Catalyst Metals Limited (ASX:CYL) Held Back By Insufficient Growth Even After Shares Climb 44%

Despite an already strong run, Catalyst Metals Limited (ASX:CYL) shares have been powering on, with a gain of 44% in the last thirty days. This latest share price bounce rounds out a remarkable 685% gain over the last twelve months.

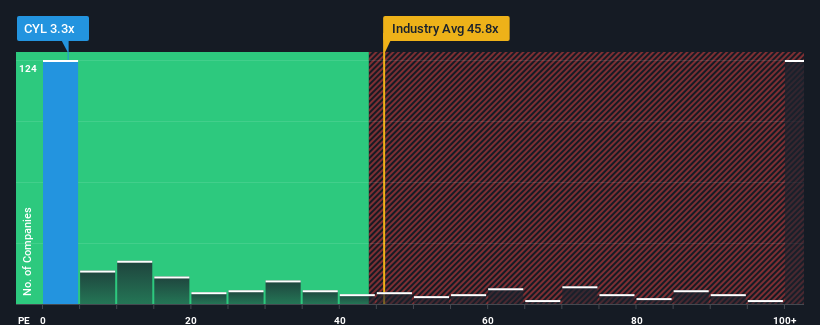

Although its price has surged higher, Catalyst Metals may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.3x, since almost half of all companies in the Metals and Mining industry in Australia have P/S ratios greater than 45.8x and even P/S higher than 328x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

See our latest analysis for Catalyst Metals

What Does Catalyst Metals' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Catalyst Metals has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Catalyst Metals' future stacks up against the industry? In that case, our free report is a great place to start .Is There Any Revenue Growth Forecasted For Catalyst Metals?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Catalyst Metals' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 148%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% per year during the coming three years according to the three analysts following the company. That's shaping up to be materially lower than the 89% each year growth forecast for the broader industry.

With this information, we can see why Catalyst Metals is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Catalyst Metals' P/S

Shares in Catalyst Metals have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Catalyst Metals' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Catalyst Metals that you should be aware of.

If you're unsure about the strength of Catalyst Metals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10