Buffett's Long-Term Bet on Coca-Cola Delivers 2,824% Return Over 36 Years

April 30 - Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway has been holding onto its Coca-Cola (KO, Financial) stock since 1988, and it's still paying off. Coca-Cola is known for its resilience, making it a solid choice even when the market gets rocky. Thanks to its steady demand and consistent dividend payouts, Coca-Cola has managed to thrive during tough times, which is why Buffett keeps it in his portfolio.

Warren Buffett (Trades, Portfolio) first began accumulating Coca-Cola (KO, Financial) shares in late 1988, ultimately purchasing roughly 23.35 million shares at an adjusted price of $2.45 per share following 4 stock splits. By the end of 1989, his stake was worth about $1.8 billion. Those early purchases, when adjusted for the multiple stock splits Coca-Cola has executed since 1988, laid the groundwork for one of Buffett's signature long-term holdings.

Today, Coca-Cola trades at $71.70 per share (as of April 30, 2025), representing a price gain of approximately 2,824 percent on that original $2.45 basis. A hypothetical $1,000 investment made at the time would now be worth roughly $28,240 before accounting for dividends. But Buffett hasn't simply ridden the share-price appreciation, over the decades his 23.35 million-share position has generated hundreds of millions of dollars in dividends, all of which have been reinvested and compounded, further magnifying total returns.

The above chart shows Berkshire Hathaway's top equity holdings as of December 31, 2024. Apple leads at $75.1 billion (28.1%), followed by American Express ($45 B, 16.8%) and Bank of America ($29.9 B, 11.2%). Coca-Cola ranks fourth with $24.9 B (9.3%). Other notable stakes include Chevron, Occidental, Moody's, Kraft Heinz, Chubb, and DaVita.

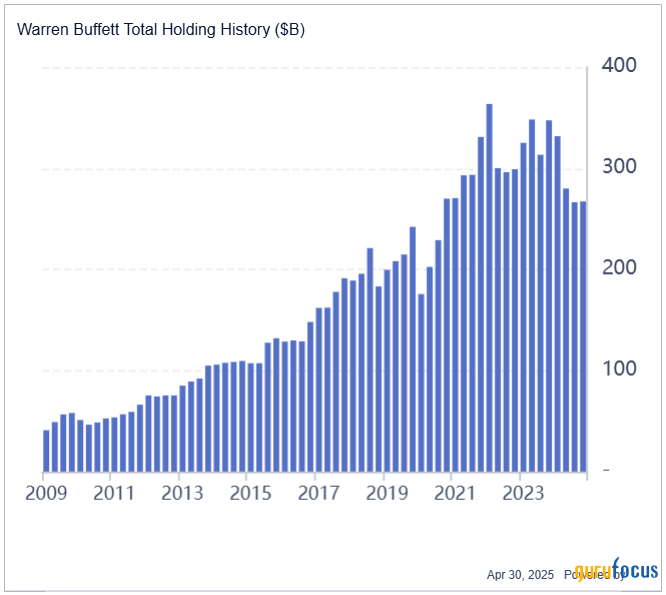

While many market commentators focus on one-year performance, Buffett himself measures success over multi-year horizons. From the first quarter of 2009 through the fourth quarter of 2024, Berkshire Hathaway's overall portfolio value grew from $40.9 billion to $267.18 billion, achieving a compounded annual growth rate (CAGR) of 13.33 percent. Over that same 15-year span, the S&P 500 delivered a 12.78 percent CAGR—meaning Buffett's portfolio outpaced the broader market by 0.55 percentage points per year on average.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10