Albemarle Corp Reports Q1 2025 Earnings: Adjusted EPS Loss of $0.18 Beats Estimates, Revenue at $1.1 Billion Misses Expectations

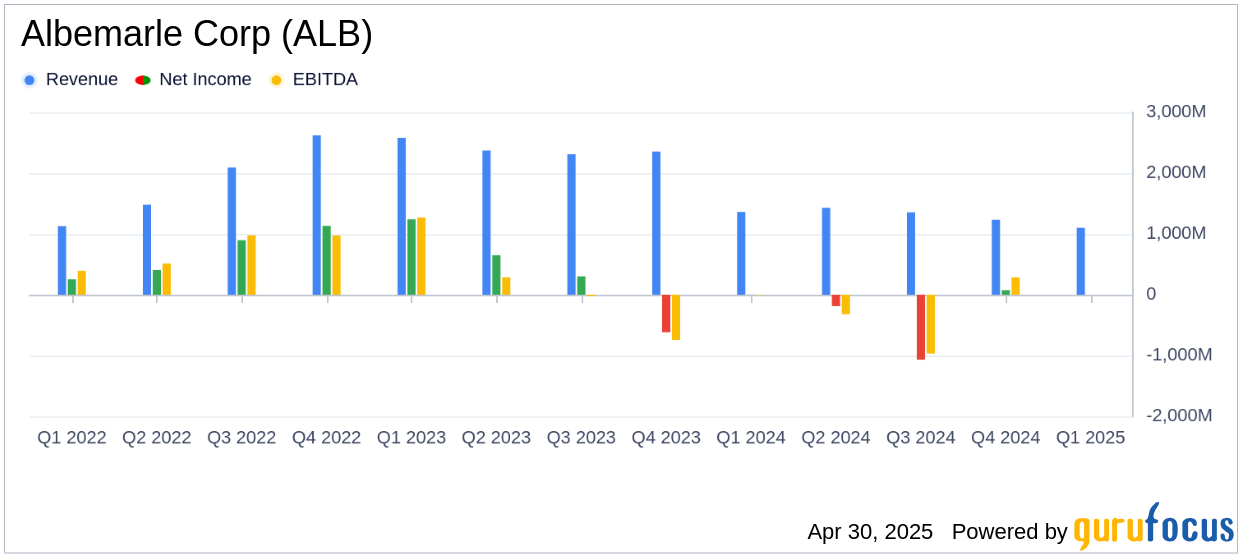

On April 30, 2025, Albemarle Corp (ALB, Financial) released its 8-K filing for the first quarter of 2025, revealing a challenging financial landscape. The company, a global leader in lithium production, reported net sales of $1.1 billion, falling short of the analyst estimate of $1.157 billion. Despite this, Albemarle achieved a net income of $41 million, translating to a diluted loss per share of $0.00, which is an improvement from the estimated loss of $0.32 per share.

Company Overview

Albemarle Corp (ALB, Financial) is one of the world's largest lithium producers, with a significant portion of its demand stemming from the battery industry, particularly for electric vehicles. The company is a fully integrated lithium producer, with upstream resources in Chile, the US, and Australia, and operates lithium refining plants in several countries. Additionally, Albemarle is a global leader in bromine production and a major producer of oil refining catalysts.

Performance and Challenges

Albemarle's first-quarter performance was marked by a 21% year-over-year decline in net sales, primarily due to lower pricing in the Energy Storage segment. Despite this, the company saw double-digit volume growth in Specialties (+11%) and record lithium salt production. The decline in sales was partially offset by cost reduction efforts and lower average input costs, resulting in an adjusted EBITDA of $267 million, a decrease of 8.3% from the previous year.

Financial Achievements

Albemarle's financial achievements include a significant increase in cash from operations, which reached $545 million, up by $447 million from the prior-year period. This increase was driven by a $350 million customer prepayment and improved working capital. The company also achieved approximately 90% of its cost and productivity improvement target, with opportunities identified to reach the high-end of the $300 to $400 million range.

Income Statement Highlights

| Metric | Q1 2025 | Q1 2024 | $ Change | % Change |

|---|---|---|---|---|

| Net Sales | $1,076.9 million | $1,360.7 million | $(283.9) million | (20.9)% |

| Net Income | $41.3 million | $2.4 million | $38.9 million | 1,620.8% |

| Adjusted EBITDA | $267.1 million | $291.2 million | $(24.1) million | (8.3)% |

Segment Performance

The Energy Storage segment experienced a 35% decline in net sales to $525 million, primarily due to a 34% drop in pricing. However, the Specialties segment saw a 2% increase in net sales to $321 million, driven by an 11% increase in volumes. The Ketjen segment reported a 5% decrease in net sales to $231 million, with adjusted EBITDA increasing by 75.6% due to favorable product mix and higher equity income from joint ventures.

Analysis and Outlook

Albemarle's performance reflects the challenges of fluctuating lithium market prices and the impact of global trade actions. Despite these challenges, the company remains focused on cost reduction and optimizing its lithium conversion network. The company's liquidity position remains strong, with approximately $3.1 billion in estimated liquidity as of March 31, 2025.

Our business continues to perform in line with our outlook considerations, including first-quarter adjusted EBITDA of $267 million with strong year-over-year improvements in Specialties and Ketjen," said Kent Masters, Chairman and CEO.

Albemarle's strategic focus on cost control and productivity improvements positions it well to navigate the current market environment. The company's ability to maintain its full-year 2025 outlook, despite the economic impact of tariffs and other global trade actions, underscores its resilience and adaptability in the face of industry challenges.

Explore the complete 8-K earnings release (here) from Albemarle Corp for further details.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10