Ethereum Price Forecast for June 2025: Is $3000 Next?

Ethereum (ETH) remains at the center of the crypto conversation, not just as a top altcoin, but as a foundational layer of the decentralized web. With Ethereum’s Layer-2 ecosystem booming, staking adoption rising, and ETH ETF speculation heating up, investors are watching closely to see if ETH can sustain its upward trajectory through mid-2025.

This Ethereum price analysis explores Ethereum’s current market position, recent developments, forecast for June 2025, and key drivers that could shape its long-term outlook.

Ethereum’s Dominance Remains Intact Despite Market Volatility

While the broader crypto market has seen alternating weeks of bullish rallies and profit-taking, Ethereum has managed to retain its position above key technical levels, largely due to its Layer-2 expansion and growing institutional presence.

According to DeFiLlama, Ethereum’s ecosystem still commands over 55% of all DeFi TVL across blockchains, with protocols like Arbitrum, Optimism, Base, and Blast contributing billions in liquidity. This robust infrastructure has allowed Ethereum to remain the preferred base layer for developers and protocols alike.

“Ethereum is maturing into the financial internet,” says Michael O’Grady, head of research at Blocklytics. “Its dominance is not in Ethereum price alone, but in utility and composability.”

Recent News: Ethereum ETFs and Layer-2 Growth Fuel Optimism

Several headlines have reinforced ETH’s bullish long-term case:

VanEck and BlackRock resubmit Ethereum ETF applications in early May 2025, with potential approval eyed for Q3.

Layer-2 networks like Base and Arbitrum crossed $5 billion and $12 billion TVL, respectively, a record.

Ethereum Foundation announces next upgrade, “Pectra,” focused on light client functionality and scalability improvements.

Meanwhile, staking adoption has exceeded 31%, with over 42 million ETH now locked in validator nodes. This reduces the circulating supply, effectively acting as a deflationary pressure over time, especially after EIP-1559 burn mechanisms.

Technical Analysis: ETH Eyes Mid-Range Breakout

From a charting perspective, Ethereum continues to consolidate within a wide ascending triangle, suggesting an eventual breakout above resistance if momentum holds.

Support zone: $3,500 to $3,700

Resistance zone: $4,100 to $4,300

Indicators: RSI holding near 60; MACD approaching bullish crossover

If Ethereum price breaks and closes above $4,300 in June, analysts anticipate a potential rally toward the psychological $5,000 mark by Q3, fueled by ETF momentum and risk-on sentiment returning to markets.

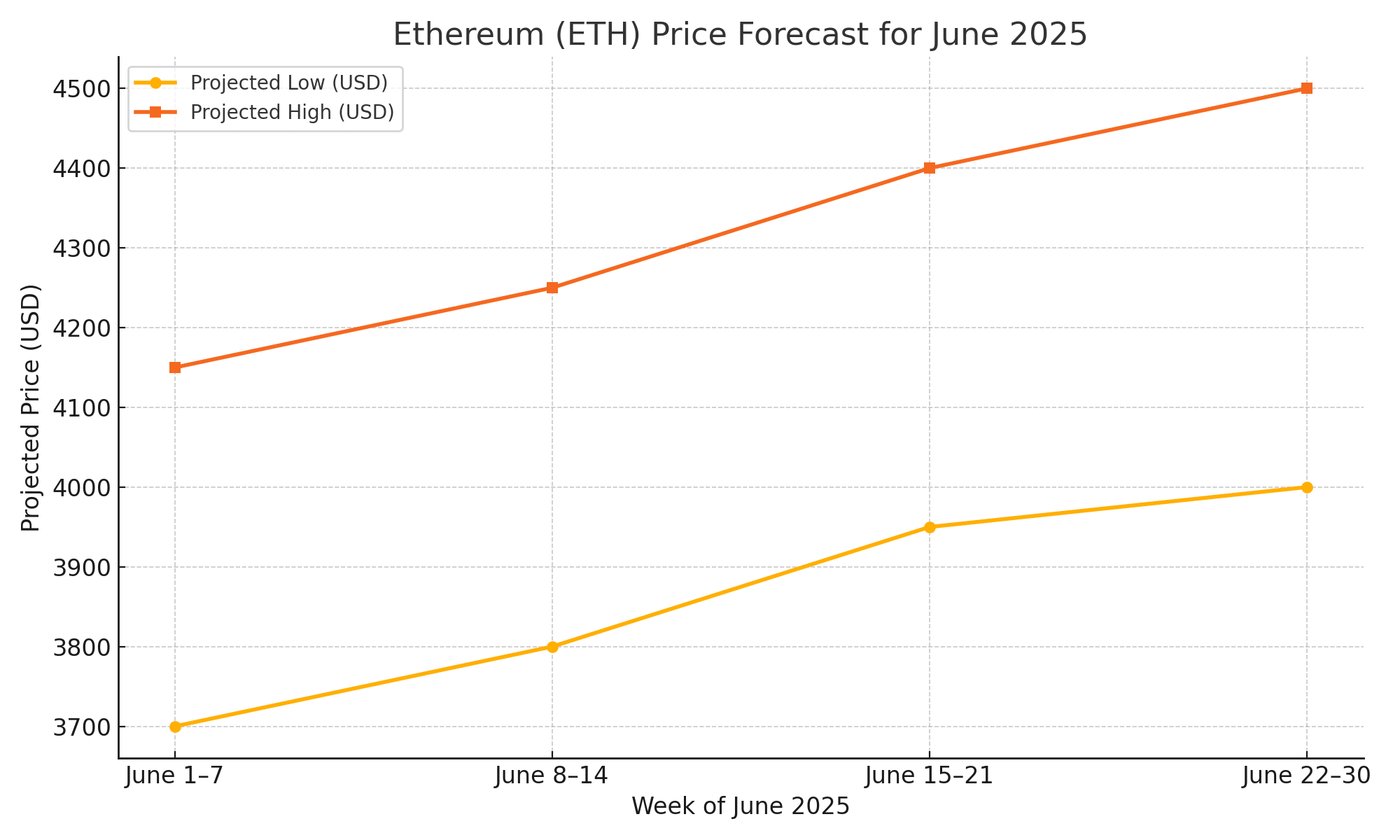

Ethereum Price Forecast for June 2025

Based on market sentiment, macro indicators, and ecosystem strength, here’s a forecast range for Ethereum’s price across the month of June:

| Date | Projected Low (USD) | Projected High (USD) |

|---|---|---|

| June 1–7 | $3,700 | $4,150 |

| June 8–14 | $3,800 | $4,250 |

| June 15–21 | $3,950 | $4,400 |

| June 22–30 | $4,000 | $4,500 |

These ranges account for both a continuation of current momentum and the possibility of ETF-related volatility or FOMC rate uncertainty.

Factors Driving ETH Price in June 2025

Several catalysts could influence Ethereum price direction this month:

1. ETF Approval Speculation

With VanEck and BlackRock pushing for spot Ethereum ETFs, institutional demand could surge, much like Bitcoin in early 2024.

2. Layer-2 Usage Spike

Arbitrum, Base, Optimism, and Blast are onboarding record users, boosting ETH gas burn and overall network value.

3. DeFi and RWA Tokenization

Real-world asset platforms (like Ondo and Maple) are increasingly using Ethereum rails for onboarding treasury and yield-bearing assets.

4. Supply Dynamics

With ETH staking and EIP-1559 burns in play, Ethereum remains net deflationary, increasing long-term value capture for holders.

Risks to Watch

Despite strong fundamentals, investors should stay mindful of:

Regulatory uncertainty: Delays or rejections of ETF applications may cause volatility.

Bitcoin dominance: If BTC rallies sharply due to macro factors, it may siphon capital away from ETH temporarily.

Network congestion: High gas fees during peak DeFi or NFT seasons could slow user growth.

Conclusion: Ethereum Price in June 2025, A Key Turning Point?

June 2025 may serve as a critical pivot for Ethereum. With institutional tailwinds building and fundamental strength across the L2 ecosystem, ETH appears poised to hold its upward momentum, especially if spot ETF approvals materialize.

Whether or not Ethereum price breaks above $4,500 this month, its role as the backbone of decentralized finance, tokenized assets, and blockchain infrastructure seems only to be strengthening. For long-term investors, Ethereum continues to look like a cornerstone asset with asymmetric upside potential.

Frequently Asked Questions (FAQs)

Will Ethereum reach $5,000 in 2025?

If an ETH spot ETF is approved and L2 usage continues growing, Ethereum could test $5,000 by late 2025.

What is driving Ethereum’s price in June?

Staking supply lockup, ETF speculation, and expanding Layer-2 activity are major drivers.

Is ETH still a good long-term investment?

Yes. Ethereum remains the leading smart contract platform with deep DeFi and enterprise adoption.

Glossary of Key Terms

Layer-2

A secondary framework built on top of Ethereum to improve speed and reduce gas fees (e.g., Arbitrum, Optimism).

EIP-1559

A protocol upgrade that burns a portion of transaction fees, reducing ETH supply over time.

TVL (Total Value Locked)

The total value of assets locked in DeFi protocols — a key measure of blockchain utility and adoption.

Ethereum ETF

An exchange-traded fund that would track the price of Ethereum, allowing institutional investors to gain exposure via traditional markets.

Staking

The process of locking ETH in the network to validate transactions and earn yield, also reducing circulating supply.

Sources and References

theblock.co/

cointelegraph.com/

cryptonews.com/

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10