Philip Morris Gears Up for Q1 Earnings: Key Factors to Consider

Philip Morris International Inc. PM is likely to register growth in its top and bottom lines when it reports first-quarter 2025 earnings on April 23. The Zacks Consensus Estimate for revenues is pegged at almost $9 billion, implying a 1.8% increase from the prior-year quarter’s reported figure.

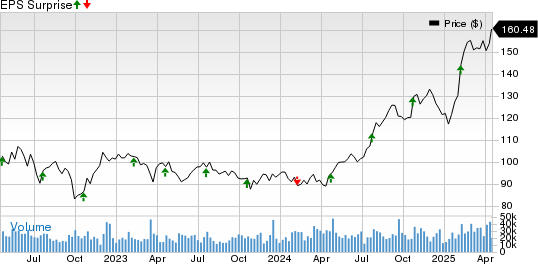

The consensus mark for quarterly earnings has remained unchanged in the past 30 days at $1.61 per share, suggesting an increase of 7.3% from the figure reported in the year-ago quarter. PM has a trailing four-quarter earnings surprise of 4%, on average. (Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.)

Things to Know About PM’s Upcoming Results

Philip Morris’ ability to leverage strong pricing has been a key driver of its revenue and operating income growth. Smokers’ propensity to absorb price increases, given the addictive nature of cigarettes, has enabled the company to sustain revenue growth.

The company has also been benefiting from its significant strides toward a smoke-free future. Smoke-free products accounted for 40% of the company’s net revenues in the fourth quarter of 2024, reflecting the success of IQOS, its leading heat-not-burn device. Key innovations like IQOS ILUMA, ZYN nicotine pouches and VEEV ONE e-vapor have been making strong progress in the company's smoke-free business.

These upsides bode well for the quarter to be reported. The Zacks Consensus Estimate for total smoke-free product revenues (excluding Wellness and Healthcare) for the first quarter is pegged at $3,576.89 million, indicating an increase from $3,296 million recorded in the year-ago period. Apart from this, Philip Morris’ cost-saving measures and strategic initiatives to enhance its margins have been working well.

Philip Morris International Inc. Price and EPS Surprise

Philip Morris International Inc. price-eps-surprise | Philip Morris International Inc. Quote

In its last earnings call, management highlighted that it expects adjusted earnings per share (EPS) in the range of $1.58-$1.63 for the first quarter of 2025. However, volatile currency movements have been a concern for the tobacco giant. The company forecasts a 4-cent unfavorable currency impact on its first-quarter adjusted EPS. Apart from this, strict government regulations, such as mandatory precautionary labels and self-critical advertisements, hinder cigarette consumption.

Earnings Whispers for PM Stock

Our proven model doesn’t conclusively predict an earnings beat for Philip Morris this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Philip Morris currently carries a Zacks Rank #3 and has an Earnings ESP of -1.83%.

Stocks With the Favorable Combination

Here are some other companies worth considering, as our model shows that these also have the right combination of elements to beat on earnings this reporting cycle.

BJ's Wholesale Club Holdings, Inc. BJ currently has an Earnings ESP of +2.09% and a Zacks Rank of 2. The Zacks Consensus Estimate for first-quarter fiscal 2025 earnings per share (EPS) is pegged at 91 cents, which implies a 7.1% increase year over year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BJ's Wholesale Club’s quarterly revenues is pegged at $5.2 billion, which indicates growth of 5.3% from the figure reported in the prior-year quarter. BJ has a trailing four-quarter earnings surprise of 12%, on average.

Tyson Foods, Inc. TSN currently has an Earnings ESP of +2.35% and a Zacks Rank of 3. The Zacks Consensus Estimate for second-quarter fiscal 2025 EPS is pegged at 85 cents, which implies a 37.1% increase year over year.

The Zacks Consensus Estimate for Tyson Foods’ quarterly revenues is pegged at $13.1 billion, which indicates growth of 0.2% from the figure reported in the prior-year quarter. TSN has a trailing four-quarter earnings surprise of 52%, on average.

Freshpet, Inc. FRPT currently has an Earnings ESP of +2.56% and a Zacks Rank of 3. The Zacks Consensus Estimate for the first quarter of 2025 EPS is pegged at 13 cents, which implies a 38.1% decrease year over year.

The Zacks Consensus Estimate for Freshpet’s quarterly revenues is pegged at $262.3 million, which indicates growth of 17.2% from the figure reported in the prior-year quarter. FRPT has a trailing four-quarter earnings surprise of 78.8%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

Freshpet, Inc. (FRPT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10