Howmet Aerospace (NYSE:HWM) Sees 12% Price Surge Over The Past Week

Howmet Aerospace (NYSE: HWM) recently declared dividends for both its common and preferred stock, a strategic move aimed at returning value to shareholders. Over the past week, the company's stock price increased by 12%, aligning with the broader market's upward trend, which rose by 5%. The dividend announcements may have bolstered investor confidence, affirming the company's financial health and commitment to delivering value. These announcements likely added weight to the company's stock performance during a period when positive market momentum prevailed.

We've spotted 1 possible red flag for Howmet Aerospace you should be aware of.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

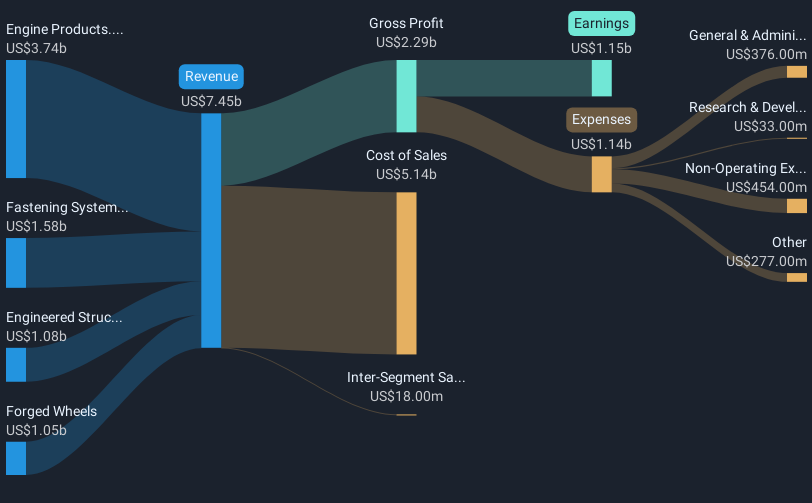

Howmet Aerospace's recent dividend declarations could enhance its narrative of financial robustness and shareholder value commitment, potentially reinforcing investor optimism regarding future growth. These announcements align with the company's strategic investments in aerospace and industrial gas turbines, areas identified as growth generators. Such strategic movements may foster increased confidence in Howmet’s revenue and earnings forecasts, which project substantial growth, with anticipated earnings to reach US$1.9 billion by April 2028. Hence, the recent share price surge might be seen as a market response to what investors perceive as a promising trajectory, despite existing market challenges.

For the long term, Howmet's total shareholder return over five years was very large at 991.42%, reflecting a significant appreciation that outpaced many industry peers. In the last year, the company notably delivered stronger returns than both the US Aerospace & Defense industry, which yielded a 19.4% increase, and the broader US market, which posted a 3.6% increase. This suggests that Howmet's strategic initiatives and operational execution have been effective in driving value compared to its sector and market benchmarks.

With Howmet's current share price at US$114.62, it remains at a 17.3% discount to the consensus analyst price target of US$138.57. This indicates potential room for upward movement, contingent on the continued execution of growth strategies and economic conditions. The recent dividend news, alongside ongoing sector investments, contributes to solidifying investor trust in the company's revenue and earnings forecasts, which remain bullish amid industry headwinds. Such conditions encourage ongoing scrutiny and analysis by investors seeking to align expectations with realistic financial performance projections.

Unlock comprehensive insights into our analysis of Howmet Aerospace stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howmet Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10