J.B. Hunt’s intermodal bid season delivers mixed results

J.B. Hunt Transport Services said it has seen mixed results so far this intermodal bid season, capturing rate increases and adding volume in some empty lanes of the network while also losing business to competitors as it remains disciplined and tries to up its freight mix.

The Lowell, Arkansas-based company’s intermodal head, Darren Field, said on a Tuesday evening call with equity analysts that J.B. Hunt (NASDAQ: JBHT) has had “only modest success in repairing rates while retaining existing business.” The company is getting rate increases in headhaul markets while walking from lower-margin business in other areas.

A changing tariff landscape has the management team contemplating multiple volume scenarios.

Roughly 20% to 30% of its intermodal volume comes off the West Coast, but it didn’t say how much of that freight originates in China. Field said there hasn’t been a notable change in demand indications from customers. Most customers also haven’t said they pulled forward freight ahead of recent tariff implementations, which if they have, would create a void in demand later this year.

The multimodal transportation provider reported first-quarter earnings per share of $1.17 after the market closed Tuesday. The result was 3 cents ahead of the consensus estimate but 5 cents lower year over year. Of note, earnings estimates for transportation companies have been coming down in recent weeks as trade risks rise and as March failed to live up to typical seasonality. J.B. Hunt’s first-quarter consensus estimate moved from $1.42 90 days ago to $1.14 ahead of the print.

Consolidated revenue of $2.92 billion was 1% lower y/y. Operating income fell 8% y/y to $179 million. Higher costs (insurance and claims, medical insurance, and maintenance) were the culprits. The company slightly beat its guidance calling for a 20% to 25% sequential decline in operating income for the period.

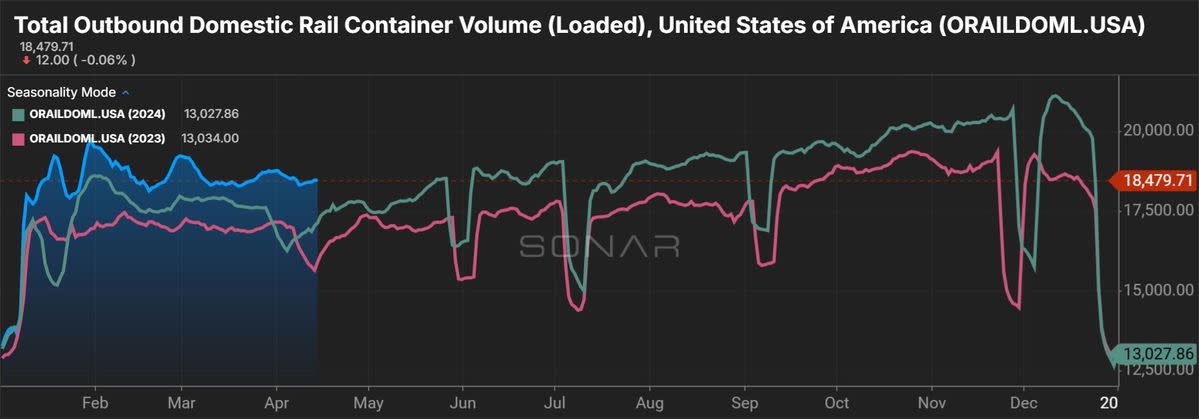

Record Q1 intermodal volumes, margin lags again

Intermodal revenue of $1.47 billion was 5% higher y/y as the company reported record first-quarter volumes. Total loads increased 8% as transcontinental loads were up 4% and shipments in the Eastern network were up 13%. Loads were up 9% y/y in January, 6% in February and 7% in March. That compared to a 9% y/y increase in total intermodal traffic on the U.S. Class I railroads during the quarter, according to the Association of American Railroads.

Revenue per load declined 2% y/y (down just 1% from the fourth quarter). A higher growth rate in the East was a modest drag on yields given the shorter length of haul. The company still has some large bids to be negotiated in the coming months.

The segment recorded a 93.6% operating ratio (inverse of operating margin), which was 90 basis points worse y/y. Average loads per container were off 4% y/y, and operating income per load fell 14%. The company didn’t commit to margin improvement in the unit this year given the difficult operating environment that’s being further complicated by trade uncertainty.

“We wanted to get the business on a trajectory to see an improvement in our margins in 2025, and we still have a long way to go to know if we will be successful or not,” Field said.

Dedicated remains sluggish, brokerage losses narrow

The dedicated segment reported a 4% y/y revenue decline to $822 million. Average trucks in service fell 5%, but revenue per truck per week increased 2% (up 4% excluding fuel surcharges). Severe winter weather was a headwind in the quarter, and J.B. Hunt’s lawn and garden customers haven’t seen the typical “spring surge.”

It sold service on 260 dedicated trucks in the period, but the timing of future deals will dictate if it returns to net fleet growth this year. Those additions will also determine if the company is able to grow operating income.

A 90.2% OR in the unit was 110 bps worse y/y.

The brokerage unit reported a 6% y/y revenue decline to $268 million. Total loads fell 13% but revenue per load increased 8%. The unit booked a $2.7 million operating loss, which was the smallest of this downcycle as both loads per employee and gross profit per employee increased 18% and 36% y/y, respectively.

Shares of JBHT were off 5.8% in after-hours trading on Tuesday.

More FreightWaves articles by Todd Maiden:

- March freight demand enters, exits like a lamb

- Amazon launches inbound-only LTL service

- Forward Air flags 10% to 15% revenue impact from new tariffs

The post J.B. Hunt’s intermodal bid season delivers mixed results appeared first on FreightWaves.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10