Is OrthoPediatrics (NASDAQ:KIDS) A Risky Investment?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies OrthoPediatrics Corp. (NASDAQ:KIDS) makes use of debt. But the more important question is: how much risk is that debt creating?

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

What Is OrthoPediatrics's Debt?

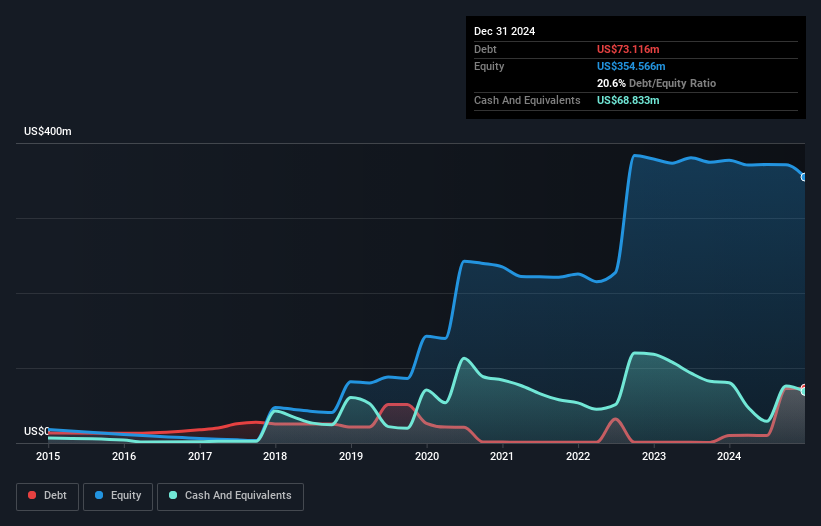

The image below, which you can click on for greater detail, shows that at December 2024 OrthoPediatrics had debt of US$73.1m, up from US$10.1m in one year. However, it also had US$68.8m in cash, and so its net debt is US$4.28m.

How Healthy Is OrthoPediatrics' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that OrthoPediatrics had liabilities of US$34.0m due within 12 months and liabilities of US$84.7m due beyond that. Offsetting these obligations, it had cash of US$68.8m as well as receivables valued at US$42.4m due within 12 months. So its liabilities total US$7.45m more than the combination of its cash and short-term receivables.

This state of affairs indicates that OrthoPediatrics' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the US$551.3m company is short on cash, but still worth keeping an eye on the balance sheet. Carrying virtually no net debt, OrthoPediatrics has a very light debt load indeed. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if OrthoPediatrics can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts .

View our latest analysis for OrthoPediatrics

In the last year OrthoPediatrics wasn't profitable at an EBIT level, but managed to grow its revenue by 38%, to US$205m. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

While we can certainly appreciate OrthoPediatrics's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. To be specific the EBIT loss came in at US$30m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled US$41m in negative free cash flow over the last twelve months. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - OrthoPediatrics has 2 warning signs we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking to trade OrthoPediatrics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10