Asian Penny Stocks To Watch In April 2025

As global trade tensions escalate, Asian markets are experiencing a period of volatility and uncertainty. Despite these challenges, investors continue to seek opportunities in smaller or newer companies that might be overlooked by the broader market. Penny stocks, while an older term, still represent a relevant investment area for those interested in discovering potential value and financial strength within these often underestimated companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Rojana Industrial Park (SET:ROJNA) | THB4.78 | THB9.66B | ✅ 3 ⚠️ 3 View Analysis > |

| Interlink Telecom (SET:ITEL) | THB1.20 | THB1.66B | ✅ 4 ⚠️ 5 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.415 | SGD168.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.178 | SGD35.46M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.02 | SGD7.97B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$2.98 | HK$1.22B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.98 | HK$45.58B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.10 | HK$694.05M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.10 | HK$1.83B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥2.93 | CN¥3.39B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,148 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Meitu (SEHK:1357)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Meitu, Inc. is an investment holding company that creates products to enhance image, video, and design production with beauty-related solutions for digitalization in China and globally, with a market cap of HK$22.70 billion.

Operations: The company generates revenue from its Internet Business segment, which amounted to CN¥3.34 billion.

Market Cap: HK$22.7B

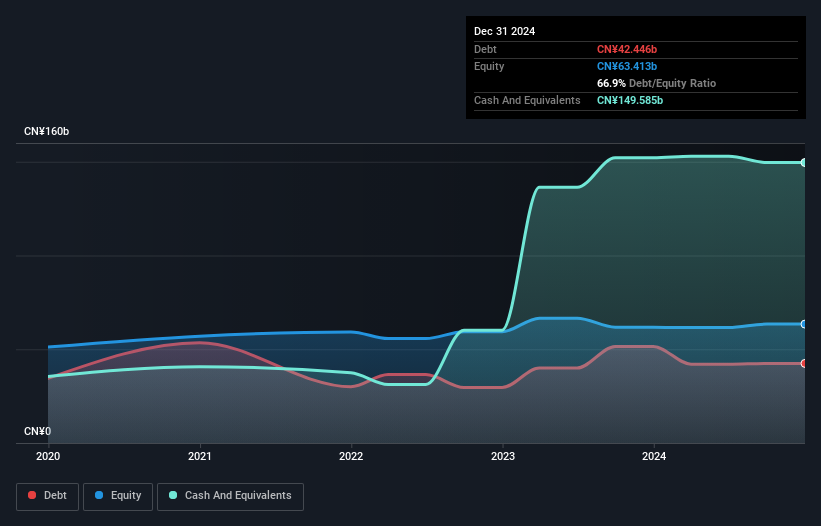

Meitu, Inc. has shown robust financial performance with earnings growing by 112.8% over the past year, significantly outpacing the industry average. The company's net profit margins have improved to 24.1%, and its debt is well-covered by operating cash flow, indicating strong financial health. Despite a highly volatile share price recently and significant insider selling, Meitu remains undervalued compared to its estimated fair value. Recent announcements include a final dividend increase and special dividend payments, reflecting confidence in future cash flows despite a large one-off loss impacting recent results.

- Get an in-depth perspective on Meitu's performance by reading our balance sheet health report here.

- Understand Meitu's earnings outlook by examining our growth report.

Sunshine Insurance Group (SEHK:6963)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sunshine Insurance Group Company Limited offers a range of insurance products and related services in the People’s Republic of China, with a market cap of HK$40.26 billion.

Operations: The company's revenue is primarily derived from its Life Insurance segment, generating CN¥37.51 billion, and its Property and Casualty Insurance through Sunshine P&C, contributing CN¥51.31 billion, with a smaller amount from Sunshine Surety at CN¥54 million.

Market Cap: HK$40.26B

Sunshine Insurance Group's recent performance highlights its financial stability, with net income reaching CN¥5.45 billion, an increase from the previous year. The company declared a final cash dividend of RMB 2,185 million for 2024, indicating solid profit distribution plans. Despite having more cash than total debt and stable weekly volatility at 5%, challenges remain as short-term assets don't cover long-term liabilities of CN¥481 billion. While earnings have grown significantly by 45.8% over the past year—exceeding its five-year average decline—board inexperience could pose governance risks amid executive resignations and management changes.

- Click here to discover the nuances of Sunshine Insurance Group with our detailed analytical financial health report.

- Gain insights into Sunshine Insurance Group's future direction by reviewing our growth report.

Xinyi Solar Holdings (SEHK:968)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xinyi Solar Holdings Limited is an investment holding company that produces and sells solar glass products across various regions including the People's Republic of China, Asia, North America, and Europe, with a market cap of HK$24.78 billion.

Operations: The company's revenue is primarily derived from the sales of solar glass, amounting to HK$18.82 billion, and its solar farm business, including EPC services, which contributes HK$3.02 billion.

Market Cap: HK$24.78B

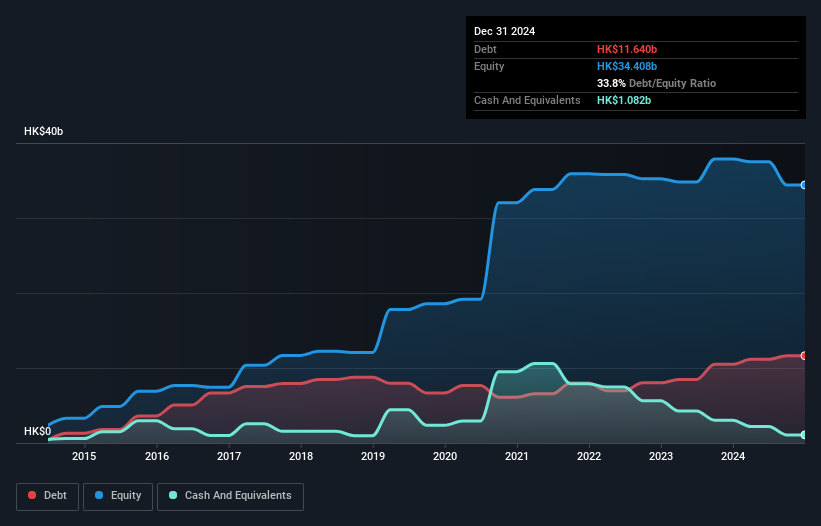

Xinyi Solar Holdings has experienced a challenging year, with net income dropping to HK$1.01 billion from HK$3.84 billion in the previous year, and a decision not to recommend a final dividend for 2024. Despite these setbacks, the company maintains high-quality earnings and its debt is well covered by operating cash flow at 41.7%. Its short-term assets of HK$17.6 billion exceed both short- and long-term liabilities, indicating financial stability amidst volatility in earnings growth. The board's seasoned leadership could provide strategic guidance as the company navigates industry challenges and seeks improvement in profit margins currently at 4.6%.

- Click here and access our complete financial health analysis report to understand the dynamics of Xinyi Solar Holdings.

- Learn about Xinyi Solar Holdings' future growth trajectory here.

Taking Advantage

- Click this link to deep-dive into the 1,148 companies within our Asian Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10