What will it take to revive Forest City, Malaysia’s US$100 billion ‘ghost town’?

JOHOR BAHRU, Malaysia: Insurance executive Wafa Aina Wahid’s daily commute to Johor Bahru used to take nearly two hours from the town of Kluang. Her husband was based even further away from her — he was working, and renting a place, in Singapore.

But just recently, the couple made a move that would cut her commuting time by more than half and bring them together again.

They signed a lease for a three-room apartment in Forest City, the US$100 billion mega housing project at the southern tip of Johor, just across from Singapore. And Wafa was “so excited to move”.

“Finally, I’m not going to do a long-distance relationship with my husband,” said the 27-year-old. “He can commute daily (from) here.”

Convenience was not the only reason they seized this opportunity. They were also attracted by the rental.

“Here, I can easily get, (for) below RM2,000 (US$465) per month, … an apartment with two bathrooms, but (in) other places, maybe just a studio (at) the same price,” said Wafa. “It’s more, I’d say, affordable compared to other places.”

Forest City has a notorious reputation, however, having gained international attention in the last few years as Malaysia’s ghost town.

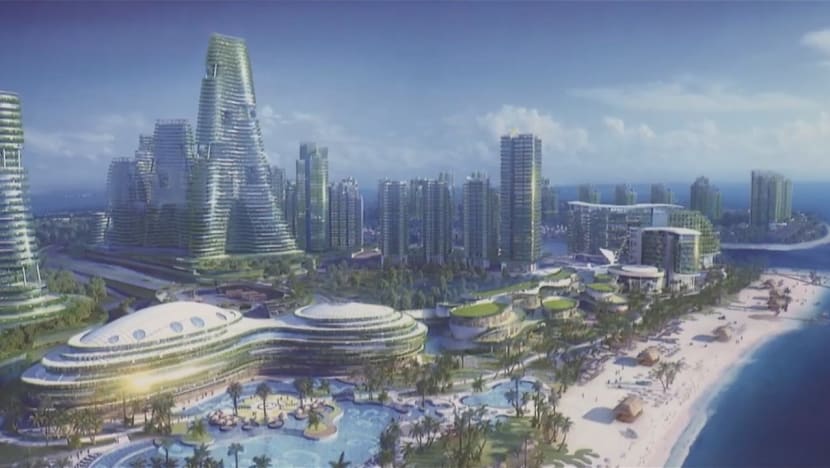

It was once billed as a “living paradise” — a luxurious, eco-friendly and smart city development with a mix of apartments, commercial spaces, malls and hotels.

Jointly developed by Chinese developer Country Garden and Esplanade Danga 88, a Malaysian company backed by the Johor state government and Johor’s sultan, the project is linked to the Belt and Road Initiative, China’s mega infrastructure and trade network.

Forest City is meant to accommodate around 700,000 people on four man-made islands by 2035, with a total land area of nearly 14 sq km — about three times the size of Sentosa — once the reclamation is complete.

But since the project launch in 2014, only one of the islands has been reclaimed, with about 20,000 people currently living there.

The project started stalling in 2017 when the Chinese government introduced capital controls on money leaving the country. This affected Chinese buyers seeking properties abroad, the primary target for Forest City’s developers.

Malaysian politics also had an impact on sales when former Prime Minister Mahathir Mohamad declared that overseas buyers would not easily receive residency visas. He had initially threatened to ban foreign purchases in Forest City altogether.

Then the pandemic hit, and travel restrictions led to a significant decline in demand.

At the same time, China’s property sector downturn left Country Garden battling a liquidity crisis, with total liabilities of US$164 billion at the end of 2023, including US$16.4 billion in offshore debt.

Plans are now underway to revive and transform the Forest City project.

And with a new cross-border development realised in January — when the agreement to establish the Johor-Singapore Special Economic Zone (SEZ) was signed — the question arises as to how much of a boost this will be for Forest City.

With its growing residential community, is it not even a ghost town any longer, the programme Insight also asks.

WATCH: Malaysia’s $100b “ghost town” — Can Forest City be revived? (45:51)

BREATHING NEW LIFE INTO THE PROJECT

The proposal to integrate Forest City into the Johor-Singapore SEZ was made last August by the Johor state government.

Extending across Iskandar Malaysia and Pengerang in Johor, the SEZ — at 3,571 sq km — is close to five times the size of Singapore and is aimed at improving trade and business ties between the two neighbouring countries.

If the SEZ succeeds, more people could be working and living in southern Johor, said Adib Zalkapli, managing director of political risk consultancy Viewfinder Global Affairs. “So Forest City, being a ready-made township, could attract some of these people.”

And one important key to the SEZ’s potential success is the financial centre that is Singapore.

“What Singapore has is advanced logistics … (and an) international trade hub,” cited Lee Ting Han, chairman of Johor’s investment, trade, consumer affairs and human resources committee.

“In Johor, what we can offer is a talent pool, infrastructure, land, resources, et cetera.

“Therefore, we think that with Forest City being included … (in) the Johor-Singapore SEZ, Forest City itself may be able to complement part of the existing ecosystem within Singapore.”

Forest City’s value proposition does not only lie in its housing. It was declared a duty-free zone last year to support tourism and bolster the local economy.

The Malaysian government has also designated it as a special financial zone, to breathe new life into the project by transforming it into a hub for international capital.

One plan is to turn Forest City into a destination for global family offices — companies that manage a family’s wealth and investments. The goal is to attract high net-worth individuals to the island.

In Malaysia, a single-family office can be set up with a minimum of RM30 million in assets under management, which is lower than the minimum of S$20 million required in Singapore.

Noting that the Asia Pacific is one of the world’s high-growth areas, PricewaterhouseCoopers Malaysia tax partner Fung Mei Lin said: “There are a lot of wealth movements, and I don’t think it’s unreasonable for Malaysia to (be) trying to attract a part of that.”

To this end, Malaysia has offered a zero per cent tax rate for family offices located in Forest City, which Fung said would be “a no-brainer” for these offices, compared to the standard corporate tax rate of 24 per cent.

This is part of a tax incentive package for the special financial zone that the government announced last September to stimulate financial services such as fintech.

And in April, two family offices got the ball rolling as the first to set up in Forest City.

COMPLICATIONS REMAIN

Things are not necessarily going to be straightforward for Forest City, however.

According to the finance ministry, 70 per cent of the properties sold have been bought by Chinese investors. The project is still largely marketed to this group, even as their appetite for investment has waned following China’s property sector troubles.

While Chinese overseas investment in real estate has seen a “slow recovery” to about US$10 billion last year, said National University of Singapore Business School dean’s chair professor of real estate Qin Yu, about US$40 billion was invested in 2017 by comparison.

Can investment levels recover to the peaks in 2016 and 2017? “Probably not,” she said.

But Danny Wong, chief executive officer of private wealth management company Areca Capital, is confident that the Chinese will “come back”

“China’s population is so huge, and internal demand itself can make them vibrant,” he said. “What they need to do is stabilise the whole situation. … It’s just a matter of time.”

Having lost as much as 97 per cent of its market value from its peak in 2018, however, it is unclear whether Country Garden can continue to develop Forest City. The company, which is still mired in debt, declined comment.

“It might be challenging for (Country Garden),” said Qin, “because (it) even has trouble … finishing some of the projects within mainland China.”

Last November, Country Garden said its Malaysian projects were “operating normally”. The developer is now in talks with creditors to restructure its offshore debt to avoid liquidation. But should it fail, who will complete the Forest City project?

Johor’s government, for one, is “not in that position at the moment”, said Lee. “The government isn’t directly involved in the project itself, so we don’t have any equity participation.”

Nor should there be a government bailout because of the scale of the project, said economist Geoffrey Williams, the founder and director of Williams Business Consultancy.

“The best way for the government to support (it) is to provide a deregulated, liberal environment where people can get access to the licence to operate,” he said.

“Nobody in Malaysia would be happy to see government money taken from health, education and social protection in order to bail out a failed Chinese property development.”

The burden could fall on Forest City’s co-developer, Esplanade Danga 88, whose controlling stake is owned by Johor’s sultan and which has a 40 per cent share in the project.

“Esplanade Danga 88 can become the master developer,” suggested Samuel Tan, CEO of Olive Tree Property Consultants. But it would “have to find other developers or a joint venture partner” for the remaining islands.

New developers, however, may not wish to undertake the original plan. “It’s best if the market decides whether the area should be expanded or it should remain as it is,” said Adib. “It’ll have to depend on the demand.”

Without the Chinese, where this demand will come from is unclear.

Although prices in Forest City have come down since launch, its cheapest homes are typically priced at more than RM520 per square foot, compared to the median price of around RM400 in Johor Bahru.

With the Chinese not buying and prices “too high for locals”, there is a “huge supply and no demand”, said Williams.

“When you’re so highly leveraged and have spent so much money, you can’t really bring down the price of the units because then you’re going to lose not just on individual units but across tens of thousands … of units.”

Recent revisions to the Malaysia My Second Home (MM2H) programme — a long-stay visa programme — could expand the foreign buyer pool, however, beyond the Chinese.

Under the previous government, principal applicants had to park RM1 million, for example, in a fixed deposit to attain a five-year multiple-entry visa. The current administration has reduced this to US$150,000.

Lee is hopeful the current policy will help. “We do receive some inquiries, and it seems to be generating positive feedback,” he said. “And banks are looking to set up their office within Forest City.”

DOES IT STILL DESERVE ITS MONIKER?

For all the portrayals of Forest City as a ghost town before this, entrepreneur Her Kai, who owns two units in the development and lives there, does not think it deserves to be depicted as such.

“After the pandemic, there was a lot of negative news, of which about 60 to 70 per was false, in my opinion,” said the 40-year-old, who was born and raised in Shanghai but has made Malaysia his home since 2019.

“There are plenty of people, including tenants and owners. … I know the real situation. If it were truly a ghost town, we’d all have left.”

Certainly, there are more occupants now, said Mohd Nizamuddin Zainuddin, 35, who moved to Forest City with his wife just before the pandemic struck and is still renting a unit there.

This is also the case compared to 2023, when 9,000 people were living there. And its landscape has been well maintained, the businessman added. “If I can afford to own a house here, I’ll continue living here.”

WATCH: Why we moved into Malaysia’s “ghost city” — Forest City’s growing community (4:46)

Some 30 condominium blocks have been completed, along with dozens of landed homes. With the uptick in occupancy, businesses have followed suit.

Felix Lam used to work in Kuala Lumpur, offering internet services to consumers. But he decided to relocate to Forest City to meet the demand for connectivity on the island.

“Many people here still have a wait-and-see attitude, wondering whether it can grow and help their business thrive,” said Lam, who also rents one of the apartments for his staff, paying RM1,500 a month.

“My perspective is different. I believe that even though Forest City had a slow start, there’s a high demand and very high requirements. As long as we provide good services, it shouldn’t be a problem.”

More supermarkets and food outlets are opening in the area, according to Lee. And locals are patronising places there for recreational purposes, “so it isn’t really a ghost town”, said Olive Tree’s Tan.

“But the management hasn’t addressed this issue very well by putting up a more positive narrative (of) the development and attraction of Forest City,” Tan added.

From the outside, Faezatul Khatimah did wonder whether people would want to rent in Forest City because “it didn’t seem to have that many occupants” three years ago, when she ventured into real estate to earn some side income.

That was when she saw an opportunity. “I found out that many people came here every day to view the houses,” she recounted, “so I started uploading posts on social media platforms like Facebook and TikTok.”

Demand was high enough that she eventually became a full-time real estate agent, and she finds herself a lot busier these days. One of her clients is Wafa.

“Looking at the facilities, looking at the environment, looking at everything here,” said Wafa, “I think it’s not the ghost town that people have been talking about.”

Watch this episode of Insight here. The programme airs on Thursdays at 9pm.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10