Jazz Pharmaceuticals plc (NASDAQ:JAZZ) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Jazz Pharmaceuticals plc (NASDAQ:JAZZ) shares have had a horrible month, losing 26% after a relatively good period beforehand. The recent drop has obliterated the annual return, with the share price now down 9.8% over that longer period.

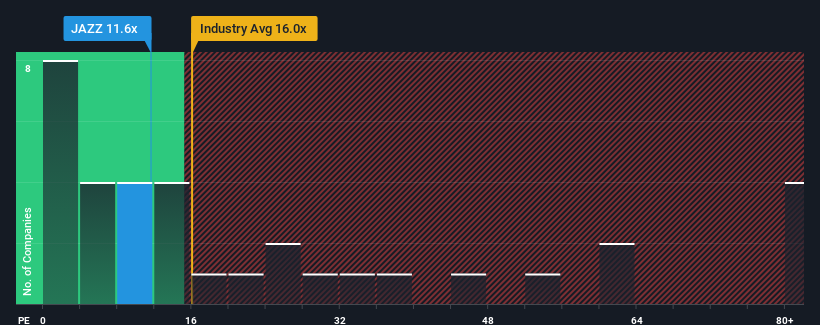

After such a large drop in price, Jazz Pharmaceuticals' price-to-earnings (or "P/E") ratio of 11.1x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 16x and even P/E's above 29x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Recent times have been advantageous for Jazz Pharmaceuticals as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Jazz Pharmaceuticals

Is There Any Growth For Jazz Pharmaceuticals?

There's an inherent assumption that a company should underperform the market for P/E ratios like Jazz Pharmaceuticals' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 38% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 11% each year as estimated by the analysts watching the company. With the market predicted to deliver 11% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Jazz Pharmaceuticals' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Jazz Pharmaceuticals' P/E has taken a tumble along with its share price. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Jazz Pharmaceuticals currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Jazz Pharmaceuticals that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Jazz Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10