Crypto climbs as stocks crater: Bitcoin holds steady, altcoins take flight in tariff turmoil 6 seconds ago

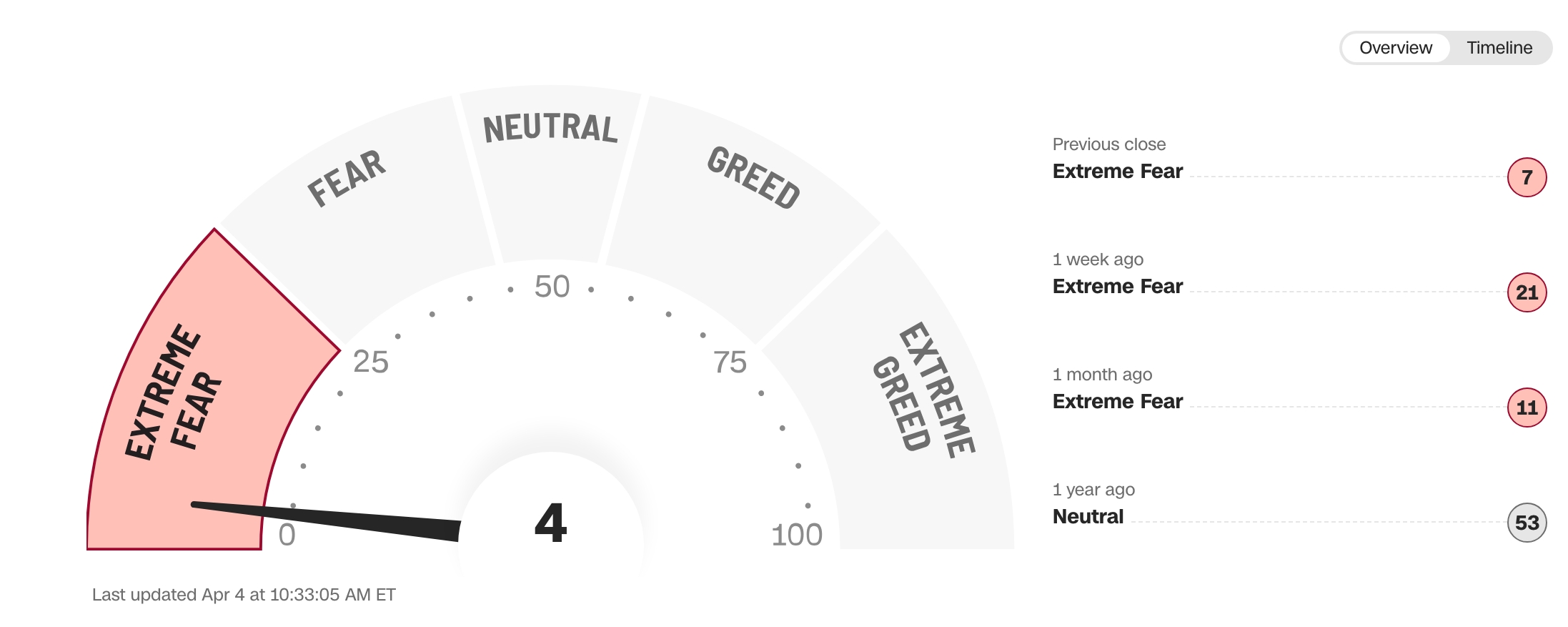

Cryptocurrencies, including certain altcoins, outperformed global stocks this week as the fear and greed index dropped to its lowest level in years.

Bitcoin (BTC) is holding firm while the stock market melts down, with several altcoins soaring as global markets reel from President Trump’s newly announced tariffs on Chinese imports.

The world’s leading cryptocurrency has officially outperformed the tech-heavy Nasdaq 100 on a year-to-date basis, despite staying relatively flat this week. Meanwhile, U.S. equities took a historic tumble. The Dow Jones Industrial Average lost a staggering 2,200 points on Friday alone, following a 1,200-point drop the day prior—wiping out $5.4 trillion in value across American stocks in just two days. Since February, the Dow has dropped from $45,000 to $38,200, while the Nasdaq 100 has fallen from $22,220 to $13,400, and the S&P 500 slipped from $6,145 to $5,000.

This turmoil followed Trump’s imposition of a sweeping 34% tariff on all Chinese imports, a move that triggered immediate retaliation from Beijing. The fear and greed index—a widely watched sentiment gauge—plunged to 6, its lowest reading in years, as investors scrambled for safety.

Oddly enough, that safe haven may have included crypto. Altcoins outpaced both Bitcoin and traditional assets.

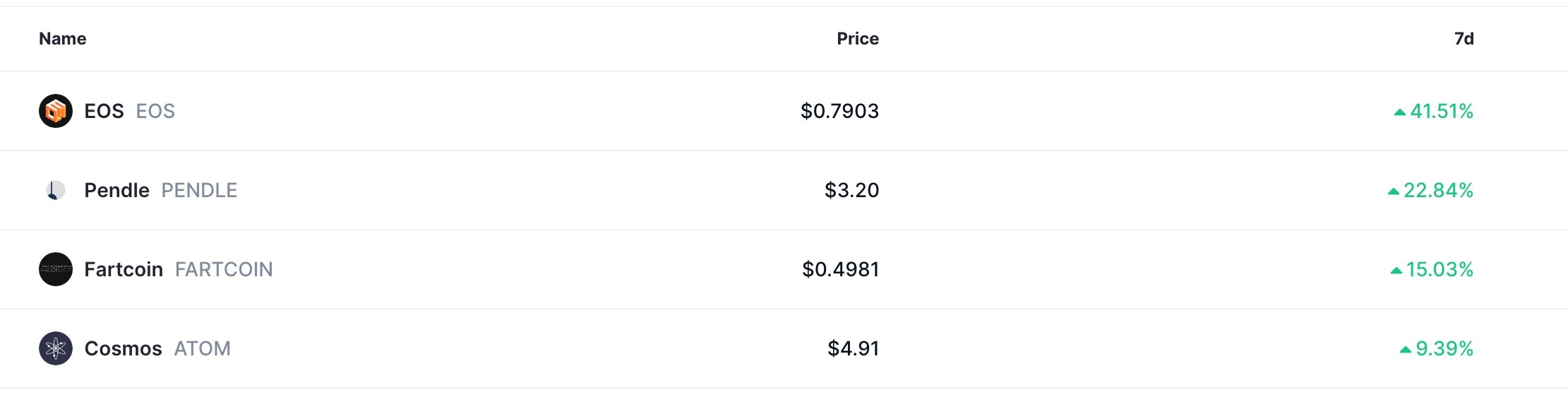

EOS, Pendle, Fartcoin, ATOM rose as stocks sunk

EOS (EOS) led the rally, jumping 41% after rebranding to Vaulta and announcing a pivot toward blockchain banking and asset tokenization.

As part of its rebrand, the project also launched VirgoPay in partnership with VirgoCX Global, enabling cross-border payments via stablecoins.

Other standout performers included Pendle (PENDLE), which surged 22% as yield-hungry investors flocked to its DeFi platform offering annual returns upwards of 7.5% on synthetic stable assets.

The other top-performing altcoins during the week were Fartcoin (FARTCOIN) and Cosmos (ATOM), which jumped by 15% and 9.5%, respectively.

Zcash, OKB, and Raydium were other top movers.

Still, it is too early to conclude whether Bitcoin and these altcoins can be considered safe-haven assets. After all, cryptocurrencies are highly speculative.

Also, while some altcoins did well throughout the week, many others tumbled. Berachain (BERA) crashed by 27%, while Pi Network (PI), Immutable X, and Movement (MOVE) tumbled by over 15%.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10