Carvana (NYSE:CVNA) Expands Phoenix Megasite, Adding 200 Jobs and Enhancing Operations

Carvana (NYSE:CVNA) has announced key business expansions with the integration of auction and reconditioning megasites in Phoenix and New Jersey, aimed at enhancing operational efficiency and customer service. Despite these developments, the company's shares experienced a 6% decline over the last month. This decline occurred during a period of heightened market volatility, with the S&P 500 also dropping 12%, driven by new tariffs and economic uncertainty. While Carvana's business advancements may bolster future prospects, immediate market pressures from trade tensions likely influenced its recent stock performance, aligning with broader market trends.

Be aware that Carvana is showing 3 possible red flags in our investment analysis and 1 of those makes us a bit uncomfortable.

The end of cancer? These 23 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Carvana's integration of auction and reconditioning megasites is anticipated to improve operational efficiency, which aligns with its broader strategy to enhance customer service and reduce costs. These developments could positively impact revenue and earnings forecasts by boosting the volume of cars processed and improving margins. Despite the recent 6% decline in share price amid market volatility, Carvana's shares have returned a very large total of 110.71% over the past year, reflecting strong longer-term performance. This outpaces both the declining 12% of the S&P 500 over the same period and the US Specialty Retail industry, which saw a negative 4.6% performance.

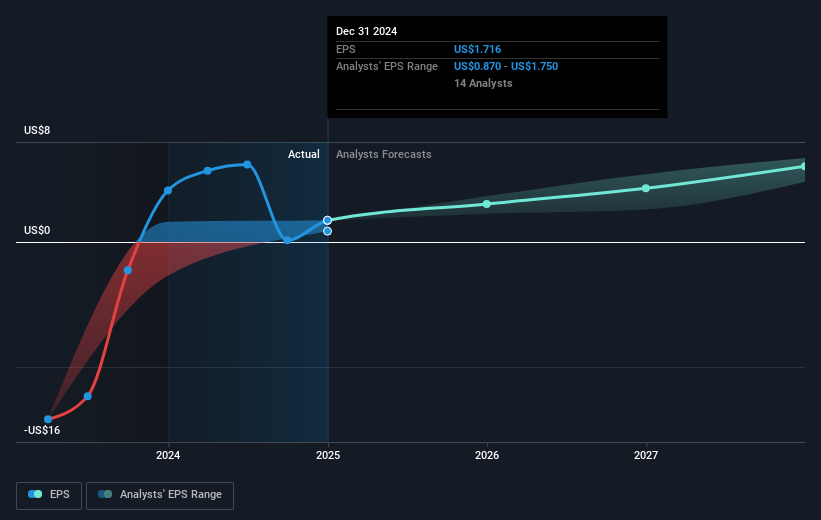

The recent price movement positions Carvana's shares at a discount relative to the analyst price target of $265.56. With the current share price at $212.59, this suggests a potential 19.9% upside, according to consensus forecasts. While the integration of ADESA and AI adoption are seen as catalysts for growth, analysts are divided in their expectations, highlighting uncertainty in whether projected revenue growth of 20% annually and margin expansion to 5.7% will be achieved. Therefore, the recent market developments and strategic expansions could serve as key factors driving future shareholder returns, though execution risks in scaling operations remain.

Learn about Carvana's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Carvana, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10