SUI price set for next leg higher as price holds key confluence zone 7 seconds ago

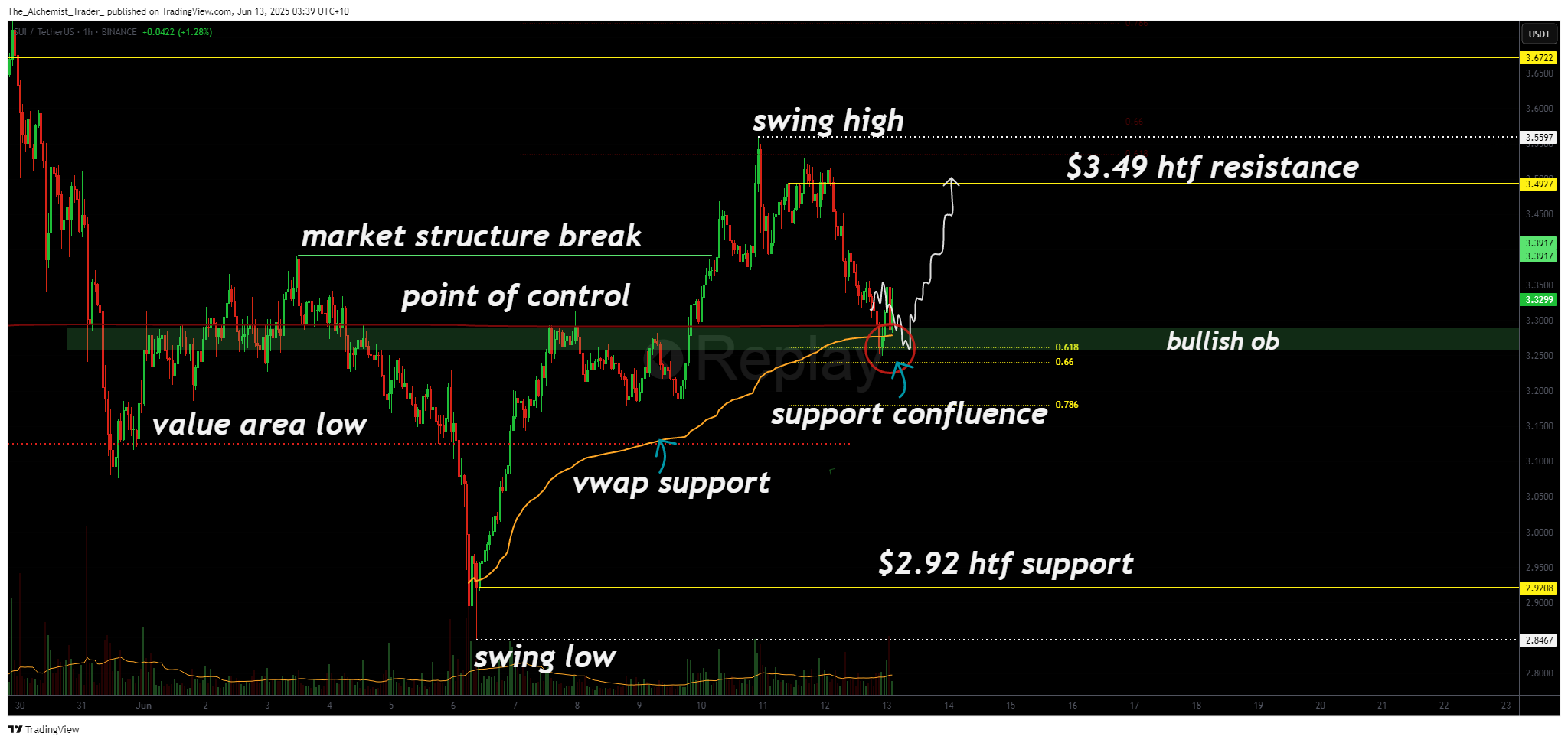

SUI has confirmed a bullish market structure shift after breaking to a new swing high from the $2.22 region. Following an aggressive rally, price is now consolidating at a powerful support confluence, a sign that the uptrend remains intact and may be gearing up for another leg higher.

SUI’s (SUI) price action has demonstrated strong bullish momentum after reclaiming high-timeframe support at $2.22. The breakout was backed by an aggressive rally that reclaimed the value area low and surged through the point of control with strength. Now, price is pulling back, not as a sign of weakness, but rather a bullish correction into a multi-factor support zone.

Key technical points

- Break of Market Structure Confirmed: A new swing high has been formed, flipping market structure to bullish.

- Strong Support Confluence Below: The current correction has landed on the POC, an active bullish order block, a BOS/SR flip, and the 0.618 Fibonacci retracement.

- Healthy Higher Low in Play: Holding this zone confirms trend continuity and sets the stage for higher targets.

- Next Key Resistance at $3.49: A break above this level will confirm continued bullish momentum toward new local highs.

After rallying from the $2.22 region, SUI posted a decisive swing high, confirming a market structure break. This breakout was technically significant, as it was accompanied by aggressive price action that sliced through major resistance levels with ease. The reclaim of the value area low followed by a clean move through the point of control suggests strong demand and trend conviction.The current pullback is now retracing into a powerful support cluster. This includes:

- The point of control

- A bullish order block

- A BOS/SR flip

- And the 0.618 Fibonacci retracement

This makes it a high-confluence demand zone and a logical place for price to form a higher low — which would keep the bullish structure fully intact.

As long as this zone holds, SUI is structurally poised for a move toward the $3.49 resistance, the next key level in the local trend. A break of this region could trigger a new wave of buying and set up the asset for higher highs.

What to expect in the coming price action

SUI remains in a bullish structure following its recent breakout. If the current support confluence zone holds, the next leg higher could target the $3.49 level and potentially beyond. However, failure to defend this zone would invalidate the higher low and introduce deeper correction targets. Until then, the bias remains bullish.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10