Merck (NYSE:MRK) Faces Multiple Shareholder Proposals Ahead Of Annual Meeting

Merck (NYSE:MRK) recently experienced a significant corporate governance event when multiple shareholder proposals were announced, with the company recommending against them for the upcoming annual meeting. This development comes amid a general market downturn, underscored by the Dow and Nasdaq dropping 4% and 6%, respectively. Over the past week, Merck's share price has decreased by 5.42%, slightly exceeding the broader market's decline. The combination of these shareholder proposals and overall market bearishness suggests that investor sentiment around Merck may have been influenced, reinforcing downside trends observed across the equity landscape.

Merck has 1 weakness we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

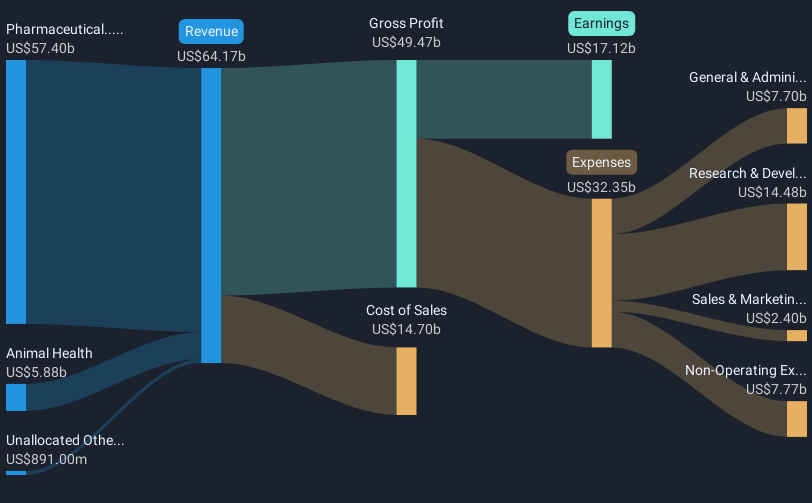

The recent shareholder proposals at Merck sparked discussions around corporate governance and could influence future strategic decisions impacting revenue and earnings forecasts. While the company is focusing on its strong pipeline, including impactful launches like WINREVAIR and KEYTRUDA, the shareholder dissent highlights potential investor concerns. The corporate event, amid a market downturn, may play a role in tempering enthusiasm for projected revenue growth and earnings improvements, despite expectations of US$72.9 billion in revenue by 2028.

Looking at Merck's longer-term share performance, the total return, including dividends, over the past five years stands at 22.03%. However, it underperformed the US Pharmaceuticals industry, which saw returns fall by a very large amount over the past year, indicating Merck's shares were relatively resilient over a longer period compared to recent industry trends.

Despite the current share price of US$78.95 and a price target of US$110.89, the market's immediate negative sentiment could impact the pace at which Merck closes this gap. Analysts foresee earnings reaching US$25.3 billion by April 2028, contingent on achieving proposed revenue growth and maintaining competitive margins. The share price decline in light of these developments suggests that investors remain cautiously observant, likely weighing near-term challenges against the company's robust future outlook.

Examine Merck's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10