Asian Penny Stocks: SSY Group And 2 Promising Contenders

As global markets continue to capture attention with mixed performances across major indices, investors are increasingly looking toward Asia for opportunities in smaller-cap stocks. Penny stocks, despite their somewhat outdated moniker, remain a relevant area of interest for those seeking potential value in less-established companies. By focusing on those with robust financials and clear growth prospects, these stocks can offer a compelling mix of stability and upside potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.25 | HK$788.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.06 | HK$3.56B | ✅ 5 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.28 | HK$1.9B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.14 | HK$1.9B | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.44 | THB2.66B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.24 | SGD8.82B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.205 | SGD41.45M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.55 | HK$52.2B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 986 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

SSY Group (SEHK:2005)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SSY Group Limited is an investment holding company involved in the research, development, manufacturing, trading, and sale of pharmaceutical products to hospitals and distributors both in the People's Republic of China and internationally, with a market cap of HK$8.36 billion.

Operations: The company generates revenue from two primary segments: Medical Materials, contributing HK$405.07 million, and Intravenous Infusion Solution and Others, which brings in HK$5.59 billion.

Market Cap: HK$8.36B

SSY Group Limited presents a complex picture for investors interested in penny stocks. The company has a satisfactory net debt to equity ratio of 29.6% and its short-term assets exceed both short-term and long-term liabilities, indicating solid liquidity. However, the company's earnings have experienced negative growth over the past year, contrasting with its 11.1% annual profit growth over five years. Recent approvals for several pharmaceutical products could enhance future revenue streams, yet the dividend yield of 6.16% is not well covered by free cash flows. Additionally, SSY's ongoing share repurchase program may positively impact earnings per share.

- Click here and access our complete financial health analysis report to understand the dynamics of SSY Group.

- Assess SSY Group's future earnings estimates with our detailed growth reports.

Jinhai Medical Technology (SEHK:2225)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jinhai Medical Technology Limited is an investment holding company offering minimally invasive surgery solutions, medical products, and related services in China and Singapore, with a market cap of HK$7.60 billion.

Operations: The company generates revenue from two main segments: Products, contributing SGD 25.93 million, and Services, accounting for SGD 24.31 million.

Market Cap: HK$7.6B

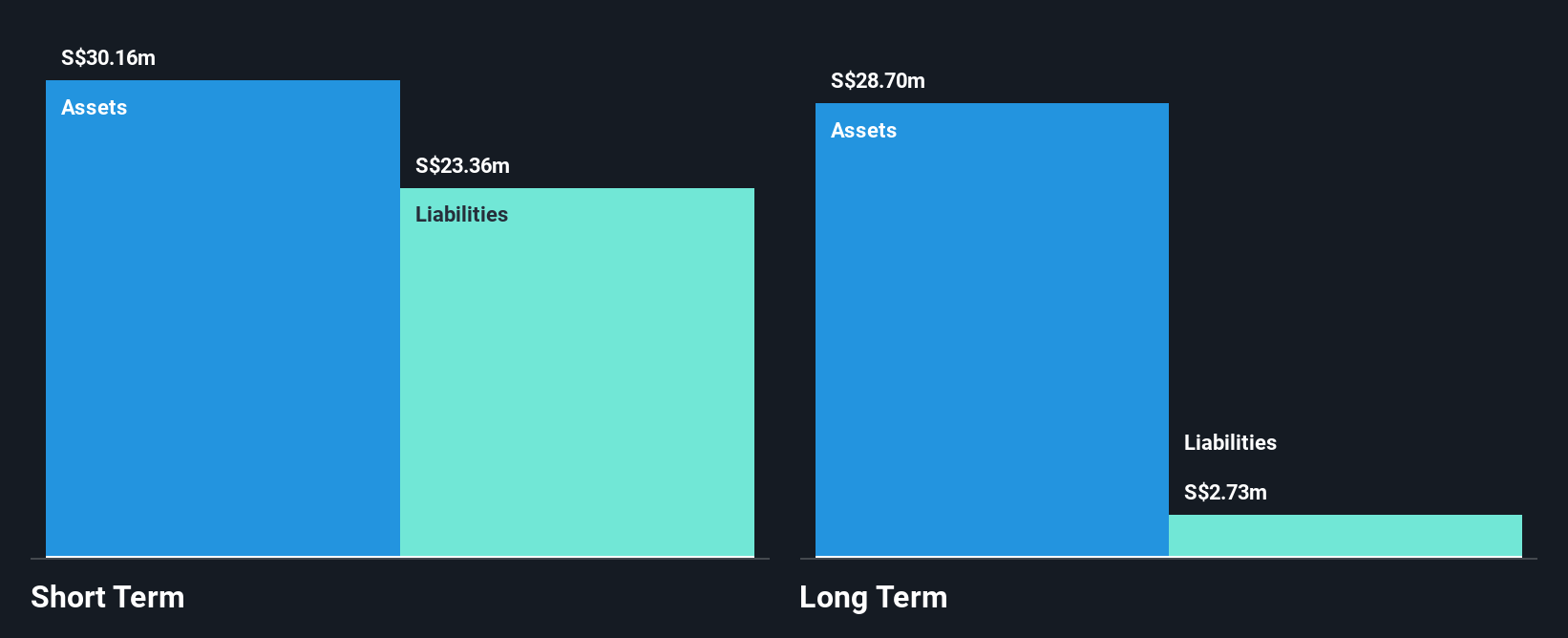

Jinhai Medical Technology Limited, while positioned in the minimally invasive surgery market, presents a mixed outlook for penny stock investors. The company exhibits strong liquidity with short-term assets of SGD 30.2 million exceeding both short and long-term liabilities. However, it remains unprofitable with losses escalating at an annual rate of 83.6% over five years and a negative return on equity of -55.69%. Despite having more cash than total debt and a cash runway exceeding three years, its increased debt-to-equity ratio from 0% to 32.9% raises concerns about financial stability amidst declining earnings.

- Click to explore a detailed breakdown of our findings in Jinhai Medical Technology's financial health report.

- Understand Jinhai Medical Technology's track record by examining our performance history report.

Sinopec Shanghai Petrochemical (SEHK:338)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sinopec Shanghai Petrochemical Company Limited, along with its subsidiaries, is engaged in the manufacturing and sale of petroleum and chemical products in China, with a market cap of HK$27.40 billion.

Operations: Sinopec Shanghai Petrochemical Company Limited does not report specific revenue segments.

Market Cap: HK$27.4B

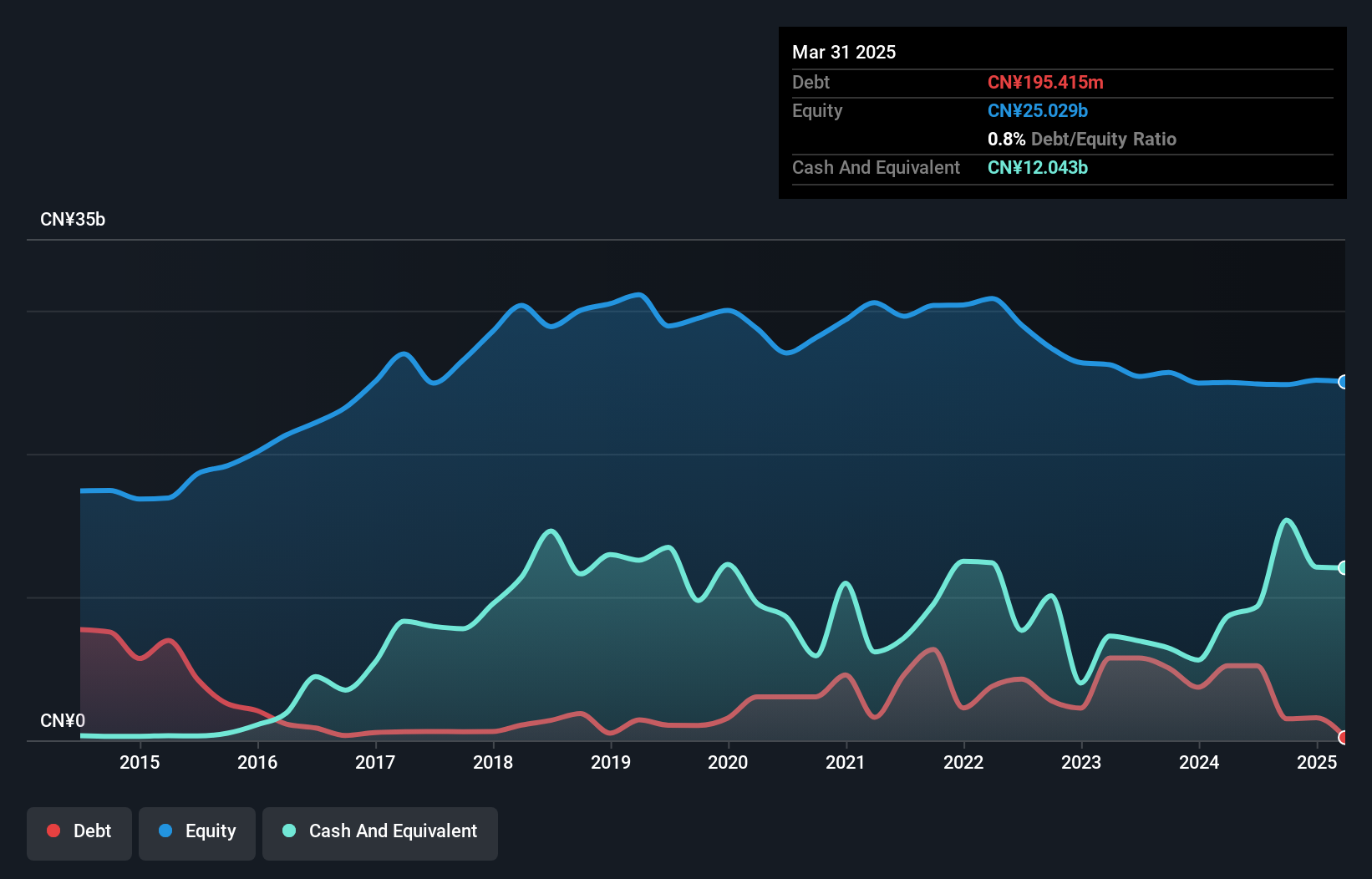

Sinopec Shanghai Petrochemical Company Limited offers a complex picture for penny stock investors. Despite its substantial market cap of HK$27.40 billion and recent profitability, the company faces challenges with a low return on equity at 0.6%. Its financial health is supported by short-term assets of CN¥20.5 billion exceeding both short and long-term liabilities, and debt levels are well managed with more cash than total debt. Recent strategic moves include a steam sales contract with Baling New Materials to optimize resource use, alongside dividend affirmations and completed share buybacks, signaling shareholder value focus amidst fluctuating earnings performance.

- Navigate through the intricacies of Sinopec Shanghai Petrochemical with our comprehensive balance sheet health report here.

- Explore Sinopec Shanghai Petrochemical's analyst forecasts in our growth report.

Summing It All Up

- Navigate through the entire inventory of 986 Asian Penny Stocks here.

- Looking For Alternative Opportunities? These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10