Cardano price target: bullish setup forms with $2.04 in sight 6 seconds ago

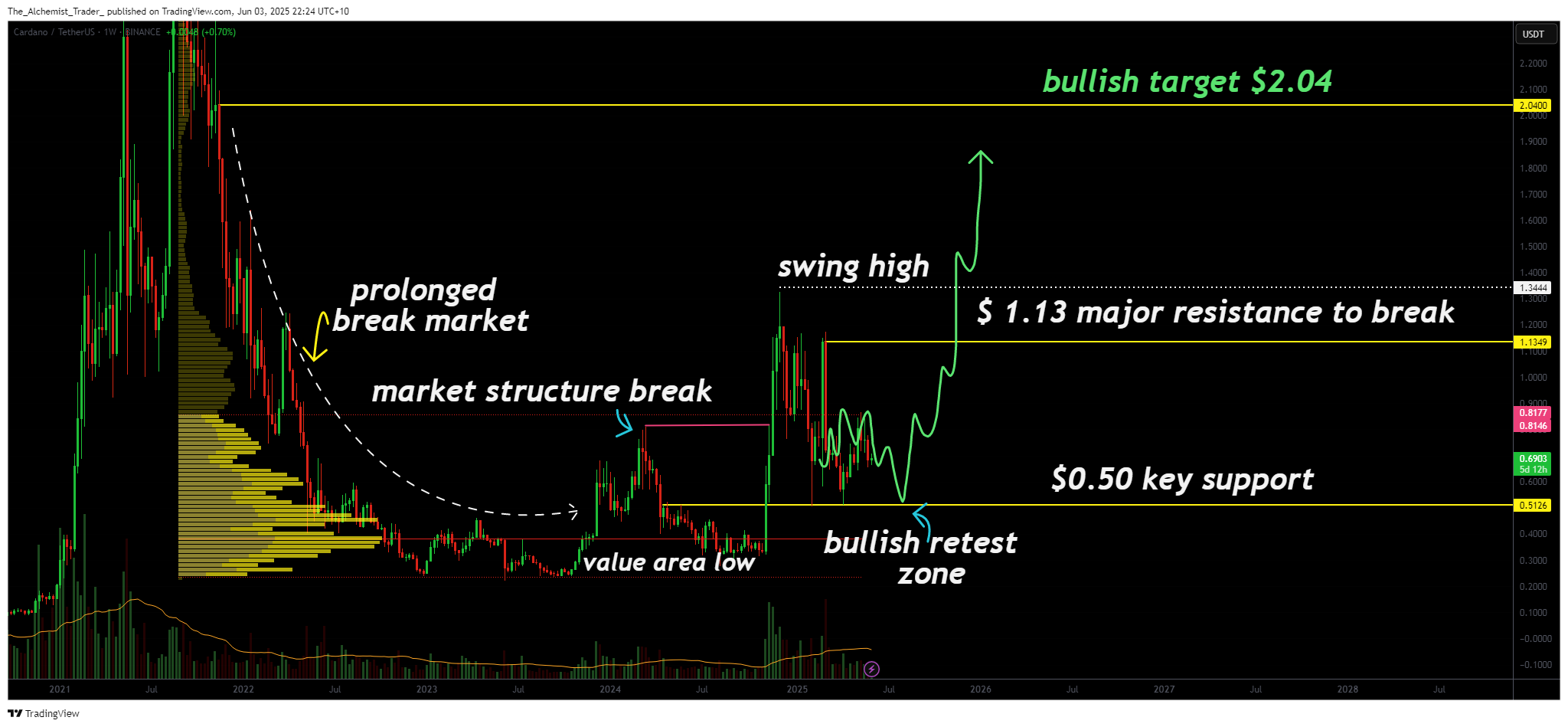

Cardano has defended a crucial support level at $0.50 after a market structure shift to the upside. With a swing high recently established and the correction now stalling at support, the groundwork for a long-term move toward $2.04 is forming.

After a prolonged bearish phase, Cardano (ADA) has shown signs of strength with a clean breakout from accumulation and the confirmation of a new swing high. This marks the first significant bullish structure break in months and suggests that a new macro trend may be underway.

The current correction, now respecting support at $0.50, appears to be forming a higher low, offering strong evidence that ADA is setting up for its next leg higher.

Key technical points

- $0.50 Key Support Level: Price has been consolidating above this zone for weeks, marking it as a likely higher low in the bullish market structure.

- Market Structure Shift Confirmed: A new swing high has been printed, confirming a bullish reversal from the previous downtrend.

- $2.04 Swing Target: From a high-timeframe perspective, $2.04 marks the next key resistance and a realistic long-term objective once upside momentum returns.

The value area low formed during the bear market has acted as a long-term accumulation zone. This was followed by an impulsive breakout that triggered the first true structural shift, breaking above previous lower highs and confirming a swing high. Since that breakout, price action has retraced—though in a controlled, corrective manner, and is now basing at the $0.50 support.

This support level holds significance due to the time spent consolidating here. Multiple weekly closes above this region suggest strong buyer presence. From a technical lens, this retest can be considered a bullish retest of broken resistance now turned support, a classic pattern seen in trend continuation setups.

Price may continue to range or trade sideways near this zone over the coming weeks. However, as long as the $0.50 support remains intact, the current correction will serve as a base for the next expansion phase. Once momentum returns, the next logical target is the $2.04 high-timeframe resistance—a key level from prior price cycles.

What to expect in the coming price action

Cardano’s bullish market structure remains intact as long as $0.50 holds. This level is likely a higher low forming in a broader uptrend. A breakout from this region could initiate a macro rotation toward $2.04, continuing ADA’s long-term recovery and trend reversal from the recent bear market.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10