ASX Penny Stocks To Watch In April 2025

The Australian market recently experienced a positive shift, with all sectors closing in the green and notable gains in IT and Materials. In this context, penny stocks—though an older term—continue to represent smaller or less-established companies that might offer significant value. By focusing on those with strong financials and clear growth potential, investors can find opportunities that balance risk and reward effectively.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.57 | A$122.48M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.00 | A$147.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.785 | A$1.01B | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.32 | A$62.27M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.38 | A$366.95M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$119.49M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.13 | A$148.52M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.72 | A$578.2M | ✅ 4 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.66 | A$438.69M | ✅ 4 ⚠️ 1 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.41 | A$1.1B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 979 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

EcoGraf (ASX:EGR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EcoGraf Limited focuses on exploring and producing graphite products for the lithium-ion battery and advanced manufacturing markets in Tanzania and Australia, with a market cap of A$143.05 million.

Operations: EcoGraf's revenue is primarily generated from its operations in Australia, amounting to A$3.94 million.

Market Cap: A$143.05M

EcoGraf Limited is navigating the penny stock landscape with a focus on graphite production for lithium-ion batteries, primarily in Tanzania and Australia. Despite being pre-revenue, EcoGraf has made significant strides with recent developments like the TanzGraphite Mechanical Shaping Facility and securing a Special Mining Licence for its Epanko Graphite Project. These moves are pivotal as they enhance operational certainty and support financing efforts. However, challenges remain as the company is unprofitable with increasing losses over five years. EcoGraf's experienced board contrasts its less seasoned management team, adding complexity to its strategic execution.

- Navigate through the intricacies of EcoGraf with our comprehensive balance sheet health report here.

- Examine EcoGraf's past performance report to understand how it has performed in prior years.

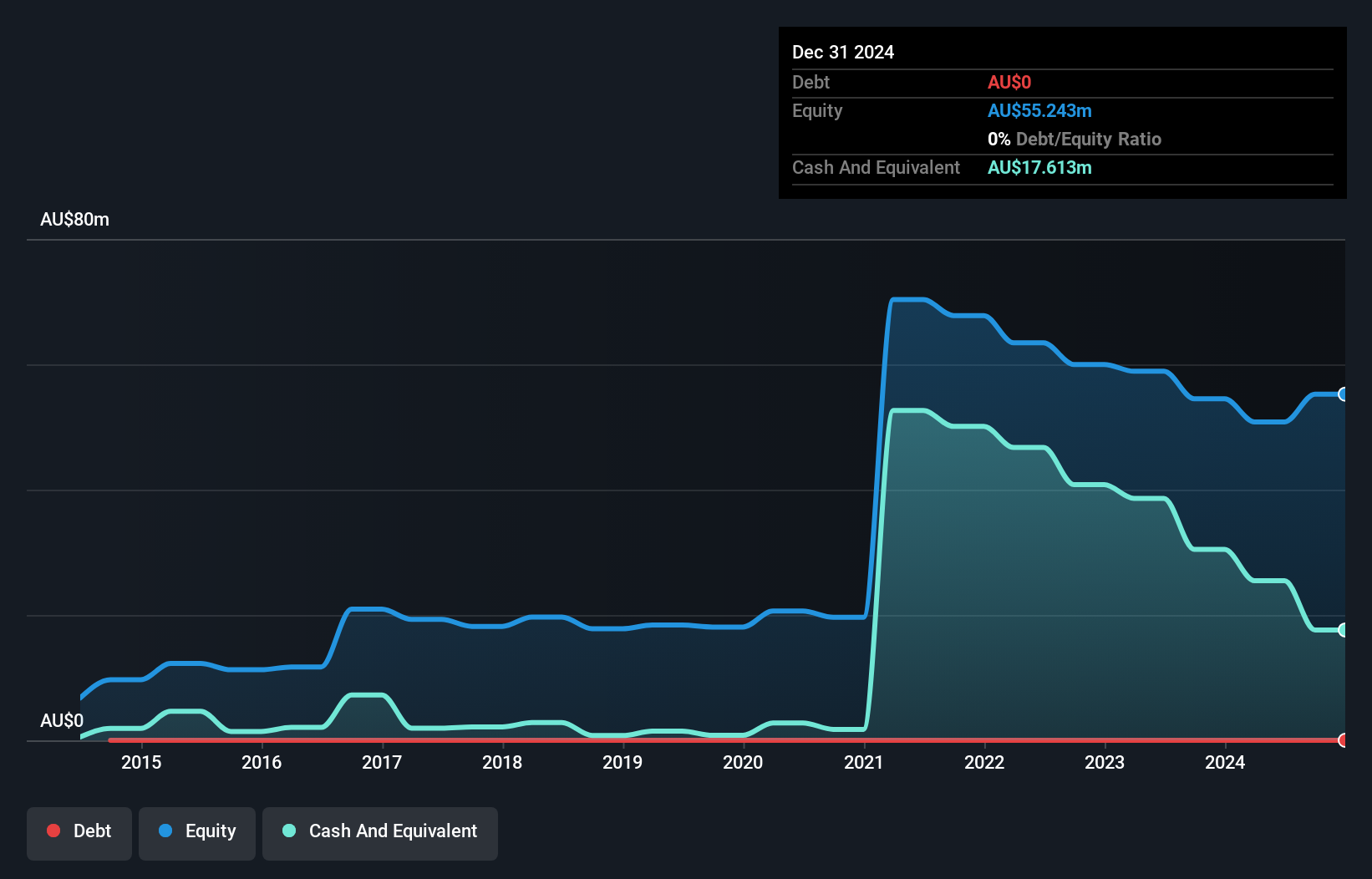

MFF Capital Investments (ASX:MFF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.45 billion.

Operations: The company generates its revenue primarily from equity investments, totaling A$1.01 billion.

Market Cap: A$2.45B

MFF Capital Investments stands out in the penny stock arena with robust financial health and significant earnings growth. Its recent earnings report shows a substantial revenue increase to A$551.81 million for the half-year ended December 2024, with net income rising to A$381.46 million. The company's short-term assets of A$3 billion comfortably cover both its short- and long-term liabilities, reflecting strong liquidity. MFF also offers an attractive dividend yield of 3.8% and trades below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities with solid fundamentals in the Australian market.

- Get an in-depth perspective on MFF Capital Investments' performance by reading our balance sheet health report here.

- Assess MFF Capital Investments' previous results with our detailed historical performance reports.

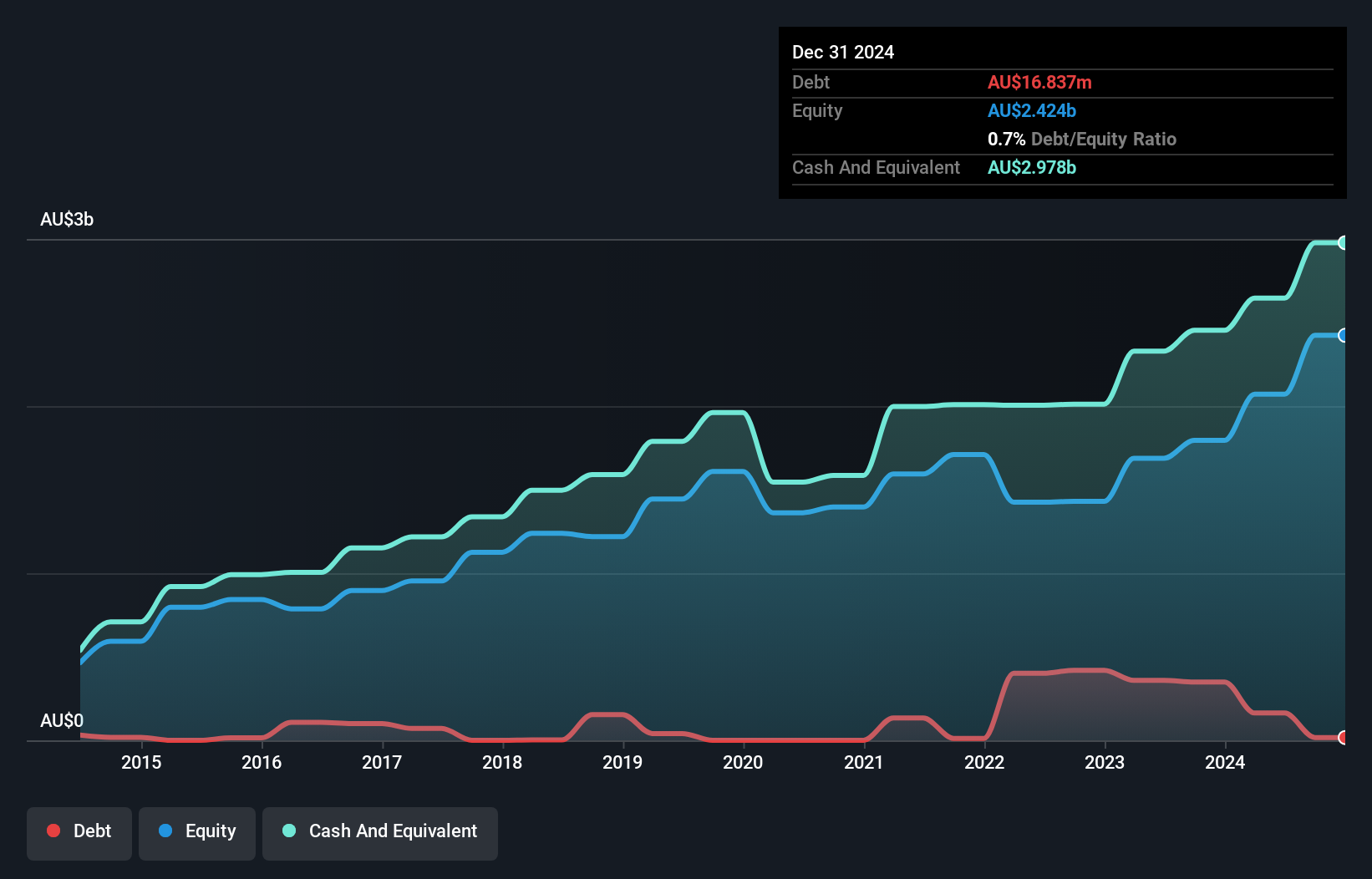

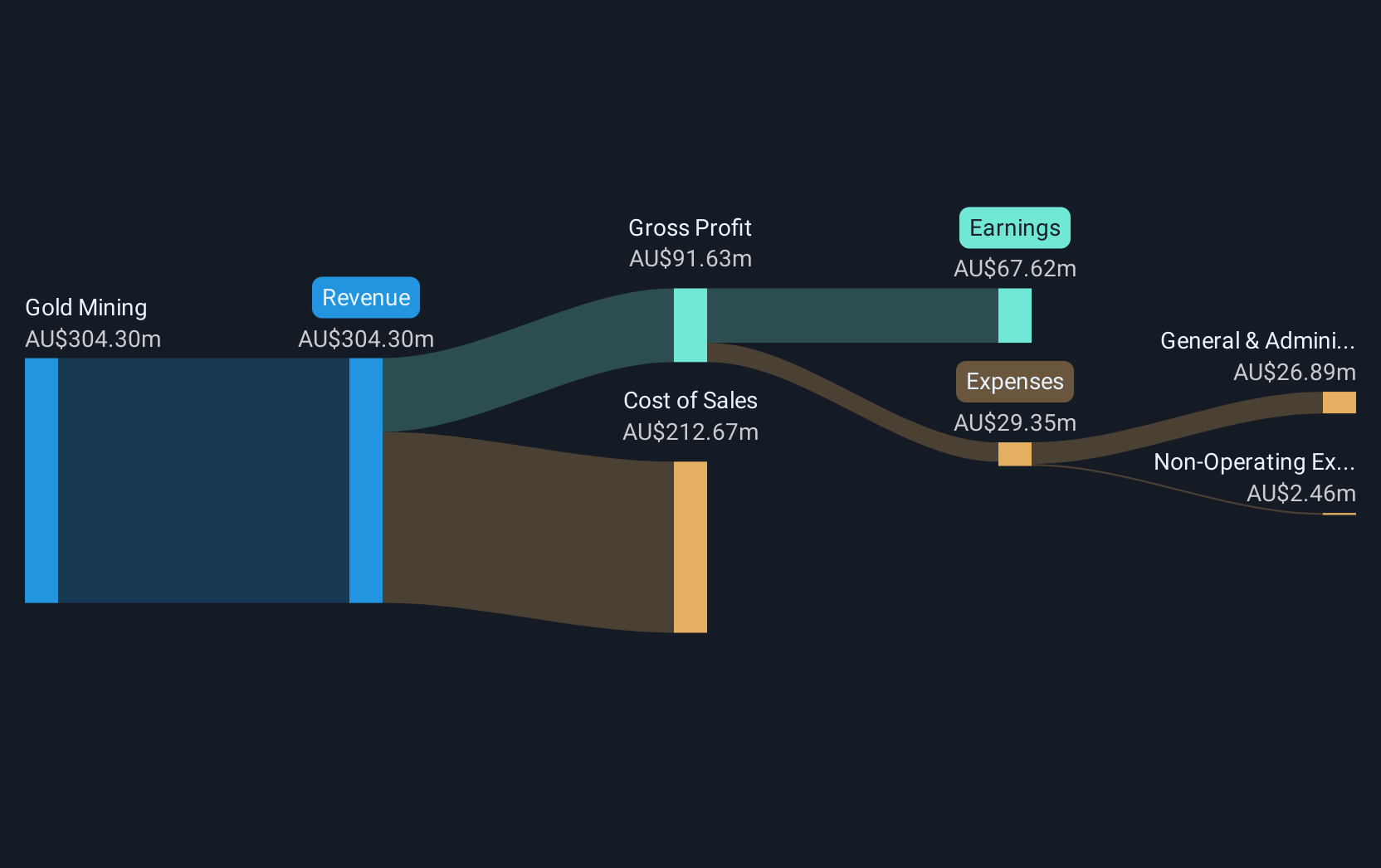

Ora Banda Mining (ASX:OBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties with a market cap of A$2.03 billion.

Operations: The company's revenue is primarily derived from its gold mining operations, totaling A$304.30 million.

Market Cap: A$2.03B

Ora Banda Mining's recent inclusion in the S&P/ASX 300 and Small Ordinaries Indexes highlights its growing presence in the market. The company has secured a revolving credit facility of A$50 million, enhancing liquidity to over A$100 million. With sales reaching A$186.42 million for the half-year ending December 2024, Ora Banda reported a significant net income increase to A$50.84 million, reflecting its transition to profitability. Despite management's relatively short tenure suggesting inexperience, Ora Banda boasts strong financial metrics with well-covered debt and outstanding return on equity at 44.3%, positioning it as an intriguing prospect among penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Ora Banda Mining.

- Learn about Ora Banda Mining's future growth trajectory here.

Seize The Opportunity

- Access the full spectrum of 979 ASX Penny Stocks by clicking on this link.

- Ready For A Different Approach? We've found 22 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10