Insider Buying Highlights 3 Undervalued Asian Small Caps

Amidst heightened global trade tensions and the resulting volatility in financial markets, Asian small-cap stocks have faced significant challenges, with indices reflecting broader market declines. Despite this turbulence, certain small-cap companies in Asia may present opportunities for investors as they exhibit resilience and potential for growth through strategic insider investments.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.6x | 1.1x | 40.67% | ★★★★★★ |

| Atturra | 24.8x | 1.0x | 45.34% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 41.33% | ★★★★★☆ |

| Puregold Price Club | 8.2x | 0.3x | 15.09% | ★★★★☆☆ |

| Dicker Data | 18.6x | 0.6x | -32.06% | ★★★★☆☆ |

| Sing Investments & Finance | 7.0x | 3.6x | 44.13% | ★★★★☆☆ |

| PWR Holdings | 34.2x | 4.7x | 26.20% | ★★★☆☆☆ |

| Zip Co | NA | 1.7x | -29.58% | ★★★☆☆☆ |

| Integral Diagnostics | 142.4x | 1.6x | 46.19% | ★★★☆☆☆ |

| Manawa Energy | NA | 2.6x | 44.23% | ★★★☆☆☆ |

Click here to see the full list of 59 stocks from our Undervalued Asian Small Caps With Insider Buying screener.

Underneath we present a selection of stocks filtered out by our screen.

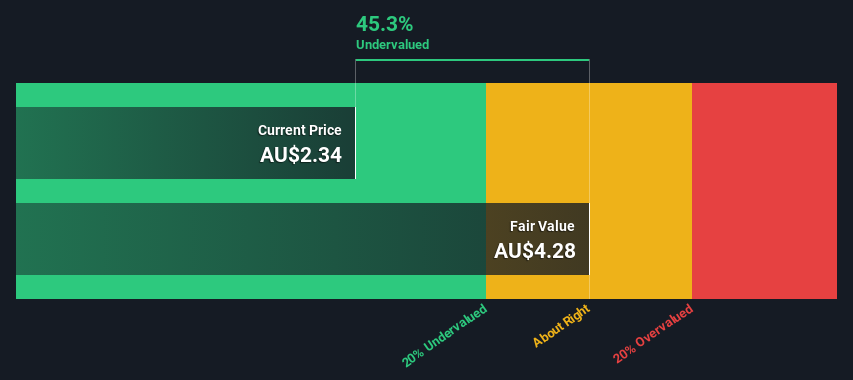

Nuix (ASX:NXL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nuix is a technology company specializing in software and programming solutions, with a market capitalization of A$0.38 billion.

Operations: The company generates revenue primarily from its software and programming segment, with the latest reported revenue at A$227.37 million. Its gross profit margin has shown fluctuations, reaching 90.03% in the most recent period. Operating expenses are significant, with notable allocations to sales and marketing as well as research and development efforts.

PE: -1544.6x

Nuix, a smaller player in the tech sector, recently joined the S&P/ASX 200 Index. Despite reporting a net loss of A$10.4 million for the half-year ending December 2024, sales increased to A$105.19 million from A$98.44 million year-on-year. Insider confidence is evident with Jonathan Rubinsztein acquiring 70,000 shares worth approximately A$238,499 in March 2025. Although reliant on external borrowing for funding, Nuix forecasts earnings growth of over 53% annually, suggesting potential for future value creation amidst its challenges.

- Dive into the specifics of Nuix here with our thorough valuation report.

Gain insights into Nuix's historical performance by reviewing our past performance report.

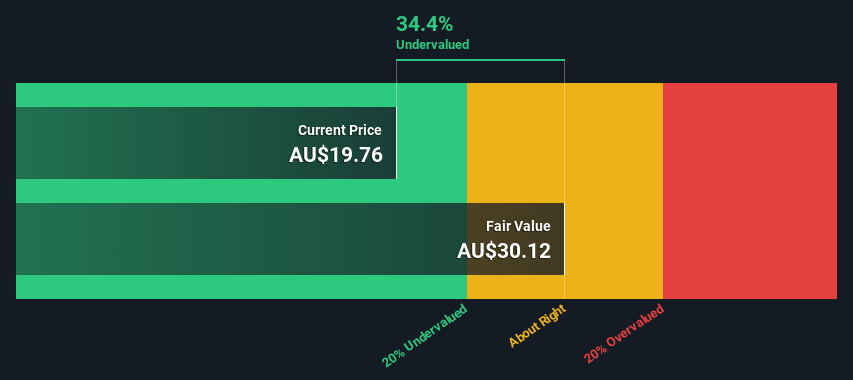

Perpetual (ASX:PPT)

Simply Wall St Value Rating: ★★★★★★

Overview: Perpetual is a diversified financial services company focusing on asset management and wealth management, with operations generating revenue primarily from these segments and a market capitalization of A$1.83 billion.

Operations: Revenue primarily stems from Asset Management and Wealth Management, with a significant portion allocated to operating expenses. The gross profit margin has shown a decreasing trend, reaching 39.09% by the end of 2024. Net income margins have turned negative in recent periods, influenced by rising non-operating expenses and depreciation costs.

PE: -3.7x

Perpetual's recent performance highlights a mixed picture, with sales rising to A$693 million for the half-year ending December 2024, up from A$657.8 million in the previous year. However, net income dropped significantly to A$12 million from A$34.5 million. The company's dividend decreased to 61 cents per share for the first half of 2025. Insider confidence is evident as Christopher Mark Jones increased their shareholding by over 100% in February 2025, purchasing shares worth approximately A$159,420. Despite challenges like high-risk external borrowing and fluctuating earnings, growth prospects remain optimistic with an anticipated annual earnings increase of over 68%.

- Click here to discover the nuances of Perpetual with our detailed analytical valuation report.

Gain insights into Perpetual's past trends and performance with our Past report.

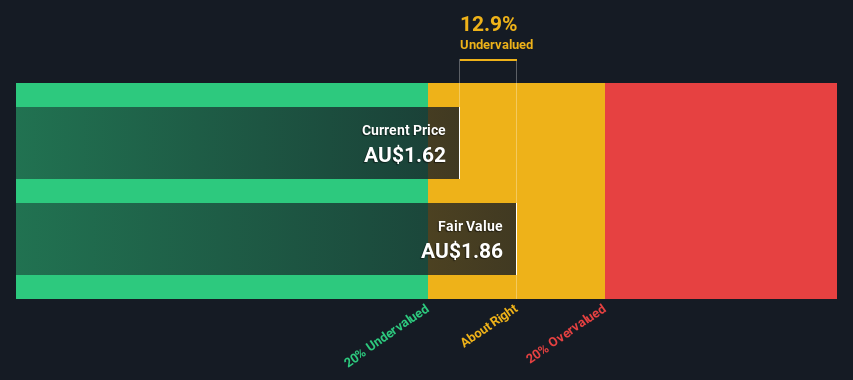

Viva Energy Group (ASX:VEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Viva Energy Group operates as an integrated downstream petroleum company in Australia, focusing on refining, supplying, and marketing fuels and lubricants, with a market capitalization of A$4.13 billion.

Operations: The company's revenue streams are primarily driven by its Commercial & Industrial and Convenience & Mobility segments, with the former generating A$18.71 billion and the latter A$11.43 billion. Over recent periods, the gross profit margin has shown fluctuations, reaching 9.62% by December 2024 from a low of -4.61% in June 2019. The cost of goods sold (COGS) constitutes a significant portion of expenses, impacting profitability across various periods.

PE: -30.8x

Viva Energy Group, a smaller player in the Asian market, shows potential despite challenges. With earnings forecasted to grow 39.53% annually, there's optimism around future performance. However, their reliance on external borrowing adds risk to their financial structure. Recent reports reveal a net loss of A$76.3 million for 2024 against previous profits, and dividends have decreased to A$0.039 per share for the last half-year period ending December 2024. Insider confidence remains steady with recent share purchases indicating belief in recovery prospects amidst current hurdles.

- Click here and access our complete valuation analysis report to understand the dynamics of Viva Energy Group.

Learn about Viva Energy Group's historical performance.

Taking Advantage

- Click this link to deep-dive into the 59 companies within our Undervalued Asian Small Caps With Insider Buying screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Perpetual, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10