ProQR Therapeutics N.V. (NASDAQ:PRQR) Not Doing Enough For Some Investors As Its Shares Slump 34%

To the annoyance of some shareholders, ProQR Therapeutics N.V. (NASDAQ:PRQR) shares are down a considerable 34% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

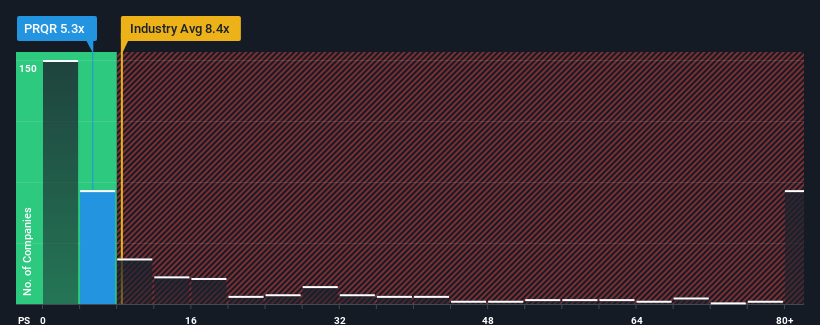

Following the heavy fall in price, ProQR Therapeutics' price-to-sales (or "P/S") ratio of 5.3x might make it look like a buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 8.4x and even P/S above 47x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

See our latest analysis for ProQR Therapeutics

What Does ProQR Therapeutics' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, ProQR Therapeutics has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think ProQR Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For ProQR Therapeutics?

ProQR Therapeutics' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 196% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 26% per annum as estimated by the seven analysts watching the company. Meanwhile, the broader industry is forecast to expand by 173% per annum, which paints a poor picture.

In light of this, it's understandable that ProQR Therapeutics' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does ProQR Therapeutics' P/S Mean For Investors?

ProQR Therapeutics' P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of ProQR Therapeutics' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, ProQR Therapeutics' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for ProQR Therapeutics that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10