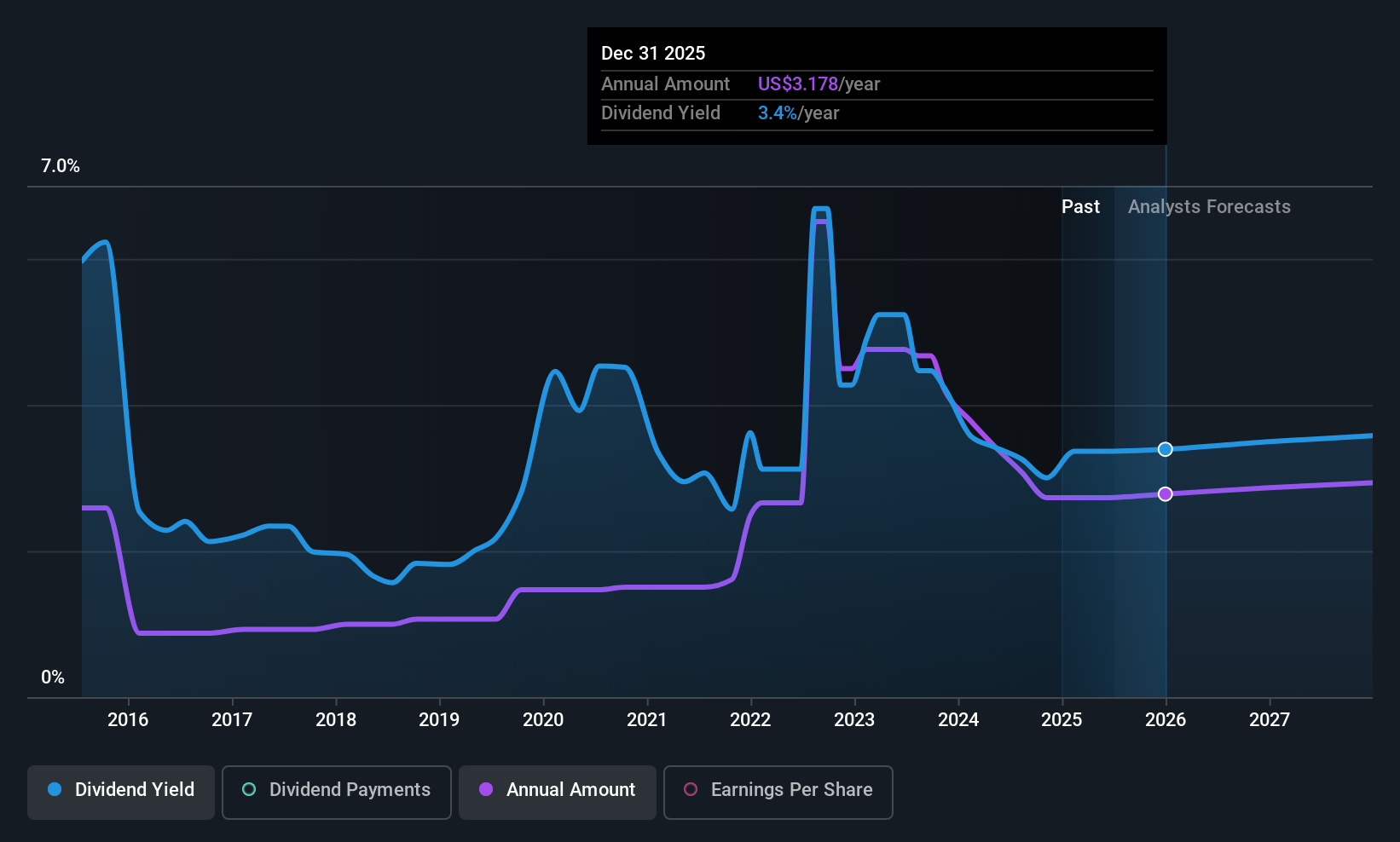

ConocoPhillips (COP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ConocoPhillips is engaged in the exploration, production, transportation, and marketing of crude oil, bitumen, natural gas, LNG, and natural gas liquids with a market cap of $116.13 billion.

Operations: ConocoPhillips generates revenue from various segments, including Alaska ($6.49 billion), Canada ($5.72 billion), Lower 48 ($39.28 billion), Asia Pacific ($2.81 billion), and Europe, Middle East, and North Africa ($6.89 billion).

Dividend Yield: 3.3%

ConocoPhillips' dividend payments have been volatile over the past decade, though recent increases are supported by a low payout ratio of 39.4% and cash payout ratio of 45.4%, indicating strong coverage by earnings and cash flows. The company declared a Q2 dividend of $0.78 per share, payable in June 2025. Recent changes include board appointments and executive retirements, alongside its removal from the Russell 1000 Value-Defensive Index amidst ongoing share buybacks totaling US$35.77 billion since 2016.

- Navigate through the intricacies of ConocoPhillips with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that ConocoPhillips is priced lower than what may be justified by its financials.

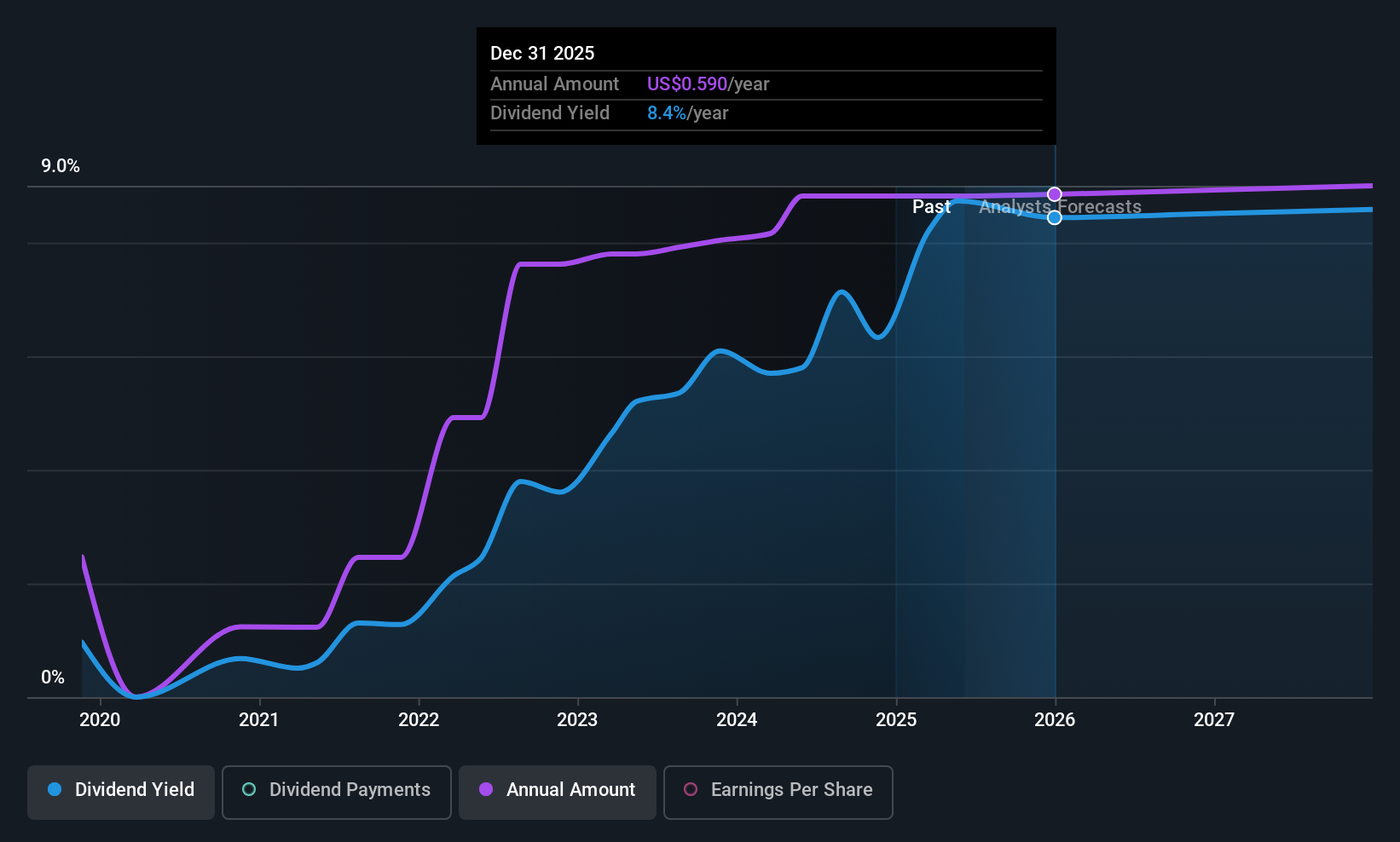

GeoPark (GPRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GeoPark Limited is an oil and natural gas exploration and production company operating in several Latin American countries, including Chile, Colombia, Brazil, Argentina, and Ecuador, with a market cap of $339.72 million.

Operations: GeoPark Limited generates its revenue primarily from its Oil & Gas - Exploration & Production segment, which amounts to $630.77 million.

Dividend Yield: 8.3%

GeoPark's dividend yield is among the top 25% in the US, supported by a low payout ratio of 38.5% and cash payout ratio of 21.6%, ensuring coverage by earnings and cash flows despite an unstable track record over six years. The recent quarterly dividend of $0.147 per share reflects commitment to returns, though Q1 sales fell to US$137.35 million from US$167.42 million year-over-year, with net income dropping significantly as well.

- Click to explore a detailed breakdown of our findings in GeoPark's dividend report.

- The valuation report we've compiled suggests that GeoPark's current price could be quite moderate.

Turning Ideas Into Actions

- Navigate through the entire inventory of 135 Top US Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10