Lyft (NasdaqGS:LYFT) Faces Boardroom Challenge Amid Investor Dissatisfaction

Lyft (NasdaqGS:LYFT) recently saw its stock price fall by 18.48% last week following news that Engine Capital Management, LP is pushing for a boardroom challenge, signaling investor dissatisfaction with the company’s declining stock. This comes during a period of significant market volatility, with the S&P 500 declining 12% due to tariff concerns. While tech giants like Apple and Tesla rallied amid these market conditions, Lyft's decline suggests that the activism-related news added weight to the broader negative market sentiment, impacting the company more acutely than some of its tech counterparts.

Buy, Hold or Sell Lyft? View our complete analysis and fair value estimate and you decide.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Over the past year, Lyft's total shareholder return, including dividends, reflected a decline of 46.14%. This substantial drop highlights investor concerns over the company's outlook amidst market volatility. In comparison, for the same period, the US market saw a return of 5.8%, while the US Transportation industry experienced an 18.5% decline, indicating that Lyft's underperformance was more severe.

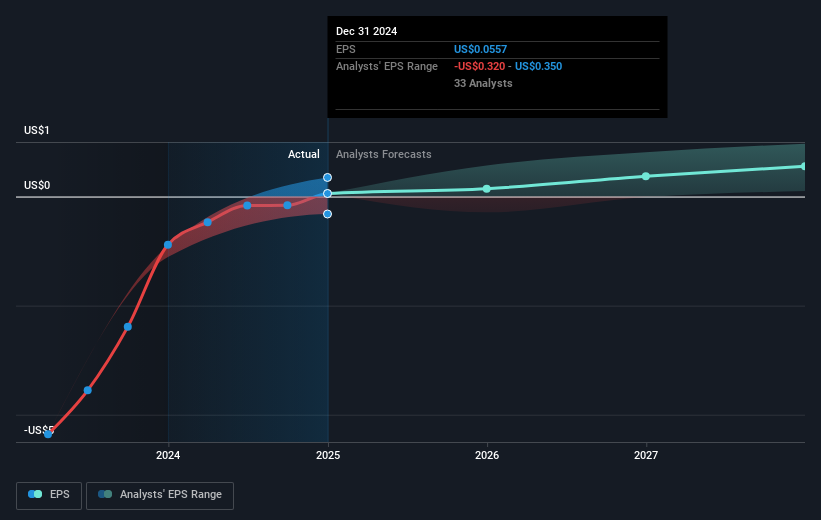

The introduction of a boardroom challenge by Engine Capital Management could have implications on Lyft's governance, potentially influencing future revenue and earnings forecasts. With the company's recent earnings reports showing a transition to profitability, these developments may add pressure on Lyft to sustain its performance targets. Furthermore, with Lyft's share price now trading at a significant discount to the consensus analyst price target of US$16.40, the market has yet to fully acknowledge improvements in operational outcomes or the strategic initiatives highlighted in recent announcements.

Unlock comprehensive insights into our analysis of Lyft stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lyft, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10