BJ's Wholesale Reaches 52-Week High: Should You Hold or Cash Out Now?

BJ's Wholesale Club Holdings, Inc. BJ has delivered an impressive performance so far in 2025, with the stock hitting a fresh 52-week high of $120.63 yesterday before closing briefly lower at $119.94. BJ is now up 34.3% year to date, comfortably outpacing the industry’s rise of 1% and the S&P 500’s decline of 9.1%.

Solid membership trends, product strategies, digital advancements and expansion plans have contributed to BJ's success. But with the stock trading near its peak, investors are now facing a familiar question: Is it time to lock in profits or continue holding for further upside?

Image Source: Zacks Investment Research

Technical indicators are supportive of BJ's Wholesale Club's strong performance. The stock is trading above both its 50-day and 200-day moving averages, indicating robust upward momentum and price stability.

Image Source: Zacks Investment Research

Decoding BJ’s Rally

BJ's Wholesale Club’s commitment to bolstering marketing and merchandising capabilities, coupled with its foray into high-demand categories and expansion of its own-brand portfolio, has yielded results. The company has been steadily increasing its footprint, targeting high-growth regions and underserved markets. This approach ensures maximum return on investment and helps BJ's tap into new customer bases. The company plans to open between 25 and 30 new clubs over the next two fiscal years.

The membership model at BJ’s Wholesale Club is another cornerstone of its success. With consistent growth in renewals and new sign-ups, BJ's offers members significant savings on a wide array of products, which strengthens customer loyalty. These have played a pivotal role in a notable surge in the membership fee income.

In the fourth quarter of fiscal 2024, the company reported an all-time high in membership, surpassing 7.5 million members. This milestone was complemented by a solid renewal rate of 90%, demonstrating the strength of BJ's value proposition. In the fourth quarter of fiscal 2024, BJ’s reported a 7.9% year-over-year increase in membership fee income. We expect the membership fee income to rise at a rate of approximately 10.2% for fiscal 2025.

BJ's Wholesale Club's focus on expanding digital capabilities is another key aspect of its growth trajectory. Offering members convenient options such as same-day delivery, curbside pick-up, and buy online and pick up in-club, the company ensures an engaging and seamless digital shopping experience.

A robust digital portfolio, encompassing platforms like Bjs.com, BerkleyJensen.com, Wellsleyfarms.com and the BJ’s mobile app, underscores the commitment to digital excellence. Members can use the app to clip coupons, navigate stores and utilize features like Express Pay Checkout. In the fourth quarter of fiscal 2024, digitally enabled comparable sales grew 26% year over year. Clubs fulfill more than 90% of digitally enabled sales. Management believes that digitally engaged members have higher average baskets and make more trips per year than members who shop in-club only.

How Consensus Estimates Stack Up for BJ's Wholesale

The Zacks Consensus Estimate for earnings per share has seen upward revisions. Over the past 60 days, the consensus estimate has risen by 4 cents to $4.23 for the current fiscal and by 18 cents to $4.65 for the next fiscal. These estimates indicate year-over-year growth rates of 4.4% and 10%, respectively. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

Image Source: Zacks Investment Research

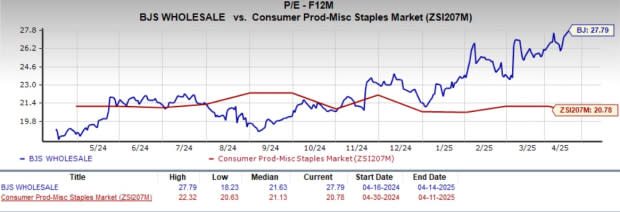

Valuation Analysis: Is BJ’s Premium Price Justified?

BJ's Wholesale Club's forward 12-month price-to-earnings ratio stands at 27.79, higher than the industry’s ratio of 20.78.

Image Source: Zacks Investment Research

Now, the question that arises is whether BJ's current price is warranted or overvalued in today’s market.

The premium valuation reflects investor confidence in the company’s ability to deliver consistent growth and maintain its competitive advantage. While the stock’s current price may seem high, its robust business model, strong customer base and reliable revenue streams justify the premium.

As part of its long-term financial targets, BJ’s Wholesale guided total revenue growth of a mid-single-digit percentage. The company also projected a low-to-mid single-digit percentage increase in comparable club sales, excluding the impact of gasoline sales. It expects a high-single to low-double-digit percentage increase in earnings per share in the long run.

How to Play BJ Stock: Buy, Hold or Sell?

BJ's Wholesale Club continues to stand out as a resilient and well-positioned player, driven by its strong membership model, expanding digital footprint and disciplined growth strategy. While the stock’s premium valuation may prompt some investors to consider booking gains, the company’s consistent execution and clear long-term vision suggest that the momentum could be far from over. BJ stock currently holds a Zacks Rank #2 (Buy).

Don’t Miss These Solid Bets

Sprouts Farmers SFM, which is engaged in the retailing of fresh, natural and organic food products, currently sports a Zacks Rank #1 (Strong Buy). SFM has a trailing four-quarter earnings surprise of 15.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Sprouts Farmers’ current financial-year sales and earnings implies growth of 11.9% and 24.3%, respectively, from the year-ago reported numbers.

United Natural Foods UNFI, which, together with its subsidiaries, distributes natural, organic, specialty, produce, and conventional grocery and non-food products in the United States and Canada, currently carries a Zacks Rank #2. UNFI has a trailing four-quarter earnings surprise of 408.7%, on average.

The Zacks Consensus Estimate for United Natural Foods’ current financial year sales calls for growth of 1.9% from the year-ago reported numbers.

Utz Brands UTZ, which is engaged in the manufacture, marketing and distribution of snack foods, currently carries a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 8.8%, on average.

The Zacks Consensus Estimate for UTZ’s current financial-year sales and earnings suggests growth of 1.2% and 10.4%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10