Rockwell Automation Inc (ROK) Q2 2025 Earnings: Adjusted EPS of $2.45 Beats Estimates, Revenue of $2,001 Million Misses Expectations

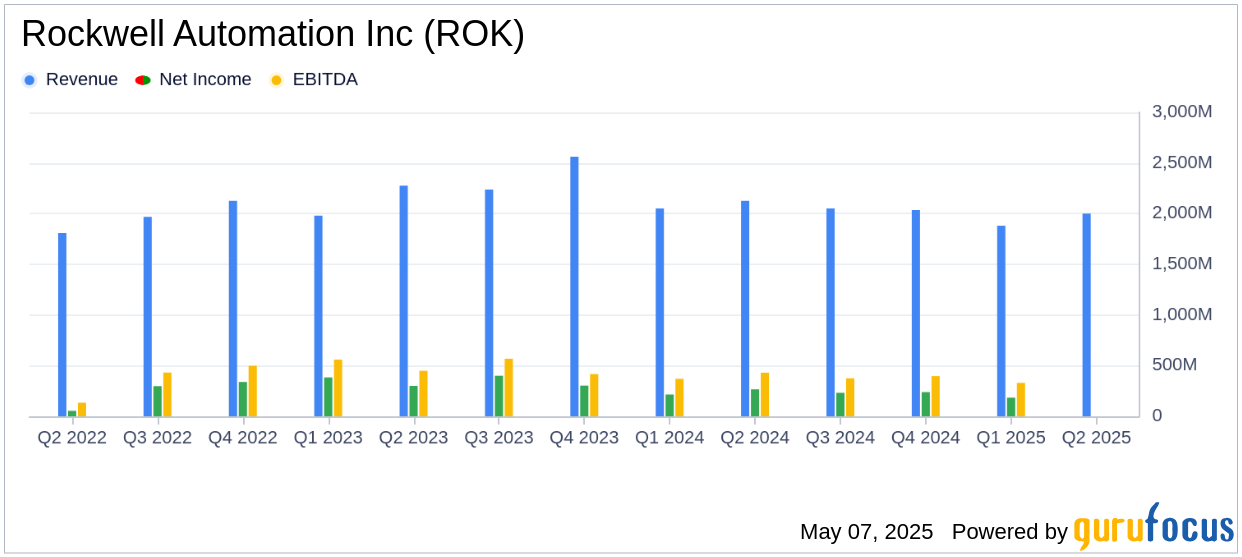

On May 7, 2025, Rockwell Automation Inc (ROK, Financial) released its 8-K filing detailing its financial performance for the second quarter of fiscal 2025. The company reported a decline in both sales and earnings, with reported sales down 6% year-over-year to $2,001 million, missing the estimated revenue of $2,045.23 million. The diluted EPS was $2.22, falling short of the analyst estimate of $2.39, while the adjusted EPS was $2.45.

Company Overview

With roots tracing back to the early 1900s, Rockwell Automation is the successor to Rockwell International, which spun off its avionics segment in 2001. It is a pure-play industrial automation company that operates through three segments. Its largest segment by revenue, intelligent devices, sells factory floor-level devices such as motors, drives, sensors, relays, and actuators. Its software and control segment sells visualization, simulation, and human-machine interface software and control products such as programmable controllers, computers, and operator terminals. Its smallest segment, lifecycle services, offers digital consulting, engineered-to-order services, and other outsourced services such as remote monitoring, cybersecurity, and asset and plant maintenance and optimization.

Performance and Challenges

Rockwell Automation Inc (ROK, Financial) faced a challenging quarter with reported sales declining by 6% year-over-year, primarily due to a 4% decrease in organic sales and a 2% negative impact from currency translation. The company's performance is crucial as it reflects the demand for industrial automation products and services, which are vital for manufacturing efficiency and productivity. The decline in sales and earnings highlights the challenges posed by currency fluctuations and market dynamics.

Financial Achievements and Industry Importance

Despite the decline in sales, Rockwell Automation Inc (ROK, Financial) achieved a total segment operating margin of 20.4%, up from 19.0% a year ago. This improvement was driven by cost reduction and margin expansion actions, as well as positive price/cost dynamics. These achievements are significant in the industrial products industry, where maintaining profitability amid fluctuating demand and currency impacts is crucial.

Key Financial Metrics

The company's income before income taxes was $299 million, slightly down from $310 million in the same period last year, with a pre-tax margin of 14.9%. Net income attributable to Rockwell Automation was $252 million, or $2.22 per share, compared to $266 million, or $2.31 per share, in the second quarter of fiscal 2024. The adjusted EPS was $2.45, down 2% from $2.50 in the previous year.

| Metric | Q2 2025 | Q2 2024 |

|---|---|---|

| Reported Sales | $2,001 million | $2,126 million |

| Diluted EPS | $2.22 | $2.31 |

| Adjusted EPS | $2.45 | $2.50 |

Segment Performance

The Intelligent Devices segment reported sales of $896 million, down 8% from the previous year, with an operating margin increase to 17.7%. The Software & Control segment saw a slight sales decrease to $568 million, with an operating margin increase to 30.1%. The Lifecycle Services segment reported sales of $537 million, down 8%, with a decrease in operating margin to 14.5%.

Analysis and Outlook

Rockwell Automation Inc (ROK, Financial) continues to face challenges from currency fluctuations and market dynamics, impacting its sales and earnings. However, the company has demonstrated resilience through cost reduction and margin expansion efforts. The updated fiscal 2025 guidance reflects a cautious outlook, with reported sales growth expected to range from -4.5% to 1.5% and adjusted EPS guidance between $9.20 and $10.20. The company's focus on structural productivity and digital transformation investments positions it to navigate the current uncertainties and capitalize on future opportunities.

Rockwell delivered another quarter of strong operating performance with sales, margins, and EPS all above our expectations. We saw a healthy intake of orders across most of our lines of business, with total company book-to-bill in-line with our historical average of about 1.0. We also continue to add resiliency to our operations as we navigate a highly dynamic environment," said Blake Moret, Chairman and CEO.

Explore the complete 8-K earnings release (here) from Rockwell Automation Inc for further details.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10