Altria Group Inc (MO) Q1 2025 Earnings: Adjusted EPS of $1.23 Beats Estimates, Revenue Falls to $5.3 Billion

On April 29, 2025, Altria Group Inc (MO, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. The company, which includes subsidiaries such as Philip Morris USA and US Smokeless Tobacco, reported a challenging quarter with a decline in net revenues but managed to exceed analyst expectations for adjusted earnings per share (EPS).

Company Overview

Altria Group Inc (MO, Financial) is a leading player in the U.S. tobacco industry, with a strong presence in cigarettes, smokeless tobacco, and machine-made cigars. The company's Marlboro brand holds a dominant 42% share in the U.S. cigarette market as of 2024. Beyond tobacco, Altria has diversified interests, including an 8% stake in Anheuser-Busch InBev and a 41% stake in cannabis manufacturer Cronos. In 2023, Altria expanded into the vaping market by acquiring Njoy Holdings and operates a joint venture with Japan Tobacco in the heated tobacco category.

Performance and Challenges

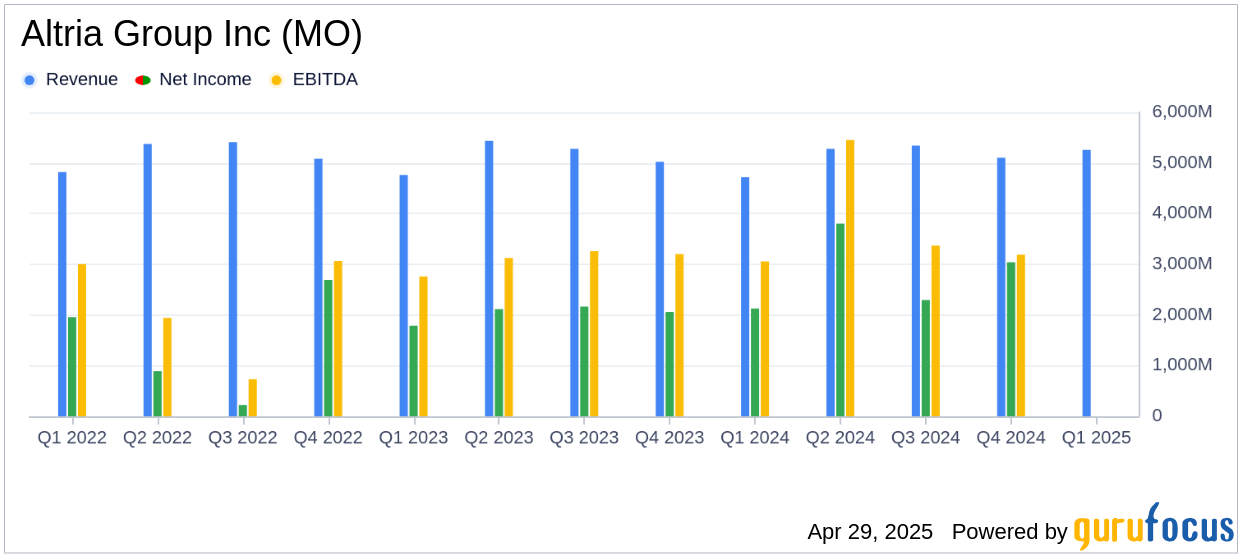

Altria Group Inc (MO, Financial) reported a 5.7% decline in net revenues to $5.3 billion, primarily due to lower revenues in the smokeable products segment. Revenues net of excise taxes also fell by 4.2% to $4.5 billion. Despite these challenges, the company's adjusted diluted EPS increased by 6.0% to $1.23, surpassing the analyst estimate of $1.18. This growth was driven by fewer shares outstanding, higher adjusted operating companies income (OCI), and a lower adjusted tax rate.

Financial Achievements

The company's ability to deliver strong adjusted EPS growth in a challenging environment highlights its operational efficiency and strategic pricing initiatives. Altria's focus on maintaining profitability in its traditional tobacco businesses, particularly through the strength of the Marlboro brand, has been crucial. The company also continues to provide strong cash returns to shareholders through dividends and share repurchases.

Key Financial Metrics

Altria's reported diluted EPS decreased by 47.9% to $0.63, impacted by a non-cash impairment charge of $873 million related to the e-vapor reporting unit goodwill. The adjusted tax rate improved slightly to 23.5%, while the reported tax rate increased to 36.0%. The company's smokeable products segment saw a 13.7% decline in domestic cigarette shipment volume, reflecting industry challenges and competitive pressures.

| Metric | Q1 2025 | Change vs. Q1 2024 |

|---|---|---|

| Net Revenues | $5,259 million | (5.7)% |

| Revenues Net of Excise Taxes | $4,519 million | (4.2)% |

| Reported Diluted EPS | $0.63 | (47.9)% |

| Adjusted Diluted EPS | $1.23 | 6.0% |

Analysis and Outlook

Altria Group Inc (MO, Financial) continues to navigate a challenging market environment, marked by declining cigarette volumes and regulatory pressures. The company's strategic investments in smoke-free products and its focus on operational efficiency are critical to sustaining growth. The reaffirmation of its full-year guidance, with an expected adjusted diluted EPS growth rate of 2% to 5%, underscores management's confidence in its strategic initiatives.

“Our highly profitable traditional tobacco businesses performed well in a challenging environment in the first quarter,” said Billy Gifford, Altria’s Chief Executive Officer.

Altria's commitment to transitioning adult smokers to smoke-free products aligns with its long-term vision and presents a substantial opportunity for growth. However, the company must continue to address challenges such as regulatory changes, competitive pressures, and evolving consumer preferences to maintain its market leadership.

Explore the complete 8-K earnings release (here) from Altria Group Inc for further details.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10