LiveRamp Holdings, Inc. (NYSE:RAMP) reported better-than-expected fourth-quarter financial results and issued first-quarter sales guidance above estimates on Wednesday.

LiveRamp reported quarterly earnings of 30 cents per share which beat the analyst consensus estimate of 28 cents per share. The company reported quarterly sales of $188.72 million which beat the analyst consensus estimate of $185.39 million.

CEO Scott Howe said: “We had a strong finish to fiscal 2025, with fourth quarter revenue and operating income exceeding our expectations, revenue growing at a double-digit rate and operating cash flow reaching a record high. As we enter fiscal 2026, more so than ever, we are focused on controlling what we can control: Making our platform faster and easier to use; rolling out new functionality, such as our new Cross Media Intelligence measurement solution; helping customers optimize ad spend by harnessing the power of our Data Collaboration Network; and, finally, prudently managing our own costs and growth investments. The near-term macro environment may be uncertain, but we remain confident that in the long-run we can drive sustained growth and shareholder value creation.”

LiveRamp said it sees FY2026 sales of $787.00 million to $817.00 million, versus market estimates of $799.14 million. The company also expects first-quarter revenue to be more than $191.00 million versus market estimates of $188.25 million.

LiveRamp shares gained 20.9% to trade at $33.94 on Thursday.

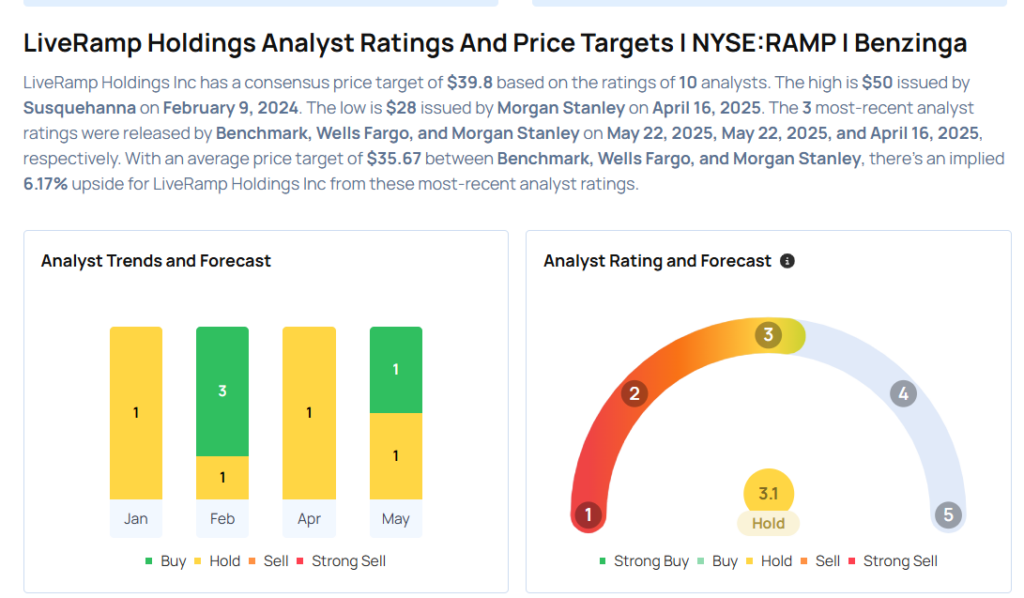

These analysts made changes to their price targets on LiveRamp following earnings announcement.

- Wells Fargo analyst Alec Brondolo maintained LiveRamp with an Equal-Weight rating and raised the price target from $26 to $31.

- Benchmark analyst Mark Zgutowicz maintained the stock with a Buy and raised the price target from $45 to $48.

Considering buying RAMP stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Recommends Not Buying Mosaic, Doesn’t Like This Industrial Stock

Photo via Shutterstock