Exploring 3 Undervalued Small Caps With Insider Action Across Regions

The United States market has shown robust growth, climbing by 5.8% over the past week and 4.8% over the last year, with every sector experiencing gains and earnings projected to grow by 14% annually in the coming years. In this vibrant environment, identifying stocks that are potentially undervalued with insider activity can offer intriguing opportunities for investors seeking to capitalize on current market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Shore Bancshares | 9.0x | 2.0x | 20.79% | ★★★★★★ |

| S&T Bancorp | 9.6x | 3.3x | 49.12% | ★★★★★★ |

| MVB Financial | 10.2x | 1.4x | 39.95% | ★★★★★☆ |

| Flowco Holdings | 6.0x | 0.9x | 41.22% | ★★★★★☆ |

| Thryv Holdings | NA | 0.6x | 32.46% | ★★★★★☆ |

| PDF Solutions | 176.3x | 4.0x | 20.91% | ★★★★☆☆ |

| Columbus McKinnon | 39.6x | 0.4x | 46.60% | ★★★☆☆☆ |

| Union Bankshares | 14.6x | 2.7x | 48.92% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.2x | -3303.92% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -320.70% | ★★★☆☆☆ |

Click here to see the full list of 80 stocks from our Undervalued US Small Caps With Insider Buying screener.

Here's a peek at a few of the choices from the screener.

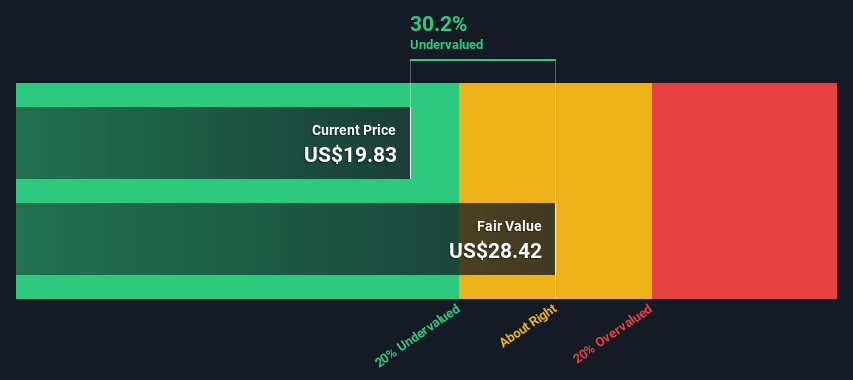

Kennametal (NYSE:KMT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kennametal is a global supplier of tooling and industrial materials, primarily operating through its Metal Cutting and Infrastructure segments, with a market capitalization of approximately $1.92 billion.

Operations: Kennametal's revenue primarily comes from its Metal Cutting and Infrastructure segments, totaling approximately $2.02 billion. The company's cost of goods sold (COGS) is around $1.40 billion, leading to a gross profit margin of 30.68%. Operating expenses are significant, with general and administrative costs being a major component at about $433 million. Net income margin stands at 4.76%, indicating the portion of revenue that translates into profit after all expenses are accounted for.

PE: 15.2x

Kennametal, a company with a market cap below the larger players, shows potential for value due to insider confidence. Sanjay Chowbey's purchase of 10,000 shares worth US$260,000 in January 2025 signifies belief in future prospects. Despite facing legal challenges from MachiningCloud over intellectual property disputes and declining earnings—US$17.93 million compared to US$23.11 million last year—the company continues strategic buybacks totaling 1.52% of shares for US$30 million by February 2025, suggesting management's commitment to shareholder value amidst forecasted annual earnings growth of 10.2%.

- Click here and access our complete valuation analysis report to understand the dynamics of Kennametal.

Review our historical performance report to gain insights into Kennametal's's past performance.

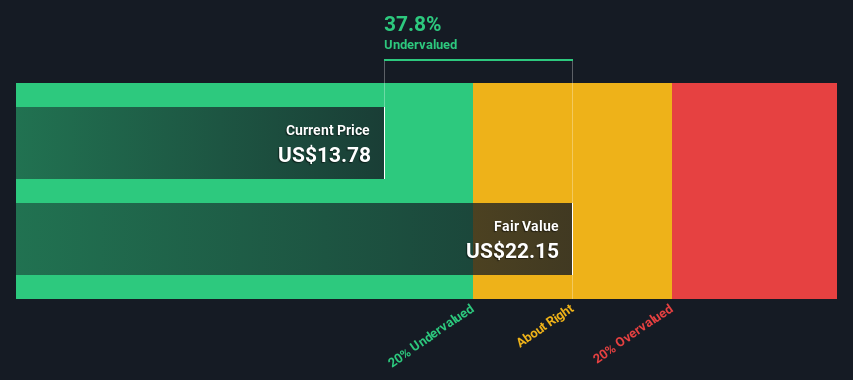

MasterBrand (NYSE:MBC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MasterBrand is a company specializing in the design and manufacturing of furniture and fixtures, with operations generating approximately $2.70 billion in revenue.

Operations: The company generates its revenue primarily from the Furniture & Fixtures segment, with recent figures reaching $2.70 billion. Over the last several periods, gross profit margin has shown a notable increasing trend, reaching 33.27% in 2024-06-30 before slightly declining to 32.48% by 2025-04-13. Operating expenses and non-operating expenses have varied but consistently contribute significantly to overall costs, impacting net income margins which have fluctuated between approximately 4.66% and 6.87%.

PE: 12.4x

MasterBrand, a small player in the U.S. market, recently announced a share repurchase program of up to US$50 million, signaling potential value recognition by the company. Despite reporting lower net income of US$125.9 million for 2024 compared to the previous year, insider confidence is evident as Robert Crisci increased their holdings by 20,000 shares in March 2025. The company's guidance suggests steady sales growth ahead amidst its high debt levels and reliance on external funding sources.

- Take a closer look at MasterBrand's potential here in our valuation report.

Evaluate MasterBrand's historical performance by accessing our past performance report.

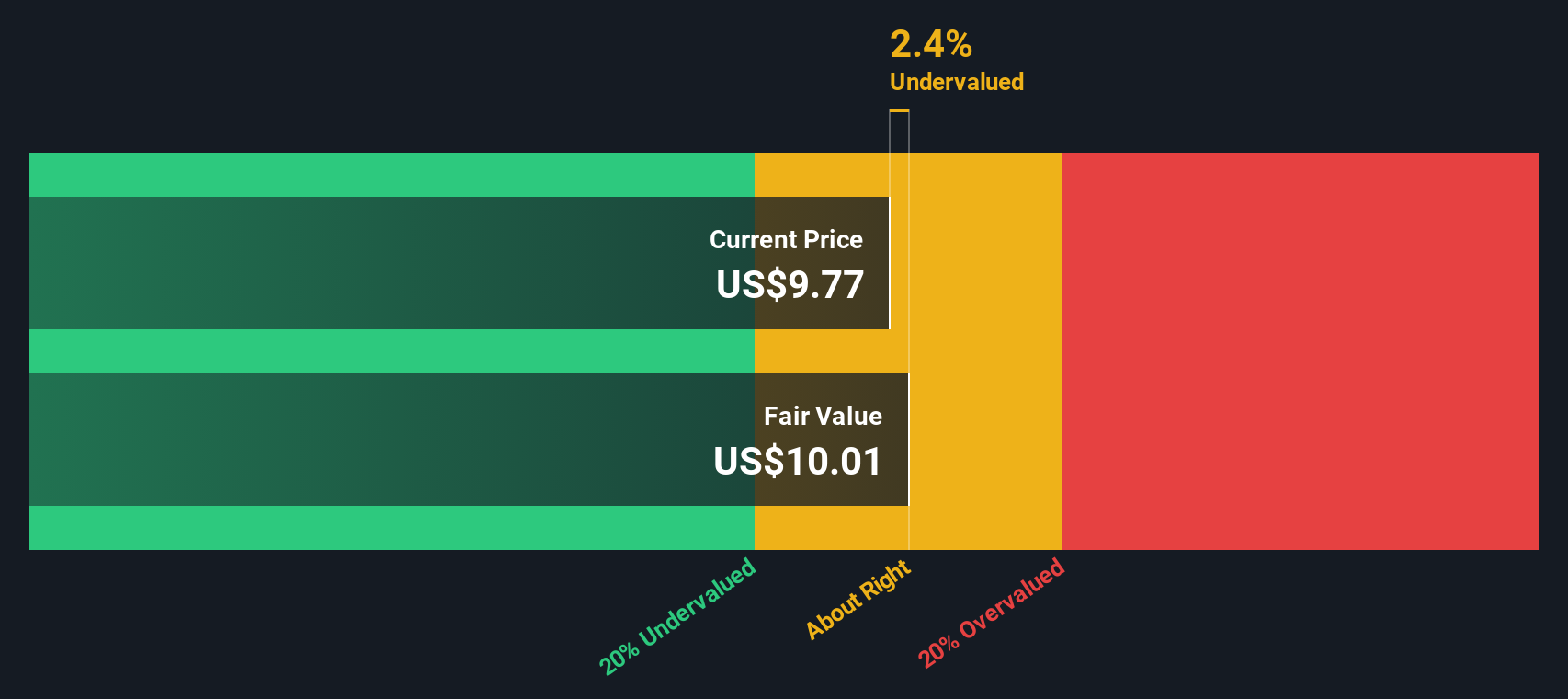

Pebblebrook Hotel Trust (NYSE:PEB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pebblebrook Hotel Trust is a real estate investment trust that specializes in the ownership and management of upscale, full-service hotels and resorts, with a market capitalization of approximately $2.16 billion.

Operations: The company generates revenue primarily from its hotels and motels segment, with the latest reported revenue at $1.45 billion. The cost of goods sold (COGS) is significant, leading to a gross profit margin of 25.19%. Operating expenses and non-operating expenses further impact profitability, resulting in a net income margin of -3.22%.

PE: -21.7x

Pebblebrook Hotel Trust, a company with a market cap in the smaller range, has caught attention due to insider confidence shown by CEO Jon Bortz purchasing 66,000 shares for US$790,680. Despite reporting a net loss of US$4.24 million for 2024—an improvement from the previous year's US$78.02 million loss—the company's earnings guidance suggests continued challenges ahead. Recent dividend declarations and no share buybacks indicate strategic financial management amidst reliance on external borrowing.

- Click here to discover the nuances of Pebblebrook Hotel Trust with our detailed analytical valuation report.

Assess Pebblebrook Hotel Trust's past performance with our detailed historical performance reports.

Next Steps

- Click through to start exploring the rest of the 77 Undervalued US Small Caps With Insider Buying now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10