Archer-Daniels-Midland Co (ADM) Q1 Earnings: Adjusted EPS of $0.70 Beats Estimates, Operating Cash Flow Challenges Persist

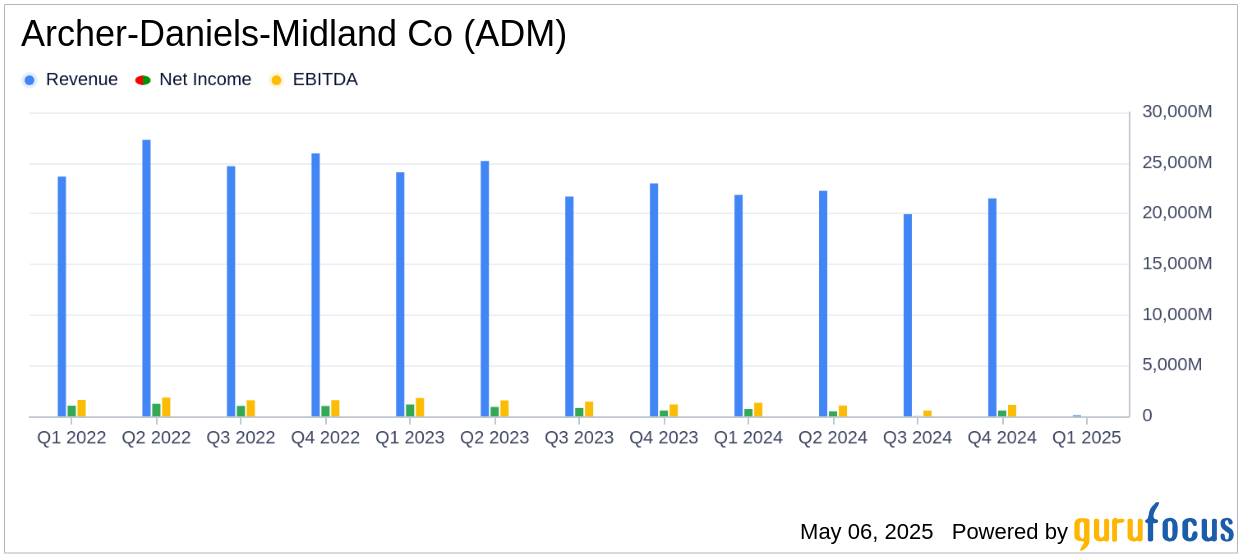

On May 6, 2025, Archer-Daniels-Midland Co (ADM, Financial) released its 8-K filing for the first quarter ended March 31, 2025. ADM, a leading processor of oilseeds, corn, wheat, and other agricultural commodities, reported a GAAP earnings per share (EPS) of $0.61, which fell short of the analyst estimate of $0.68. However, the adjusted EPS was $0.70, slightly above the estimate. The company's revenue for the quarter was not explicitly stated in the filing, but the performance reflects significant challenges in the market.

Performance and Challenges

ADM's net earnings for the first quarter were $295 million, with adjusted net earnings of $338 million. The company faced a 60% decline in earnings before income taxes compared to the previous year, highlighting the challenging market conditions. The Ag Services & Oilseeds segment, a significant contributor to ADM's revenue, saw a 52% decrease in operating profit due to tariff and trade policy uncertainties, impacting volumes and margins.

Financial Achievements

Despite the challenges, ADM achieved a trailing four-quarter average return on invested capital (ROIC) of 5.4%, with an adjusted ROIC of 7.0%. These metrics are crucial for value investors as they indicate the company's efficiency in generating returns from its investments, a key consideration in the Consumer Packaged Goods industry.

Income Statement and Key Metrics

The company's total segment operating profit was $747 million, down 38% from the prior year. The Carbohydrate Solutions segment reported a slight 3% decrease in operating profit, while the Nutrition segment saw a 13% increase, driven by improvements in Flavors and Animal Nutrition. Cash flows used in operating activities were $(342) million, with cash flows from operations before working capital adjustments at $439 million, indicating a strong cash generation capability despite the operational challenges.

Commentary and Analysis

“ADM delivered results aligned with our outlook and the market expectations for the first quarter. In a challenging and uncertain external environment, we advanced multiple aspects of our self-help agenda, including delivering operational improvements in North America, driving cost savings through targeted operational and organizational realignments, advancing our pipeline of portfolio simplification opportunities, and continuing our disciplined approach to capital allocation,” said Chair of the Board and CEO Juan Luciano.

ADM's strategic focus on operational improvements and cost savings is evident in its performance. The company's ability to navigate market uncertainties and maintain a disciplined capital allocation approach is crucial for sustaining its financial health and achieving long-term growth.

Conclusion

Archer-Daniels-Midland Co (ADM, Financial) faced significant market challenges in the first quarter of 2025, impacting its financial performance. However, the company's strategic initiatives and focus on operational efficiency provide a solid foundation for navigating future uncertainties. Investors will be keen to see how ADM continues to adapt and leverage its global footprint to drive growth in the coming quarters.

Explore the complete 8-K earnings release (here) from Archer-Daniels-Midland Co for further details.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10