Retail traders dumped $258m in Nvidia stock: Will they buy Bitcoin instead? 1 minute ago

Several reports suggest that retail investors who bought the Nvidia dip are now selling. Traders are asking whether they will use their profits to buy crypto.

Retail investors are taking profits from their Nvidia purchases, while institutions continue to buy. According to a report by Vanda Research, retail investors dumped $258 million of Nvidia stock during the week ending on June 4.

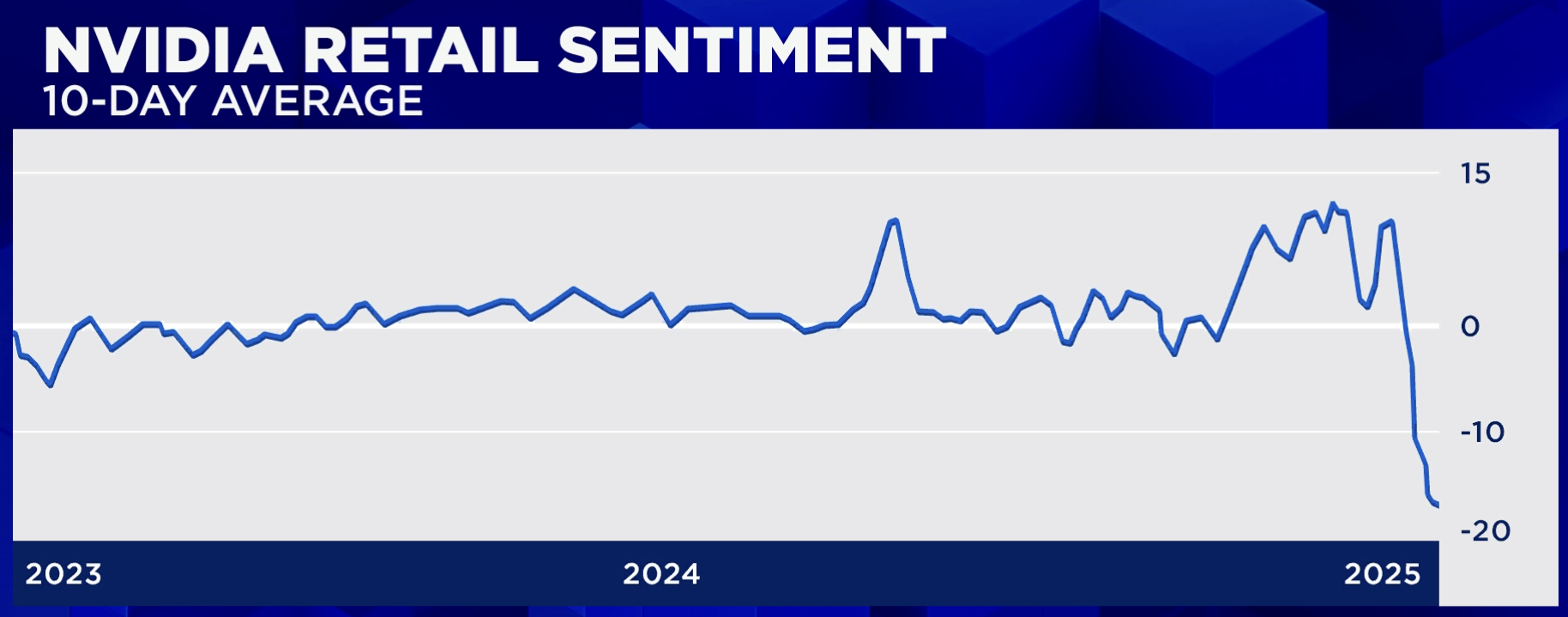

Many retail investors made significant gains from their Nvidia investments between 2023 and 2024. Now, they appear to be searching for new opportunities, according to a sentiment survey by Vanda Research. Retail sentiment has sharply dropped in 2025, shifting from 10 points leaning to buy to over 15 points leaning toward sell.

This analysis is in line with a report by Sherwood, which recorded $4.9 billion in retail outflows during the third week of May. It was the largest dollar outflow for Nvidia since 2015 and marked the longest retail selling streak, two consecutive weeks, since March 2022. The report also notes similar activity in another retail favorite, Tesla.

Why are retail investors dumping Nvidia?

Retail investors who bought the dip after Nvidia shares fell on the DeepSeek launch are now looking for more lucrative opportunities. Analyst Ben Bajarin notes that Nvidia stock has already priced in much of its growth potential. As a result, traders are seeking higher upside elsewhere.

Additionally, many are concerned about the impact of U.S. tariffs and chip restrictions on China. In this environment, investors with higher risk tolerance are turning to AI stocks and crypto. According to Vanda Research, retail investors are now eyeing more volatile small-cap AI stocks to chase further gains.

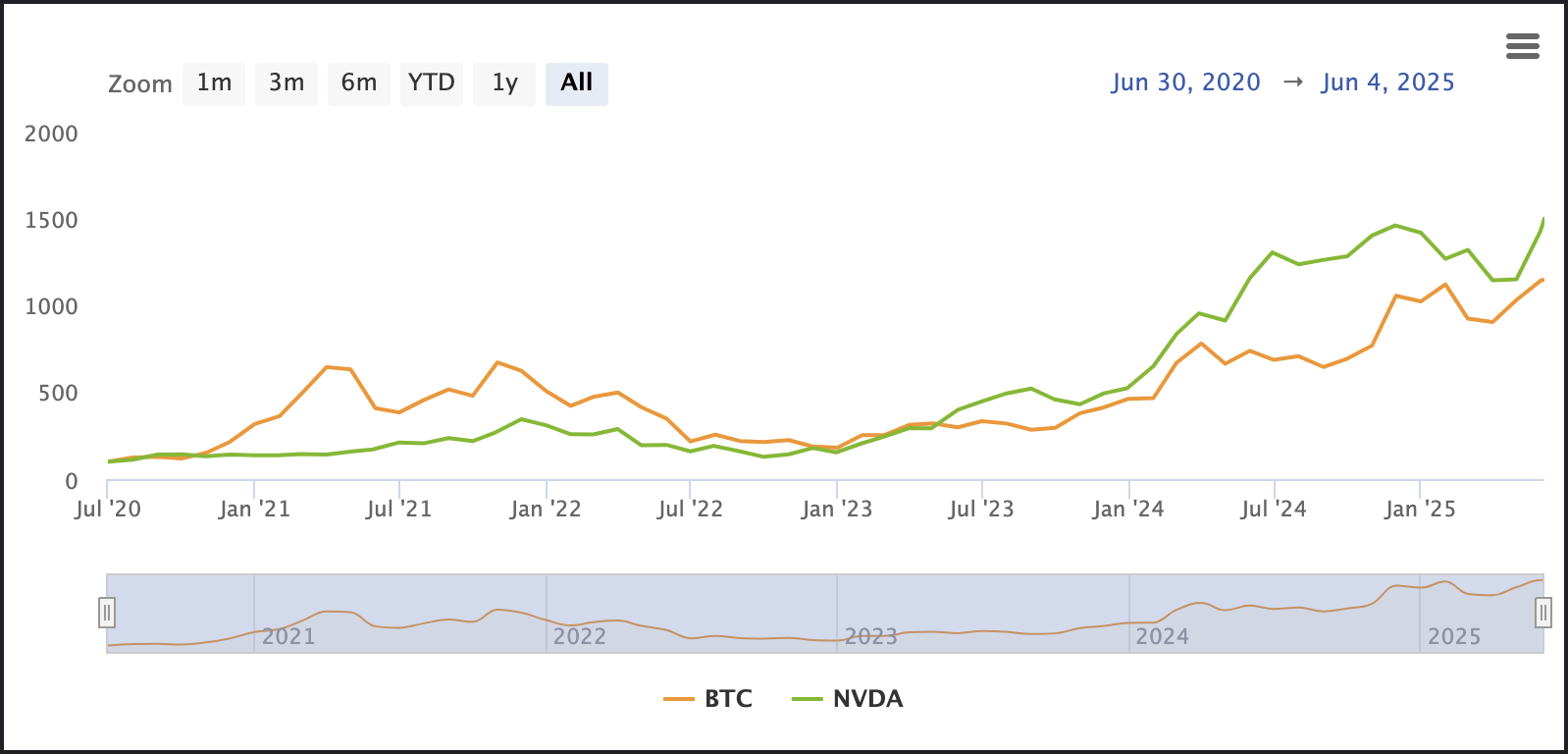

Nvidia and Bitcoin (BTC) have historically shared a strong connection. A 2024 study found a consistent correlation above 0.80 between the two assets, largely due to Nvidia’s role in powering crypto mining infrastructure. This suggests that many Nvidia investors are already familiar with, or actively involved in, the crypto market.

At the same time, retail investors are taking a back seat when it comes to Bitcoin, letting institutions accumulate. The most established crypto asset has actually underperformed Nvidia in the last five years, returning 992% vs Nvidia’s 1,523.1%.Still, there is no clear indication yet of a broad retail pivot from Nvidia into Bitcoin. While historical correlations and overlapping investor profiles suggest a potential bridge between the two, current sentiment doesn’t make the case for a clear rotation into Bitcoin. Whether those taking profits on Nvidia will ultimately move into crypto may depend on broader macro signals. This includes interest rate decisions, regulatory developments, and trade policies.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10