Why SUI may pull back before the next bullish expansion 6 minutes ago

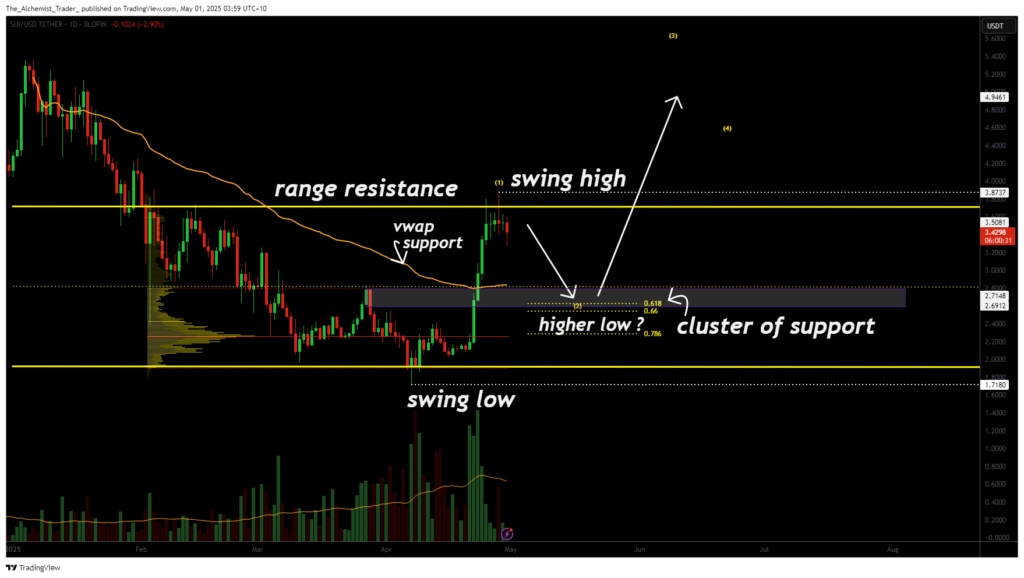

After a sharp 75% rally, SUI is now showing signs of exhaustion as it approaches a key resistance area. Although the trend remains bullish, technical indicators suggest a healthy pause may be on the horizon before the next leg of expansion.

The impulsive nature of SUI’s (SUI) recent rally reflects strong bullish momentum. However, price is now facing clear rejection from a resistance zone where both the range high and the 0.618 Fibonacci level are stacked in confluence.

This zone is not arbitrary, it was previously established as a structural ceiling, and the current failure to break cleanly through it forms what appears to be a swing-failure pattern (SFP). This adds weight to the idea that a short-term pullback may unfold as part of a larger trend continuation.

Key technical points,

- Major Resistance: Confluence of 0.618 Fibonacci retracement and range high

- Support Levels to Watch: $2.70 to $2.40 (range mid and VWAP support region)

- Trend Structure: Potential wave 3 expansion in play after corrective move

A potential short-term pullback would be technically healthy, providing an opportunity for a higher low to form. Key zones to monitor for this include the VWAP support region, the range mid, and the 0.618 retracement level, this time acting as support on the way down. These areas serve as the most probable launch points for the next leg higher, potentially initiating a wave 3 expansion in the broader bullish structure.

It’s also important to recognize that the market is entering a phase of balance, where buyers and sellers are competing around key levels. This kind of indecision often precedes a volatility breakout, especially following a strong impulsive move. Traders should watch for volume spikes and candle formations near support for early clues.

Notably, while the recent rally was strong, volume has started to taper, further supporting the case for either consolidation or a correction. Price is currently trading within a defined range between $2.70 and $2.40 and is likely to remain in this rotational zone until one of these levels breaks convincingly with volume.

What to expect in the coming price action

For now, traders should remain patient. The structure of the pullback, if it occurs, will provide critical clues as to whether the next move is another explosive rally or a deeper retracement. A break and hold above the swing high would invalidate the pullback thesis, while a bounce from support would set the stage for further upside.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10