Toast (NYSE:TOST) Faces 12% Drop Over Last Week Amid Market Volatility

Toast (NYSE:TOST) experienced a 12% decline over the past week, reflecting the broader market trend, which also saw a 12% drop due to heightened volatility from new tariffs imposed by the U.S. and retaliations from China. Although the market was dominated by fluctuations in the tech sector, as witnessed by Apple's performance, Toast's drop aligns with that of major indices without any distinguishing catalysts from recent company-specific news. Instead, its share performance can be seen as part of an industry-wide response to economic uncertainties prompted by ongoing trade tensions and tariff impacts.

Be aware that Toast is showing 2 possible red flags in our investment analysis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past three years, Toast, Inc. (NYSE:TOST) delivered a total shareholder return of 60.07%, reflecting a period of substantial value creation for investors. This performance is contrasted by its more recent developments; despite exceeding the US Diversified Financial industry and the general market over the past year, with the US market returning a decline of 5.8% and the industry gaining 7.4%, the recent tariffs and resulting economic uncertainties have weighed on its performance.

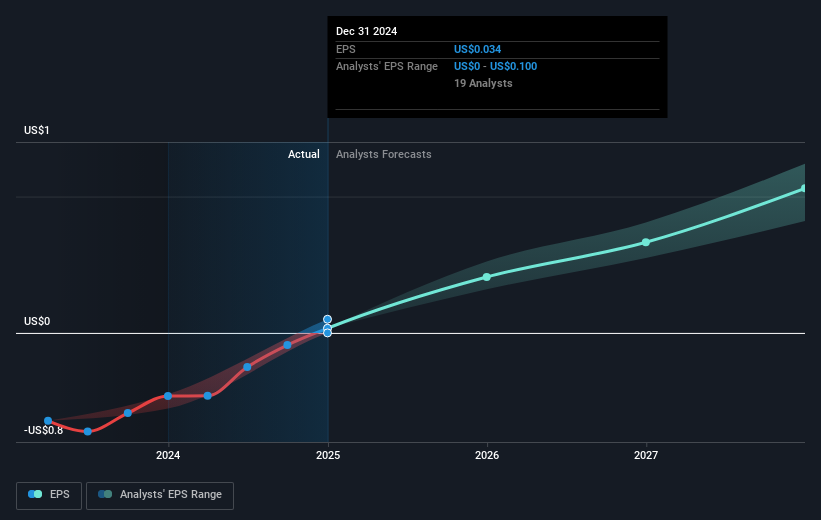

The introduction's highlighted decline may influence revenue and earnings forecasts as the economic landscape changes. Nevertheless, Toast's strategic ventures into improving operational efficiencies and expanding partnerships stand to potentially offset these external pressures. Despite the recent drop, Toast's current share price remains below the consensus analyst price target of US$41.53, suggesting potential investor optimism about the company's longer-term recovery and growth prospects.

Dive into the specifics of Toast here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10