Trump tariffs set to hamper growth of key ASEAN economies, posing tough test for some leaders

KUALA LUMPUR/JOHOR BAHRU: The chilling effect of United States President Donald Trump’s sweeping new tariffs on economic growth in Southeast Asia’s key economies is expected to pose stern tests for these countries, say analysts.

Some governments have already stated their intention to negotiate deals with the Trump administration in return for lower tariffs. But should this fail, they may also need to roll out a slew of fiscal measures to cushion the impact on their people, experts caution.

The leaders of Indonesia, Malaysia, Thailand and Vietnam have pinpointed steady economic growth as a key priority during their terms in government. As economists slash growth forecasts, all eyes will be on how they react to maintain domestic political stability.

Malaysia, as the current chair of the Association of Southeast Asian Nations (ASEAN), is coordinating a response with other regional leaders “to engage constructively” with the US.

Putrajaya will also chair a special ASEAN Economic Ministers’ meeting on Thursday (Apr 10) to address the impact of newly imposed US tariffs on regional trade and investment and to coordinate a collective response.

However, some analysts said that ASEAN as a bloc is not seen by the US as a key global player, and the countries' differing trade circumstances imply it would be more constructive for member states to negotiate with Washington directly.

Edwin Oh Chun Kit, an independent Malaysia-based socioeconomic analyst, said the ASEAN bloc should try to offer the US “selective concessions” like adjusted trade terms or market access to allow Trump a “symbolic victory” without compromising the region’s core interests.

“ASEAN should adopt a calibrated engagement strategy, emphasising in negotiations as a bloc the critical importance of its market to the US and how its resilience or alternative alignments could exacerbate American economic strain,” he told CNA.

“However, this response calculus remains inherently complex. Many have already begun negotiating independently with the US, a move that’s hard to fault given the immediate stakes of national interests and economic welfare.”

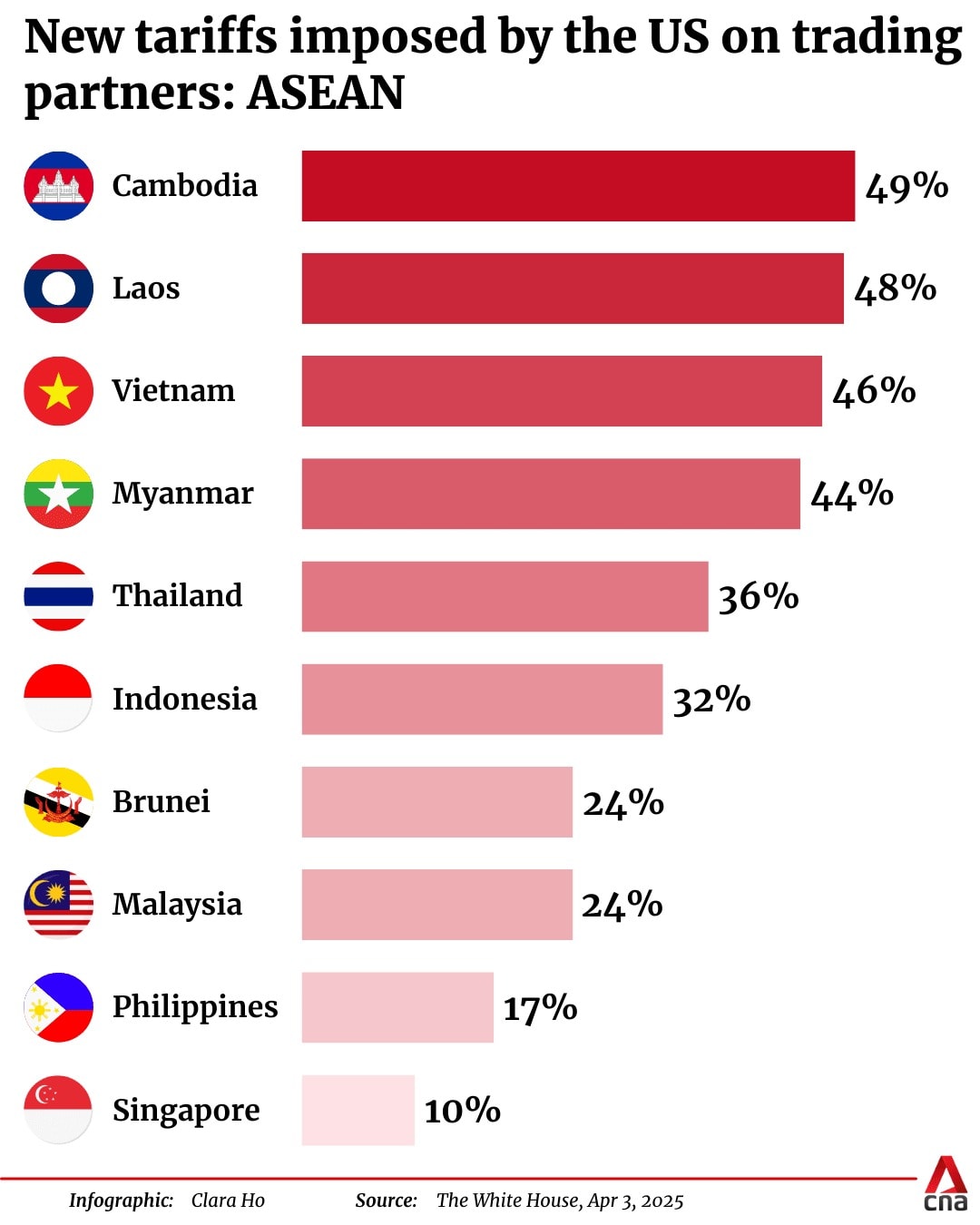

On Apr 2, Trump announced a new 10 per cent baseline levy on all imports coming into the US as well as country-specific taxes on goods from a host of other countries dubbed “reciprocal” tariffs.

Cambodia and Laos are the worst hit Asian economies, slapped with 49 per cent and 48 per cent import tariffs respectively. This was followed by Vietnam (46 per cent), Myanmar (44 per cent) and Thailand (36 per cent).

Analysts previously told CNA that they were hardest hit due to their perceived close economic ties with Beijing and large trade surpluses with Washington.

GROWTH RATES OF ASEAN-6 SLASHED, VIETNAM LIKELY HARDEST HIT

In light of the US’ reciprocal tariffs, banks and economists have lowered the economic growth forecasts of the ASEAN-6 slightly.

ASEAN-6 - referring to the bloc’s six largest economies of Indonesia, Thailand, Singapore, the Philippines, Vietnam and Malaysia - had a combined nominal gross domestic product (GDP) of US$3.7 trillion in 2023, according to a DBS Bank report published in January.

This figure made up more than 97 per cent of ASEAN’s total GDP of US$3.8 trillion in 2023.

A global market research report by OCBC Bank, published after the Trump tariffs were announced, has reduced the growth forecast for Vietnam by 1.2 percentage points, Thailand by 0.8 percentage points, Malaysia and Indonesia by 0.2 percentage points as well as Singapore and the Philippines by 0.1 percentage points.

According to the report, the economic growth forecasts for 2025 before the tariffs were imposed were 6.2 per cent for Vietnam, 2.8 per cent for Thailand, 4.5 per cent for Malaysia, 4.9 per cent for Indonesia, 2.2 per cent for Singapore and 6.0 per cent for the Philippines.

“The sharp escalation of tariffs rates, if realised, will have a hard-hitting impact on economic growth through the export channels. Based on import elasticities and our back of the envelope calculations, Vietnam will be hardest hit with GDP growth,” the report said.

However, analysts maintained that even though growth is expected to slow, the likelihood of a recession - which constitutes two consecutive quarters of negative economic growth - is low among the ASEAN-6.

Geostrategist Azmi Hassan, who is a senior fellow at Malaysia-based Nusantara Academy for Strategic Research told CNA: “No doubt that the ASEAN-6’s economic growth will be negatively impacted, but the impact varies across the different economies.

“It is unlikely though that the Trump tariffs will lead to a recession, given that their economies are also driven by exports to other regions and impacted also by domestic demand,” he added.

Economist Cassey Lee, who is coordinator for the Regional Economic Studies Programme in Singapore’s ISEAS-Yusof Ishak Institute, told CNA he could not rule out the ASEAN-6 being hit with a recession, given that these economies are highly dependent on export and trade.

However, he also noted a chance that the tariffs could be reversed or reduced in coming weeks and months following negotiations between the respective governments and the Trump administration, curtailing their impact on the economies.

“If there is a slowdown in global trade, the most affected Southeast Asian countries will be those which are very open in terms of their exposure or dependence on trade - these would include Singapore, Vietnam, Malaysia and Thailand,” said Lee.

“The size of the tariffs and the structure of trade (type of goods exported to the US) will mean the most affected countries would be Vietnam, Thailand.

GROWTH SLOWDOWN COULD STING MORE FOR SOME LEADERS

Analysts outlined that among the ASEAN-6, leaders of Indonesia, Malaysia, Thailand and Vietnam could be tested more by Trump tariffs.

They added that these countries have been hit by higher tariffs - Vietnam at 46 per cent, Thailand at 36 per cent, Indonesia at 32 per cent and Malaysia at 24 per cent.

Meanwhile, the Philippines and Singapore were hit with 17 per cent and 10 per cent respectively, and the impact of growth slowdown is likely diminished, they added.

For Indonesia, analysts outlined that President Prabowo Subianto’s lofty economic growth target will be hamstrung by the US tariffs’ impact on key sectors like apparel, footwear and electronics.

Prabowo, who assumed post in October 2024, has pledged to achieve an annual economic growth of 8 per cent during his five-year term.

Economist Siwage Dharma Negara, who is also the coordinator of the Indonesia Studies Programme at the ISEAS-Yusof Ishak Institute, told CNA that a failure to negotiate lower tariffs with the US will dampen this ambition.

“If the 32 per cent tariff by the US on Indonesian exports is fully implemented, this will pose a significant challenge to Prabowo’s ambitious goal of achieving 8 per cent economic growth during his term,” he added.

“Such setbacks make even a 5 per cent growth target more challenging to attain.”

Bhima Yudhistira Adhinegara, director of the Center of Economic and Law Studies in Indonesia, said Jakarta’s links to the global supply chain make its economy “very sensitive” to the US tariffs.

“Whatever goods that we produce and send to China, for instance, at the end of the day Chinese companies also send their products to the US,” he told CNA.

“The second thing is because of the currency fluctuations. Rupiah against US dollars is very sensitive to everything, to raw material imports, remittances and also the (rising) living costs that Indonesian consumers will bear soon."

Bhima warned that Indonesia could be hit with a double whammy as major manufacturing hubs like China and Vietnam train their sights on alternative markets, especially Indonesia’s large consumer base, to avoid US tariffs.

This means Indonesia will not be able to fully capitalise on its own base as locally-made products - that are typically exported to the US - will not be able to compete with products from China and Vietnam that will soon flood the domestic market.

“It makes it very difficult, from the Indonesia exporters’ perspective, to shift their products from the US market to the domestic market here, because the prices are a little bit expensive,” he explained.

Indonesia announced a spate of concessions for US imports on Tuesday, including reducing taxes on electronic goods and steel.

Finance Minister Mulyani Indrawati said Indonesia would also lower import taxes on mining products and health equipment from the US.

Indrawati said there is room for Indonesia to replace Vietnam, Bangladesh, Thailand and China as a source of some exports to the US under the new tariff regime.

Southeast Asia's biggest economy will also send a high-level delegation to the US next week seeking a deal to ease the impact of its 32 per cent tariff.

Prabowo has emphasised that his country will not engage in retaliatory measures but will instead pursue diplomatic negotiations.

Indonesia also plans to buy liquefied petroleum gas, liquefied natural gas and soybeans from the US as part of the negotiation efforts, said chief economic minister Airlangga Hartarto, who will lead Indonesia's delegation to the US.

Despite that, Bhima asserted that Jakarta has not displayed “seriousness” in tackling the issue, noting that the post for Indonesia’s envoy to Washington has been left vacant for two years.

The analyst urged the Prabowo government to “act fast” and start formulating fiscal stimulus policies, such as utility discounts for entrepreneurs and looser loan or credit terms for industries hit by US tariffs.

“The sense of crisis is missing from the Indonesian government … We want to keep our optimism, but on the other hand, we must acknowledge there's a huge problem ahead,” he said.

Failure to hit 8 per cent growth aside, further economic troubles will worsen already waning public trust in the current administration amid recent controversial policies involving the roles of the police and military, Bhima said.

“If people see the impact of the US tariffs becoming uncontrollable and the currency (further) weakens against the US dollar - let's say 18,000 per dollar - I think trust in the central bank and government will decline,” he added.

“The (added) political instability will be a burden on the Indonesian economy … The future of Indonesia, in that sense, is not bright enough. People are already fed up.”

Over in Malaysia, the socioeconomic analyst Oh said the impacts of a 24 per cent US tariff rate could likewise erode public confidence in Prime Minister Anwar Ibrahim’s government, pointing to the possibility of higher prices, job losses and diminished economic opportunities.

“Voters, notoriously sensitive to immediate economic pressures, may not distinguish between global trade dynamics and domestic policy failures, attributing their hardships to Anwar’s leadership,” he said.

“This vulnerability offers opposition parties a potent political narrative - or as some may say ‘bullets’ - framing the downturn as evidence of governmental incompetence.”

Still, Oh opined that the tariffs represent a “double-edged sword” for Anwar, who has a “rare chance to demonstrate resilience and vision” in steering Malaysia through this turbulent period.

He cited how many Malaysians remain appreciative of former premier Mahathir Mohamad’s efforts in speeding up the country’s recovery from the 1997 Asian Financial Crisis by pegging the ringgit to the US dollar.

“So, if Anwar navigates this storm effectively, minimising economic damage relative to neighbours, the political payoff could be substantial at both national and regional (ASEAN) stages,” he added.

While Anwar might be hit politically to some extent as he seeks re-election ahead of the next national polls expected to be held in 2027, he could use the Trump tariffs as a factor that has hampered his economic policies, said Azmi from the Nusantara Academy for Strategic Research.

Anwar has acknowledged that the economic growth forecast for Malaysia may need to be reviewed but stressed that the government does not expect a recession to occur.

Azmi noted that Anwar has been lauded for recent economic developments, including the boost in the ringgit’s value alongside the US dollar, and increased foreign investments in sectors such as semiconductors and digital technology.

“If Malaysia’s growth is impacted, perhaps Datuk Seri Anwar can blame Trump and use his protectionist policies as a scapegoat. The majority of the Malaysian electorate have a negative perception of Trump currently,” he added.

In Thailand, some analysts believe the US tariffs pose a significant risk to the Paetongtarn Shinawatra government, particularly if the response is “slow or lacks coordination”.

“Key sectors such as electronics and automobiles - along with the workers they employ - are likely to be among the hardest hit,” said Wannaphong Durongkaveroj, an economics professor at Ramkhamhaeng University.

“A rise in unemployment, coupled with sluggish economic growth, would almost certainly lead to growing public dissatisfaction and increased scrutiny of the government’s performance.”

Wannaphong, who is also a fellow at the ISEAS-Yusof Ishak Institute, told CNA that the US is Thailand's top export destination, with key products including electronics, air conditioners, vehicle parts and accessories, and processed foods.

In response to being hit with a 36 per cent US reciprocal tariff, Thailand plans to increase imports of US energy, aircraft, and farm produce, and promote Thai investment in the US while easing restrictions on US imports.

Paetongtarn, who assumed office only in August last year, has also promised short- and long-term support measures for businesses expected to be most affected by the tariff hikes.

Given that trade remains a key driver of prosperity and development for Thailand, Wannaphong feels the country - instead of turning inward - should make its business environment more accessible and cost-effective.

“Upgrading infrastructure and simplifying bureaucratic procedures are practical steps Thailand can take - without even needing to engage in high-level diplomacy, such as negotiating directly with Trump,” he said.

Wannaphong said there is a “real concern” that the Thai government may be underestimating the broader implications of the tariff hikes, stressing that it is crucial for policymakers to craft a strategic response.

“This trade shock could actually serve as a timely opportunity for Prime Minister Paetongtarn to push for broader economic reform,” he added.

“However, I’m not entirely confident this aligns with the priorities of the Pheu Thai Party, given its past focus on short-term economic measures like the Digital Wallet scheme.”

Meanwhile, for Vietnam, analysts noted that Prime Minister Pham Minh Chinh's reaction to the tariffs will also be scrutinised given the magnitude of the 46 per cent tax hike imposed by Washington.

The premier has said that a target of "at least 8 per cent" growth this year remains unchanged, according to the government's official news portal.

Experts added that Vietnam is among the countries which have benefited from the “China plus one” policy, an approach where major Chinese manufacturers route some of their supply chains to the US through countries with lower costs in Southeast Asia.

But this comparative advantage is set to be extinguished with the latest tariffs announcement.

The OCBC report cited how Chinh’s government has been negotiating with the US to reduce tariffs and raise imports from the US.

Chinh said Vietnam will buy more American goods, including defence and security products, and has asked for a 45-day delay in the imposition of the tariffs.

“While the outcomes are still uncertain, we expect the authorities to remain focussed on expediting infrastructure spending and diversifying trade partners,” the OCBC report said.

While the Philippines and Singapore were hit with relatively lower tariffs, the political impact there has not gone unnoticed.

In a commentary published by the Manila Times on Monday, columnist Rigoberto Tiglao argued that the 17 per cent rate was still considered high for a country he described as the US’ “loyal pawn in Southeast Asia against China”.

He also criticised comments by Frederick Go, President Ferdinand Marcos Jr’s special assistant for investment and economic affairs, who reportedly said the US tariffs are “good news ... as firms with higher tariff rates will be moving here”.

Tiglao said officials were doing Filipinos a disservice by “pooh-poohing” the impact of Trump’s global tariff increases, and called on the government to create a task force to deal with the “impending crisis”.

In Singapore, Prime Minister Lawrence Wong announced on Tuesday that the government will form a national task force to support businesses and workers in response to sweeping new US tariffs that could slow economic growth and impact jobs and wages.

Last week, Wong - who leads the ruling People’s Action Party (PAP) - had warned that the global environment would remain turbulent for the foreseeable future, as he urged Singaporeans to brace themselves because the risks are real and the stakes high.

But the Progress Singapore Party - which has two non-elected MPs in parliament - on Sunday pushed back against the government's strong warnings, calling the response “overblown” and suggesting that it could be an attempt to stoke fear ahead of the General Election, which must be held by November.

Analysts told CNA that while the "flight to safety" in voting for the PAP may bear on the election, as it has in the past, this year’s outcome is not a given as the electorate is diverse and has changed.

Wong told parliament on Tuesday that Singapore must deepen ties with like-minded partners who share its commitment to open and free trade.

In particular, Singapore will strengthen its collaboration and integration within the ASEAN bloc, ahead of its special meeting later this week for economic ministers to boost intra-ASEAN trade.

HOW SHOULD ASEAN COUNTRIES NEGOTIATE WITH THE US?

Even as ASEAN’s members find ways to negotiate as a bloc, some moves by individual members have caught the eye.

Vietnam’s reported proposal to cut its tariffs on US imports to zero has made global headlines, as it seeks to postpone the 46 per cent tariff imposed by Trump.

According to reports, Hanoi also pledged to import US products that are in strong demand locally and promised to create “more favourable conditions” for American businesses to invest in Vietnam.

Trump has reportedly described the call between him and Vietnam’s leader To Lam “as very productive”.

Azmi told CNA that Vietnam has “shown the way” for other ASEAN countries on how to negotiate with the US.

“Being retaliatory is not the right way to go, if ASEAN countries retaliate, it would not impact Trump’s policies,” he said.

“ASEAN member states have to individually engage the US in bilateral discussions because different countries have different trade circumstances and considerations,” he added.

Lee the economist posited that ASEAN countries should also not react by imposing retaliatory tariffs, like China, France and Germany.

“ASEAN countries have small markets - the amount they import from the US is small in terms of their share of US exports (due to relatively smaller population size and per capita income in ASEAN countries),” said Lee.

“Thus, it would make sense for countries that have been imposed very high tariffs by the US such as Vietnam to negotiate directly,” he added.

Wannaphong, the Thai economics professor, also suggested that Thailand should negotiate with the US as part of larger trade frameworks - instead of just ASEAN - as a more “constructive” response.

“I don’t believe ASEAN alone has enough negotiating leverage when dealing with Trump,” he said.

“RCEP - especially with the participation of several developed economies - offers a more promising platform for Thailand to begin formulating a coordinated response to the tariff hikes.”

The Regional Comprehensive Economic Partnership (RCEP) is a free trade agreement between the 10 ASEAN member states as well as Australia, China, Japan, South Korea, and New Zealand.

On the other hand, some experts have questioned Vietnam’s individual approach.

Security expert Collin Koh, who is a senior fellow at Singapore’s S Rajaratnam School of International Studies, posted on X that Vietnam might be seen to “spoil the market” by offering this “major concession” amid calls by the likes of Malaysia to get a unified ASEAN response.

“End of the day, national interests precede regional interests,” he wrote.

Steven Okun, chief executive officer of the Singapore-headquartered consultancy APAC Advisors, said that Vietnam’s offer to lower its duties on US products to zero “will do little to move the trade imbalance”.

“There is a great deal the US wants to buy from Vietnam and relatively little the US can sell to them,” he told CNA.

“Vietnam lowering its duties to zero may help some US sectors, of course. And, if Trump’s goal is to bring US manufacturing back to the US, then he will keep the tariffs high no matter what.”

However, he added that countries in ASEAN should persist in negotiating with the US as a bloc as Washington would hold all the cards in one-to-one individual negotiations.

Responding to Liberation Day, Malaysia PM Anwar Ibrahim said ASEAN will seek to have a collective response to Trump’s tariffs.

Okun said: “If that happens, Donald Trump would be the catalyst ASEAN always needed. A country negotiating one-on-one with the US rarely takes a maximalist approach because in bilateral settings, the US has all the cards.

“Individually, a given country may not have the power to create effective resistance. But collectively, they might. If the countries of Southeast Asia want to negotiate with Trump, their chances of success are much greater if they do so collectively,” he added.

Bhima, the Indonesia-based analyst, said some ASEAN states can negotiate with the US from a position of having a “similar” geopolitical stance against China’s expansive claims in the South China Sea.

Vietnam, Malaysia, Indonesia and the Philippines have overlapping claims with Beijing in the strategic and resource-rich waterways.

“Another thing that Southeast Asia, including Indonesia and the Philippines, can leverage more on are critical minerals,” he said.

“Why are critical minerals excluded from the reciprocal tariff? Because Trump understands that they need more nickel. They need more bauxite and copper from regions like Southeast Asia.

“I think critical minerals are the thing that Trump wants to hear more about during the negotiations.”

Still, several recently published commentaries have taken a scathing tone against the prospect of a joint ASEAN bloc response to the tariffs.

“Should ASEAN respond as a group, it is likely futile … the Trump administration is unlikely to care. The tariffs target countries individually, not ASEAN as a bloc,” said Jakarta-based journalist Edwin Shri Bimo in an article for the China Global South Project.

American news magazine Foreign Policy also published an analysis saying that ASEAN has “few other good options” and “there is no guarantee that ASEAN will move in concert”.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10